HEIL Company : Overview

HEIL (Hindusthan Engineering & Industries Limited) is a diversified engineering company in India with over 65 years of experience. Operating across multiple sectors, HEIL specializes in Rolling Stock, Railway Track Materials, Gas-based Chemicals, and Jute products. The company is a major supplier to the Indian Railways and an industry leader in the production of Bogies, Couplers, Side Frames, Bolsters, and Draft Gears.

| Company Name | Hindusthan Engineering & Industries Limited |

| Company Type | Unlisted Public Company (Buy unlisted shares) |

| Industry | Engineering – Industrial Equipments |

| Founded | 1998 |

| Registered Address | 27 Sir RN Mukherjee Road Kolkata 700 001, West Bengal. |

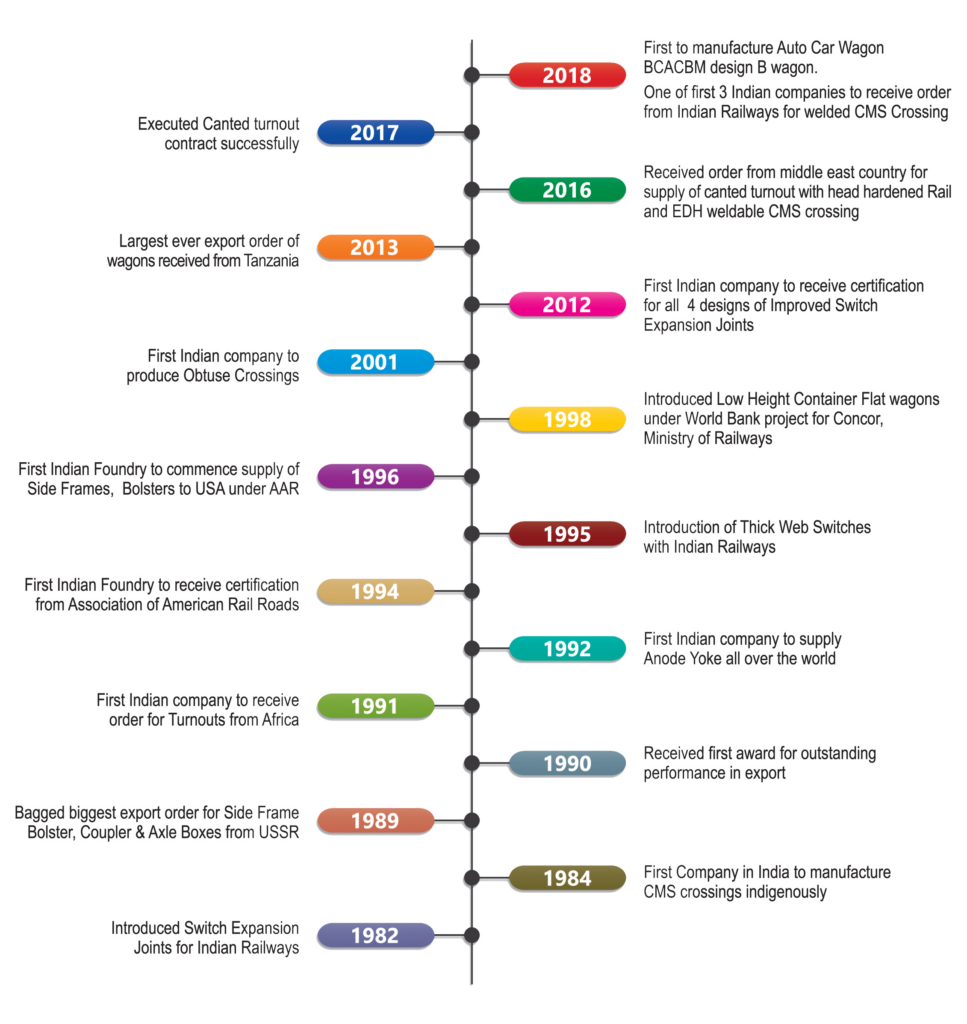

Timeline

Industry Overview

The Indian rolling stock market is poised for growth, driven by Indian Railways’ plans to expand globally and increased domestic manufacturing. A record CAPEX allocation of ~$900M in FY 2019-20 has boosted production of locomotives, coaches, and wagons. Despite disruptions from the pandemic, India’s rail industry is modernizing, with emphasis on increasing train speeds, electrification, and double-tracking.

By 2025, India will see over 25 metro networks with 3,500+ coaches, creating a demand for over 2,000 additional units. With the introduction of 150 private trains by 2023, the Indian rolling stock market is now open to global suppliers, attracting interest from international players.

The market, valued at ~$5 billion by 2025, is fueled by projects like the Delhi-Mumbai and Delhi-Kolkata freight corridors. Key manufacturers include Alstom India, BEML, and state-owned entities. BEML holds a 40% share in the metro rolling stock market, with strong competition from Bombardier, Alstom, and CRRC.

Recent developments include the increased use of bio-toilets, technology transfers, and the shift to Head-On Generation (HOG) systems to reduce emissions. However, India’s rail modernization relies heavily on Public-Private Partnerships (PPPs) due to funding constraints.

Business Segments

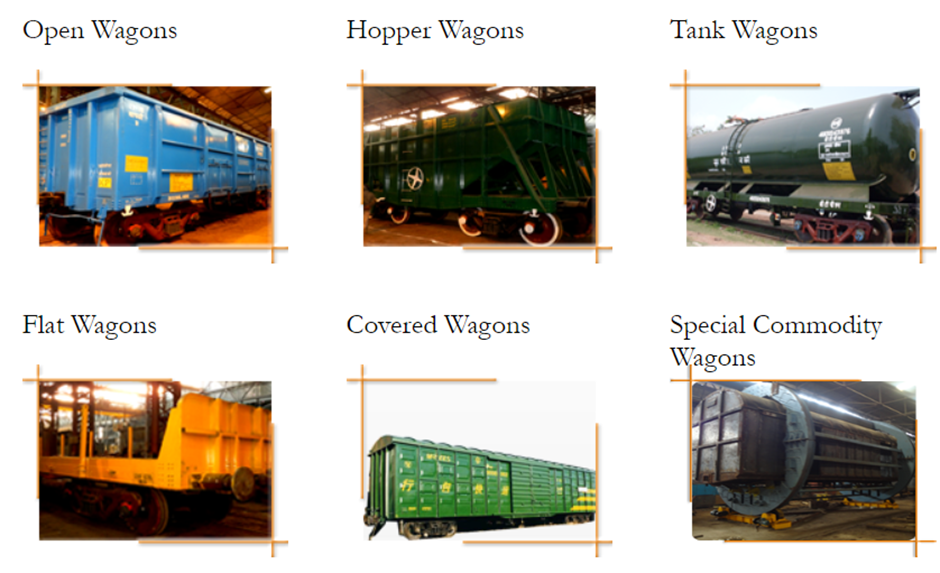

Rolling Stock

HEIL has been a market leader in the rolling stock industry since the mid-1950s, producing thousands of freight cars for Indian railroads, including both conventional and custom-built wagons for sectors like petroleum, chemicals, and cement. The company currently leads in manufacturing New Generation, Commodity-Specific, High Payload Freight Cars in stainless steel for Indian Railways, reinforcing its role as a key player in the market.

..

Foundry

HEIL is a leading supplier of bogies, couplers, draft gears, and CMS crossings to the Ministry of Railways, and is one of the largest producers of rolling stock components. As a licensee of the Standard Car Truck Company (U.S.A.) for Barber design freight bogies, HEIL exports to South Korea, Australia, and North America. The company is also the first in India to develop anode yokes for aluminum smelters, with casting offerings that include freight car, railroad track, earth-moving equipment, and marine and metallurgical castings.

..

Chemicals

HEIL operates a fully automatic plant for cyanide production, incorporating stringent pollution control measures. Over 40% of its sodium cyanide and diphenyl guanidine output is exported for use in gold refining, electroplating, pharmaceuticals, and more. The plant uses natural gas as the main raw material and includes an R&D center recognized by the Government of India. Its product range features sodium cyanide, potassium cyanide, sodium ferrocyanide, potassium ferrocyanide, diphenyl guanidine, sodium dicyanamide, mandelonitrile, and heat treatment salts.

..

Jute Product

Jute is vital to the economy of Eastern India, with the Dalhousie Jute Company’s plant in Champdany, West Bengal, producing packaging materials for food grains, sugar, cement, fertilizer, and tea, which are well-received globally. Their product range includes A Twill, B Twill, D.W. Tarpaulin, odorless cloth, and Hessian cloth specialties.

..

..

Product Portfolio

Key Clients

Management

Shri Vikram Aditya Mody – Chairman

Shri Satish Kapur – Director

Shri Biswajit Choudhury – Director

Recognition & Rewards

Shareholding Pattern

| Shareholding Above 5% | Holding % |

| Hindusthan Consultancy and Services Ltd | 40.62 |

| Promain Ltd | 9.56 |

| Deutsche Bank Trust Company Americas | 6.51 |

| Other | 43.31 |

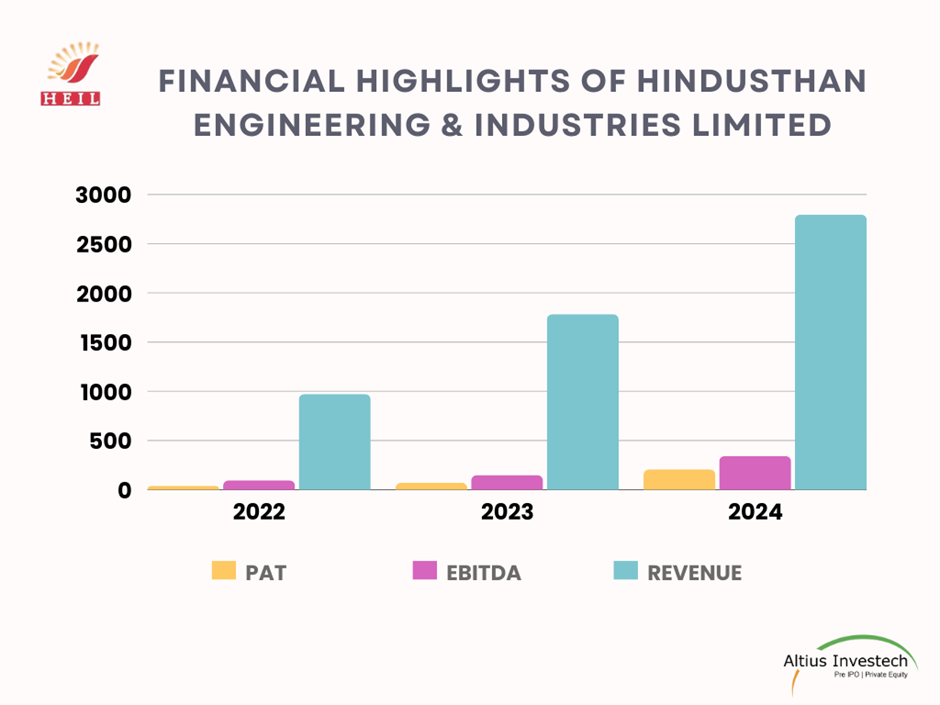

Financial Highlights

| Financials (in crores) | 31st March,2024 | 31st March,2023 | Increase % |

| Revenue | 2,796.70 | 1,783.34 | 57% |

| EBITDA | 342.53 | 147.78 | 132% |

| PAT | 207.28 | 70.03 | 196% |

| EPS (diluted) | 140.94 | 47.49 | 197% |

| PAT Margins | 7% | 4% | 89% |

Valuation

| Valuations | 31st March, 2024 |

| Share Price (as on 24 Sept,2024) | 1240 |

| Outstanding shares | 1,47,06,776 |

| MCAP (in Crs) | 1824 (Approx) |

| P/E Ratio | 8.79 |

| P/S Ratio | 0.65 |

| P/B Ratio | 1.30 |

| Book value per share | 951.12 |

Peer Comparison

| Financials (in crores) | Hindusthan Engineering & Industries Limited | Titagarh Rail Systems Ltd |

| Revenue | 2,796.70 | 3,893 |

| EBITDA | 342.53 | 492 |

| PAT | 207.28 | 286 |

| EPS (diluted) | 140.94 | 22 |

| PAT Margins | 7% | 7% |

| Share Price (as on 24 Sept,2024) | 1240 | 1,296 |

| Outstanding shares | 1,47,06,776 | 13,46,75,926 |

| MCAP (in Crs) | 1824 | 17,454 |

| P/E Ratio | 8.79 | 59.5 |

| P/S Ratio | 0.65 | 4 |

| P/B Ratio | 1.30 | 8 |

| Book value per share | 951.12 | 165 |

SWOT Analysis

Strengths:

- Industry Leader: Consistent market leader in the rolling stock industry since the mid-1950s, supplying thousands of freight cars for Indian Railways.

- Diverse Product Portfolio: Broad range of products, including bogies, couplers, draft gears, CMS crossings, jute products, and chemicals like cyanides.

- Export Success: Strong international presence, exporting to countries such as South Korea, Australia, and North America.

- Technological Expertise: First Indian company to develop anode yokes for aluminum smelters, and has strategic partnerships with global leaders like Standard Car Truck Company (U.S.A.).

- R&D Capabilities: In-house R&D center recognized by the Indian government, contributing to innovation and product development.

Weaknesses:

- Dependence on Railways: A significant portion of HEIL’s revenue comes from Indian Railways, making it vulnerable to shifts in government policies or funding.

- Capital Intensive Operations: The high capital investment required for continuous modernization of plants and stringent pollution control measures.

- Limited Diversification: Despite a diverse product range, the company’s core focus remains heavily in industrial and railway sectors, limiting potential in other high-growth industries.

Opportunities:

- Growing Global Demand: Increased opportunities for export, driven by growing global demand for rolling stock and infrastructure projects.

- Government Infrastructure Initiatives: Indian government’s push for modernization of railways and infrastructure provides scope for increased domestic business.

- Innovation in Sustainable Products: Expanding into eco-friendly and sustainable products, such as stainless steel freight cars and pollution-controlled chemical production, could open new markets.

Threats:

- Economic Slowdowns: Global economic downturns or reductions in government spending on infrastructure projects could negatively impact revenue.

- Competition: Rising competition from international players, particularly with privatization and foreign investments in the Indian railways sector.

- Environmental Regulations: Increasingly stringent environmental regulations may increase operational costs, especially for chemical production.

.

..

Hindusthan Engineering unlisted shares are currently trading ₹1240, CLICK HERE to Invest.

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/

Read More