HNI investors frequently discuss the names of new business initiatives in which they have invested in the belief that their return on investment will be the new-age disruption. Investors have discovered the ideal coffee bean and realised that as more capital flows, there will be more companies, more investment, more exits, and hence more wealth creation. With India hosting the third biggest number of unicorns behind the US and China, the buoyancy in the Indian venture capital investment landscape is note-worthy.

The pursuit of attractive risk-adjusted returns with limited public market correlation, combined with subpar returns from fixed income asset classes, has opened the door to angel investing for millennials, Gen Z, and younger generations of traditional business families through sophisticated family offices. As a result, venture capital has emerged as a promising alternative asset class.

SEBI Alternative Investment Funds Regulations

The SEBI (Alternative Investment Funds) Regulations, 2012 (SEBI AIF Regulations) went into effect on May 21, 2012. Pooling of funds through any organisation other than Alternate Investment Funds (AIF) is forbidden under the SEBI AIF Regulations.

This means that if investors need to combine funds to invest collectively, they must do it exclusively through AIFs. The regulations advise against pooling funds and investing through LLPs and Private Limited Companies, among other structures. It could be argued that this is a violation of the SEBI AIF Regulations.

According to SEBI data, AIF fund managers raised a total of INR 6,41,359.11 crore across categories as of June 30, 2022. The number in March 2021 was INR 4,51,216.01 crore. In a single year, AIFs increased by 42 percent.

AIFs are divided into three major categories, with Category-I AIF being the most popular for investment in startups. An Angel Fund is a subtype of Category-I AIF that was developed and designed primarily to attract angel investment in businesses.

The post-pandemic recovery has been hampered by global central banks raising interest rates, strained geopolitical relations, unstable local markets, and plummeting pre-IPO valuations of tech and new age businesses. The overall tone, though, is one of excitement, with an ever-expanding pool of angel investors and family offices.

To better comprehend AIFs, let us first address some frequently asked questions about investing through an AIF.

Is it necessary to register an AIF with SEBI?

Each AIF is required to be registered with SEBI under the SEBI AIF Regulations. This means that they must follow the rules and regulations that have been established.

Are there any exceptions to the SEBI AIF Regulations’ definition of AIF?

The following categories are exempt from the definition of AIF and are not subject to SEBI AIF Regulations:

- Family trusts established to benefit relatives

- Employee stock ownership plans (ESOPs) and other employee welfare trusts

- Holding corporations

- Other special purpose vehicles, such as securitisation trusts, are governed by a separate regulatory framework.

- Any such investment pool that is directly regulated by another body in India

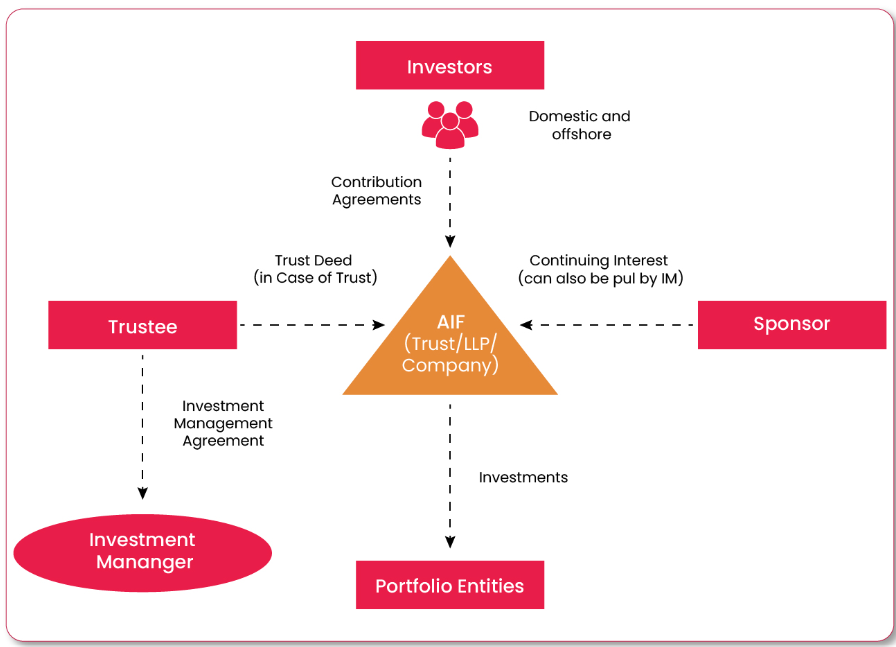

How Are AIFs Usually Structured And Who All Are The Parties To An AIF?

An AIF’s several parties include:

- The individual who establishes the AIF is known as the sponsor.

- Manager: a person or company appointed by AIF to oversee its investments under whatever name they are known, who may also be a fund sponsor.

- The manager’s primary investment team must have enough experience, with at least one important individual having at least 5 years of experience advising or managing pools of funds.

- Trustee: If an AIF is established as a trust, a trustee must be nominated under the trust deed, which must be registered.

What Exactly Is An Angel Fund?

Angel funds are a type of venture capital fund that raises cash from angel investors to invest in firms in their early phases of growth. Angel funds seek to strengthen the startup ecosystem by offering early-stage finance, management mentoring, and guidance to startups.

An angel fund invests in firms where the investment team believes it can aid in the transformation of the company. Contributing to and participating in the creation of such companies’ growth strategy is part of this.

Who Can Put Money Into An Angel Fund?

Angel investors, according to the SEBI AIF Regulations, can be persons or companies who meet the following criteria:

- Individual Investor: A person with at least INR 2 crores in net tangible assets, excluding the value of their primary house, and who:

Someone with past experience investing in an emerging or early-stage enterprise, or as a serial entrepreneur (a person who has promoted or co-promoted more than one startup venture), or a senior management professional with at least ten years of experience - Body Corporate: With a net worth of at least INR 10 Crores

- AIF or Venture Capital Fund registered with SEBI

What Is the bare minimum for an angel fund?

SEBI recently relaxed several requirements for angel funds. The modifications require each angel investor to make a minimum investment of INR 25 Lakhs in the angel fund.

Furthermore, at the fund level, an angel fund must maintain a minimum corpus (the total amount of cash committed to the angel fund by investors) of INR 5 Crores.

Can Angel Fund Units Be Listed On A Recognized Stock Exchange?

No, angel fund units cannot be listed on recognised stock exchanges.

What Is the Regulatory Process for an Angel Fund Investing?

For each investment, the angel fund is obliged to create a scheme. This is conditional on the submission of term sheets to SEBI. Among other things, the term sheet comprises information such as the scheme’s name, the name of the investee company(ies), the number of investors, the total capital committed by investors, and the money pulled by the fund.

What Is the Regulatory Process for an Angel Fund Investing?

For each investment, the angel fund is obliged to create a scheme. This is conditional on the submission of term sheets to SEBI. Among other things, the term sheet comprises information such as the scheme’s name, the name of the investee company(ies), the number of investors, the total capital committed by investors, and the money pulled by the fund.

Can Individual Angel Fund Schemes Accept Investors?

The manager of an angel fund must obtain the approval of the angel investors before investing the sum of that investor in any enterprise, according to SEBI AIF Regulations. As a result, when it comes to investing in an angel fund, investors have complete discretion.

How Does the Fund Arrangement Reflect the Commercial Understanding of the Parties?

The issuing of multiple classes of angel fund units caters to commercial agreements mutually agreed upon by the various stakeholders, such as carried interest, hurdle rate, fund management fees, and any other right/interest to the investor finding investment leads.

A distribution waterfall mechanism explains how proceeds are dispersed in the aforementioned groups of units.

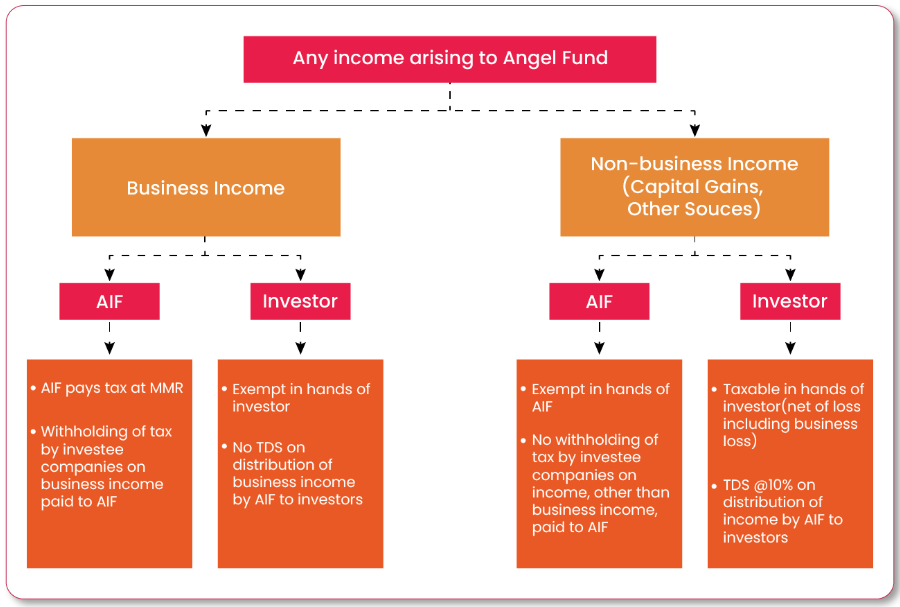

What Are the Tax Implications of Angel Fund Investment Income?

We have observed a recent trend away from traditional investment routes and toward complex financial instruments, which has led in the introduction of AIFs in India, with the development of HNIs and investable money. Before investing in an AIF, it is vital that you understand its features and types.