Blog Highlights

- Who is Ashish Dhawan ?

- Educational Qualifications of Ashish Dhawan

- Career Milestones and Financial Contributions

- Ashish Dhawan Portfolio and Top Holdings

- Ashish Dhawan Networth

A look inside Ashish Dhawan Latest Portfolio & Net Worth in 2024

Who is Ashish Dhawan ?

Acclaimed to be a distinguished and illustrious figure in the sector of Indian finance, Ashish Dhawan’s career has spanned over decades. His profound investment in strategies and educational reforms has earned him multiple accolades. The blog highlights his educational background, portfolio insights, investment strategies, and contributions to the broad financial community as a whole.

Biography and Educational Qualifications of Ashish Dhawan

Ashish Dhawan was born in 1969, and finished his early education in India, before moving to the USA for higher education. He holds a BSc degree from Yale University and an MBA degree from Harvard Business School, because of which his academic foundation has been instilled with robust analytical frameworks.

He was equipped with an understanding of practical investment applications and a plethora of economic theories. It later defined his professional investment strategies and a blend of innovative approaches for value creation, or rigorous financial analyses.

Career Milestones and Financial Contributions

Despite a career beginning in the States, where he could work at leading institutions like Soros Fund Management and Goldman Sachs, his career breakthrough occurred after a return to India. In 1999, he co-founded ChrysCapital, under his leadership which became one of the largest and most flourishing private equity firms. It focused on different sectors like financial services, consumer goods, and healthcare.

He is presently the founder and CEO of “The Convergence Foundation”, which builds institutions or impactful organizations for accelerating India’s economic growth in rapid, inclusive, and sustainable manners. The journey has been incepted by Ashoka University and Central School Foundation, where over the years they have grown from 5 to 13 companies, that aim to make a long-standing influence across different sectors.

Personal Life

Ashish Dhawan is a married man with children, and he resides in Bombay. He is known for his philanthropic efforts besides his otherwise obvious public interests. It reflects a commitment to enhancing educational outcomes across the nation, leading them to find different foundations aiming to reform the overall Indian educational system.

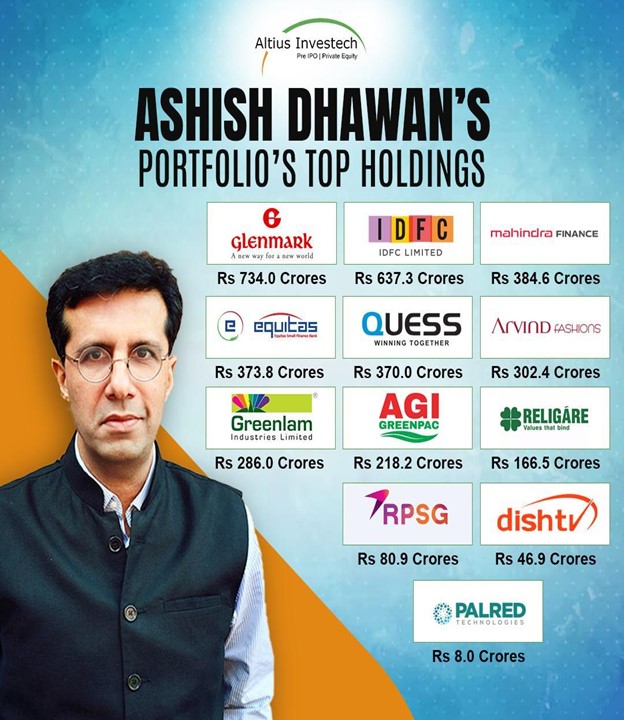

Ashish Dhawan Latest Portfolio and Top Holdings

Ashish Dhawan’s latest corporate shareholding filing reveals that he publicly holds 12 stocks with a total net worth exceeding ₹2608.6 crores The data filed as per the information within his exchanges are as follows- Note that three inactive stocks that he had purchased but are not functional, have been placed at the last.

In order of decreasing valuation (from highest to lowest), they are

- Glenmark Pharmaceuticals- The holding value for this stock is Rs 734.0 Crores with the March ‘24 holding percentage estimated to be 2.6%.

- IDFC Ltd- The holding value for this stock is Rs 637.3 Crores with the March ‘24 holding percentage estimated to be 3.5%.

- Mahindra & Mahindra Financial Services Ltd– The holding value for this stock is Rs 384.6 Crores with the March ‘24 holding percentage estimated to be 1.2%.

- Equitas Small Finance Bank Ltd– The holding value for this stock is Rs 373.8 Crores with the March ‘24 holding percentage estimated to be 3.6%.

- Quess Corp Ltd- The holding value for this stock is Rs 370.0 Crores with the March ‘24 holding percentage estimated to be 4.0%.

- Arvind Fashions Ltd– The holding value for this stock is Rs 302.4 Crores with the March ‘24 holding percentage estimated to be 4.9%.

- Greenlam Industries Ltd– The holding value for this stock is Rs 286.0 Crores with the March ‘24 holding percentage estimated to be 3.8%.

- AGI Greenpac Ltd- The holding value for this stock is Rs 218.2 Crores with the March ‘24 holding percentage estimated to be 4.8%.

- Religare Enterprises- The holding value for this stock is Rs 166.5 Crores with the March ‘24 holding percentage estimated to be 2.3%.

- RPSG Ventures Ltd– The holding value for this stock is Rs 80.9 Crores with the March ‘24 holding percentage estimated to be 3.7%.. Currently, he has sold the shares in RPSG Ventures Ltd, which lowered the stake by 0.45%.

- Dish TV India Ltd– The holding value for this stock is Rs 46.9 Crores with the March ‘24 holding percentage estimated to be 1.6%.

- Palred Technologies– The holding value for this stock is Rs 8.0 Crores with the March ‘24 holding percentage estimated to be 5.5%.

- Birlasoft Ltd – Inactive Stocks

- Karur Vysya Bank Ltd – Inactive Stocks

- Zensar technologies – Inactive Stocks

Ashish Dhawan’s Portfolio’s Top Holdings

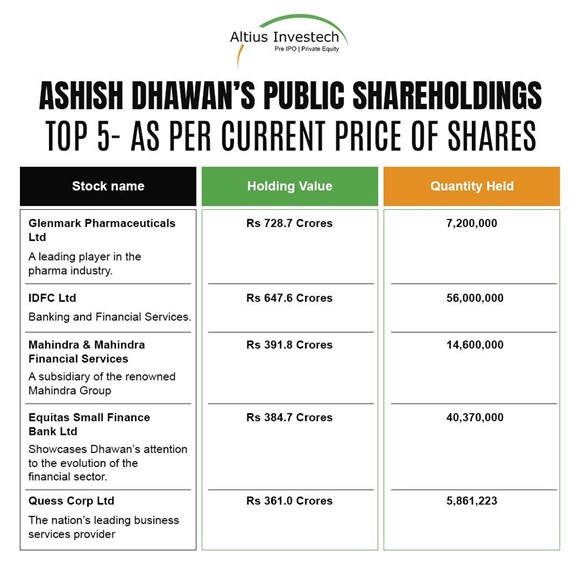

Ashish Dhawan’s Top 5 Public Shareholdings – As per current Price of Shares

| Stock name | Holding Value | Quantity Held |

| Glenmark Pharmaceuticals Ltd : A leading player in the pharma industry. | Rs 728.7 Crores | 7,200,000 |

| IDFC Ltd : Banking and Financial Services. | Rs 647.6 Crores | 56,000,000 |

| Mahindra & Mahindra Financial Services : A subsidiary of the renowned Mahindra Group | Rs 391.8 Crores | 14,600,000 |

| Equitas Small Finance Bank Ltd : Showcases Dhawan’s attention to the evolution of the financial sector. | Rs 384.7 Crores | 40,370,000 |

| Quess Corp Ltd : The nation’s leading business services provider | Rs 361.0 Grores | 5,861,223 |

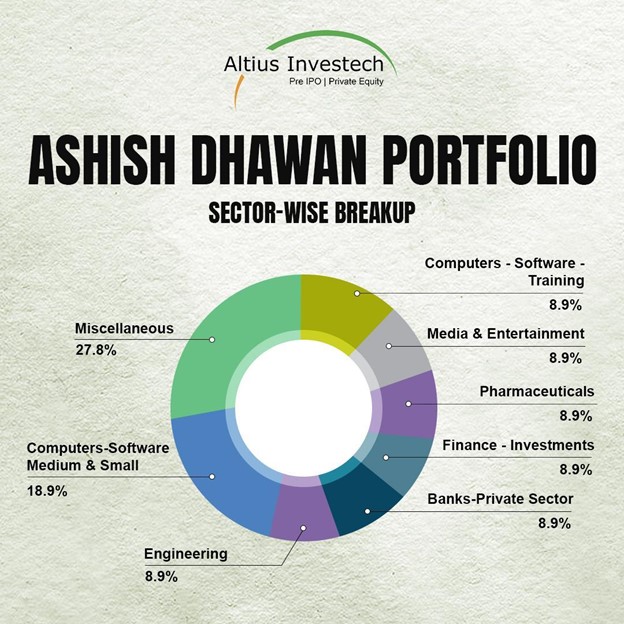

Ashish Dhawan Portfolio – Sector wise breakup

After receiving the much-deserved success, Dhawan had a knack for selecting stocks outperforming the market. Dhawan’s portfolio involves a range of sectors including hardware, software, computers, and more. His investments oversee versatility across FMCG, healthcare, IT, and banking. Also read about Vijay Kedia’s portfolio and top holdings.

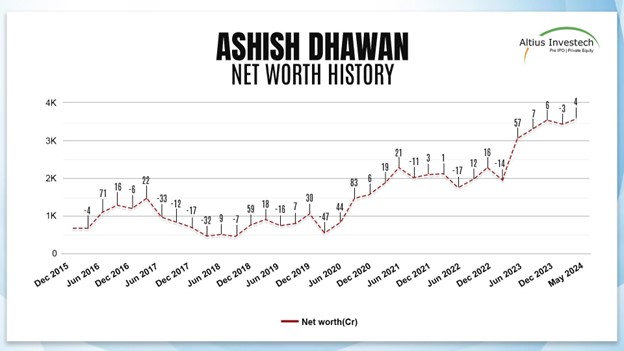

Ashish Dhawan Net Worth Growth

Dhawan’s net worth has been deemed to be approximately $800 Million or Rs 6671 Crores.

It has noticed substantial growth, most likely due to his decisions on strategic investment and his private equity firm- ChrysCapital’s influential performance. These have added significantly to the net worth that exceeds more than Rs 3187.3 Crores.

His contributions are also noted widely as the CEO and founder of CSF or Central Square Foundation. His ability to foresee market trends and investment in sectors of high growth have contributed significantly to his financial success.

Over the years, Dhawan’s portfolio has shone in times of market volatility. It went through a significant transformation wherein he was found to reduce his exposure to large-cap stocks and invested in small-cap and mid-cap stocks instead. Also read about the net worth of Radhakishan Damani.

Investment Strategy for New Investors

Dhawan has been successful in his investment initiatives and has mentored several budding investors. His interviews, articles, and talks serve as learning tools and his philanthropic ventures such as educational startups show his commitment to giving back to this community.

Mostly, the investment strategies emphasize the significance of a well-rounded understanding of markets in general, patience, and the capability to stay on course despite the presence of various market volatilities. His career portrays lessons in balancing potential rewards and risks, alongside the importance of continuous learning.

- Risk Smart– Dhawan has not been scared of adventures. It has been okay for him to invest in companies that are slightly risk-prone as opposed to the big shots. But that did not invite recklessness in him, he chose the ones that he still believed in. If you are someone willing to take minimal risks for double, or even triple the returns, unlisted shares would serve as the best bet for you! Buy it from a trusted platform like Altius Investech and maximize your revenues.

- Diversify- Putting all the eggs in a single basket is not worth it. The underperformance of some can be balanced by the good outcomes of others. Dhawan’s portfolio is a mixture of different types of companies.

- Look for Deals– His knack for bargains shows his emphasis on how he likes hidden gems. These stocks happen to be cheaper than what the companies are inherently worth. It is like getting great deals on something one is really looking for.

- Long-term– His patience and will to stick with stocks for numerous years, despite ups and downs, has gotten him a long way. He believes in the long haul.

Conclusion

It has been a journey through financial realms and philanthropic illustrations to a path of community impact and strategic foresight. Dhawan’s decisions and strategies offer valuable insights into the basic mechanics and processes of investment, and the responsibilities of success and wealth. For both seasoned and new investors, the approach serves as a guiding light, showcasing how true success in investment

FAQ

Ashish Dhawan’s net worth has been deemed to be approximately $800 Million or Rs 6671 Crores.

Ashish Dhawan is an Indian private equity investor and philanthropist. He is the founder of ChrysCapital, one of India’s leading private equity firms, and Ashoka University, a liberal arts university. He is known for his significant contributions to education and public policy in India

The owner of ChrysCapital is Ashish Dhawan, an Indian private equity investor and philanthropist who founded the firm

Top holding in Ashish Dhawan’s Portfolio includes Glenmark , IDFC limited , Mahindra Finance , Equitas , Quess , Arvind Fashion , Greenlam , AGI , Religare , RPSG , Dish TV, Parled

Dhawan has been successful in his investment initiatives and has mentored several budding investors. His interviews, articles, and talks serve as learning tools and his philanthropic ventures such as educational startups show his commitment to giving back to this community. Mostly, the investment strategies emphasize the significance of a well-rounded understanding of markets in general, patience, and the capability to stay on course despite the presence of various market volatilities. His career portrays lessons in balancing potential rewards and risks, alongside the importance of continuous learning.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

Click here to connect with us on WhatsApp

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an