Blog Highlights

- Monthly Share Price Trends & Insights of Indofil Industries

- Future Projections for Indofil Industries share price in 2025

- Why Investment in Indofil Shares is a Wise Decision

- Reasons Why Investing in Unlisted Shares is a Wise Decision

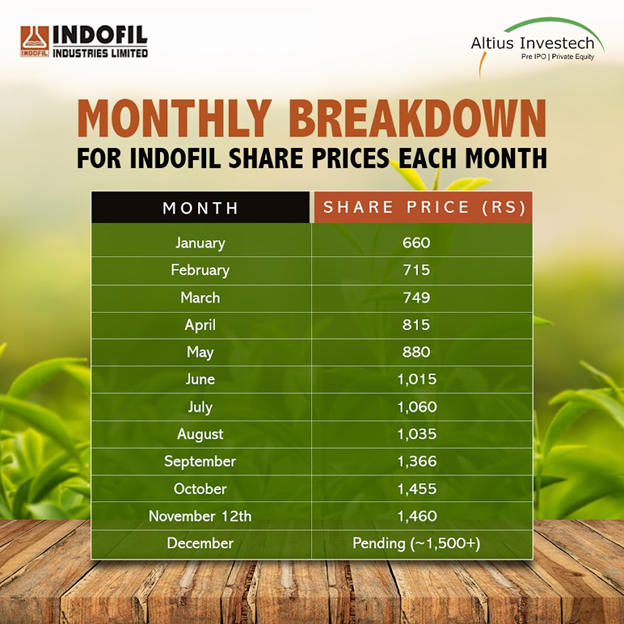

Indofil Share Price Analysis: Monthly Performance in 2024

A titan in the dynamic world of unlisted equities, Indofil Industries Ltd is a leader in the specialty and agrochemical sector and has had a remarkable performance in 2024. It has consistently captured the interests of investors with its stellar growth and market positioning.

Understanding the monthly performance of Indofil’s share prices can unveil critical insights for those willing to diversify their portfolio with high-growth potential. Each fluctuation tells a story, whether it is market sentiment, operational milestones, or future possibilities. Exploring this blog would make you discover why investing in Indofil Shares is not only wise but also a step toward capitalizing on a company primed for transformative success.

Monthly Share Price Trends & Insights of Indofil Industries

As an unlisted company, the share price trajectory reflects strong financial health, market confidence, and growth initiatives. The monthly breakdown gives us insights into how Indofil’s shares performed and evaluates its potential for future investment.

January

The year began with Indofil’s shares trading at Rs 660. The price reflected steady demand in the agrochemical sector, bolstered by favorable weather conditions for farming. Despite macroeconomic concerns globally, the company maintained its operational efficiency and positioned itself as a reliable player in the industry.

February

The share prices increased by 9% to Rs 715. The growth was driven by agrochemical products as farmers prepared for the planting season. Additionally, the government’s budget announcement, which emphasized agricultural support and subsidies, formed a positive market sentiment that bolstered the overall performance of the sector.

March

March witnessed a steady climb to Rs 749, supported by a solid quarterly earnings report. Indofil’s export business showed signs of significant growth, with increased demand in international markets like Southeast Asia and Africa. The company’s focus on cost optimization also helped boost investor confidence.

April

In April, the share price for Indofil surged to Rs 815 in April, marking a key milestone for the year. The growth has been driven by the launch of a new line of eco-friendly agrochemical products that gained traction among distributors and farmers. The organization also announced plans to increase the production capacity, further reassuring investors about the growth potential.

May

The shares continued their upward trajectory in May, closing the month at a price of Rs 880. This increase was largely attributed to the growing market share in the domestic segment. A favorable monsoon forecast as well as strategic market initiatives helped in the sustenance of the momentum. The investor sentiment remained positive as the organization showcased fluctuating commodity prices and resilience.

June

June marked a breakthrough as the share price crossed the Rs 1,000 threshold, reaching Rs 1,015. The half-yearly performance report showcased a 20% year-on-year revenue growth, supported by operational efficiencies and a strong demand. The milestone further cemented the reputation of the company as a growing, reliable player in the agrochemical market.

July

In July, the share price marginally increased to Rs 1060. Despite minor market volatility, Indofil benefitted from a stable supply chain and a rise in exports. The company announced a partnership with international distributors, positioning it well for future growth. This news has contributed to sustained investor confidence.

August

A slight dip to Rs 1,035 was observed in August, primarily due to profit-booking by early investors. This dip was expected and aligned with broader market trends during the period. However, Indofil’s fundamentals remained strong, and its strategic initiatives in research and development continued to generate optimism for long-term growth.

September

September could mark a stellar month for Indofil, as the share price surged to Rs 1,366. It was a 32% jump from the previous month. The remarkable growth was driven by exceptional quarterly results that exceeded market expectations. The company’s expansion into high-growth international markets and successful product launches further fueled the rally.

October

The upward momentum could continue in October, with the shares reaching Rs 1455. The strong market positioning and consistent performance helped sustain the growth. Investors were especially optimistic about the plans of the company to introduce innovative agrochemical solutions that are tailored to diverse markets.

November

By mid-November, the share price had stabilized at Rs 1,460. Indofil’s adaptability to market fluctuations and focus on enhancing operational efficiencies ensured steady performance. The company also hinted at potential expansions in the specialty chemicals segment, sparking renewed investor interest.

December

Although the final share price for December is pending, projections suggest a marginally higher or stable price, potentially closing at above Rs 1500. Analysts expect end-of-year announcements as well as market dynamics to influence the final numbers.

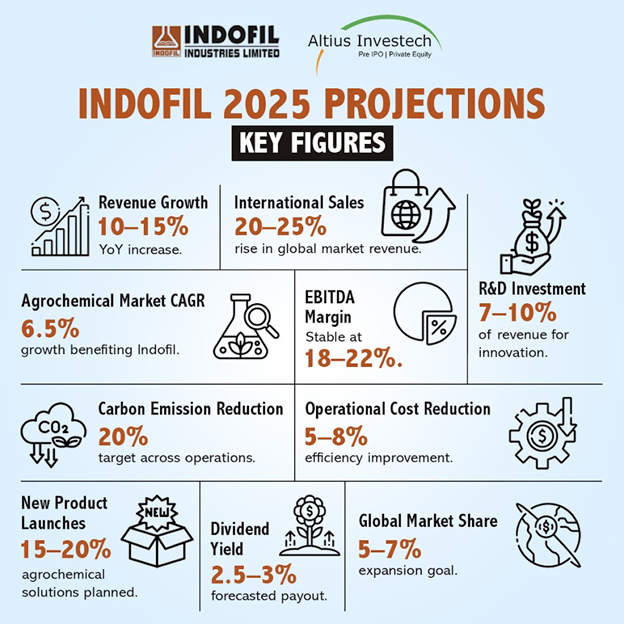

Future Projections for Indofil Industries share price in 2025

Looking ahead to 2025, Indofil Industries has been poised for continued growth.

Having a strong focus on market expansion makes the company increase its global footprint across developed and emerging economies. Its distribution network, spanning over 90 countries, positions Indofil to capitalize on rising agrochemical demand, especially in regions like Africa, Southeast Asia, and South America. In India, government-backed agricultural reforms and the adoption of modern farming practices fuel domestic demand, ensuring a solid base in the home market.

In order to meet the surging demand, Indofil is ramping up production capacity, including the expansion of existing facilities and the establishment of new manufacturing units. It includes a pivot toward eco-friendly bio-agrochemicals. By 2025, Indofil plans to launch various bio-based products and strengthen its R&D capabilities for developing innovative, environment-friendly solutions that can adhere to strict regulations in key markets.

Digital transformation is another pillar of Indofil’s growth strategy. The company is leveraging AI for supply chain optimization, launching an e-commerce platform to directly engage with farmers, and adopting data-driven approaches to refine its market strategies. These measures enhance operational efficiency while creating a seamless customer experience.

Indofil’s consistent revenue growth and profitability make it a strong contender for a premium valuation. Industry speculations suggestively imply an IPO by 2025, which can unlock significant value for investors. With strategic investments, a focus on innovation, and a robust positioning in the thriving agrochemical sector, the future outlook remains bright, presenting a compelling long-term opportunity for investors.

Why Investment in Indofil Shares is a Wise Decision

Here’s an in-depth look at why Indofil’s shares deserve attention:

1) Strong Financial Health

Indofil has demonstrated consistent profitability, with revenue growth underscoring its financial stability. In 2024, the company reported revenues of Rs 3,118 Crores, marking an impressive 45% PAT (Profit After Tax) growth year-over-year. Its ability to maintain operational efficiency and deliver solid financial results makes it a reliable investment candidate.

2) Industry Potential

The agrochemical sector is experiencing global growth, which makes Indofil a key beneficiary. As the world grapples with challenges of food security as well as climate change impacts, agrochemicals would play a critical role in improving agricultural productivity.

The global agrochemical market is projected to grow at a CAGR of 3.9% between 2024 and 2030, reaching $284 billion by the end of the decade.

3) Sector Growth & Early Entry Advantage

Indofil’s unlisted shares are currently undervalued compared to peers in the listed agrochemical space.

Investors entering at this stage can benefit from substantial value appreciation as the company scales its operations further. Indofil’s strong distribution network and presence in over 90 countries provide an edge in capturing global market share. Early investors can take the chance of riding the wave of sectoral growth while also enjoying the premium coming with acquisition prospects or future market listing.

4) Strategic Growth

Indofil’s focus on innovation, market expansion, and operational efficiency positions it as a long-term investment prospect.

Growth Strategies in Action

- Innovation: Investment in R&D to develop next-gen, eco-friendly agrochemical solutions.

- Market Expansion: Strengthening its foothold in key markets like North America and Europe while exploring untapped regions in Africa and Southeast Asia.

- Operational Efficiency: Scaling production capacity with a Rs 120 Crores investment in new manufacturing facilities.

The strategic initiatives showcase Indofil’s commitment to delivering shareholder value and sustainable growth.

5) Premium Valuation

Irrespective of its share being unlisted, Indofil’s market position and financial performance have attracted investor interest, contributing to the premium valuation.

Valuation Metrics

- Current trading price: Approximately Rs 900–Rs 950 per share.

- Projected valuation at IPO: Rs 1,200– Rs 1,500 per share.

- A steady increase in book value, supported by strong earnings growth.

Investors would be able to leverage the premium valuation for substantial returns when the company goes public or gains a strategic burnout.

6) Dividend Yield

The maintenance of a consistent dividend payout ratio makes it an attractive choice for income-focused investors.

Dividend Benefits

- Average yield: 2.5%–3%, aligning with top-performing listed companies.

- Regular payouts underscore financial discipline and commitment to shareholder returns.

The dual advantage of consistent dividend income and capital appreciation makes Indofil a well-rounded option for investment.

7) Potential for High Returns

As per its strategic initiatives and growth trajectory, Indofil offers significant long-term value for investors. Indofil promises high returns due to its continuous expansion in global markets and emerging economies, where agrochemical demand is on the rise. It adopts sustainable agricultural practices and an eco-friendly product development strategy. It has the potential for IPO listing or mergers, historically providing exponential returns for unlisted share investors.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Indofil’s remarkable performance in 2024, can be reflected in its share price journey, highlighting the company’s strong market presence and growth potential. With a focus on global expansion and innovation, the company remains well-positioned to sustain success in 2025. For investors who seek exposure to the agrochemical industry, Indofil’s unlisted shares present a great opportunity with significant upside potential. With the company continuing to scale to new heights, it stands out as a profitable, reliable investment choice for the long term.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain