SK Finance: Company Overview

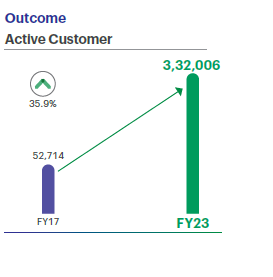

SK Finance is a prominent non-deposit taking NBFC operating in the middle layer (NBFC ML). It was founded by Rajendra Kumar Setia in 1994. (30 years). The company specializes in Vehicle financing and MSME financing, offering tailored financial solutions to diverse customer segments. According to the CRISIL Report, SK Finance is the fastest growing company in both the vehicle and MSME financing segments among its peers, based on AUM CAGR from Fiscal 2021 to Fiscal 2023. As of December 31, 2023, SK Finance operates 535 branches across 11 states and one union territory, with a significant presence in rural areas, supported by a network of 8,853 direct sales agents (DSAs) and a dedicated on-ground sales team.

| Company Name | SK Finance Limited |

| Company Type | Non-Banking Financial Company (NBFC) |

| Industry | Vehicle Financing and MSME Financing |

| Founded | 1994 |

| Registered Address | G 1-2, New Market, Khasa Kothi , Jaipur, Rajasthan, India – 302001. |

Industry Overview:

As of September 2023, Non-Banking Financial Companies (NBFCs) in India have disbursed loans totaling over 450 billion USD, reflecting the sector’s substantial role in the financial landscape. The NBFC sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% from 2021 to 2026. Notably, NBFCs accounted for the largest share of vehicle finance credit outstanding, at 39.97% in Fiscal 2023. The credit from NBFCs is expected to continue expanding at a CAGR of 16-18% between Fiscal 2023 and 2025. Despite rural areas contributing 47% to India’s GDP, they received only 8% of the overall banking credit as of March 31, 2023, underscoring a significant lending opportunity for banks and NBFCs. In the vehicle finance industry, loans have surged by 137% over the past three years, making it the second-largest loan segment after home loans. The vehicle financing segment was valued at approximately 11.85 trillion INR as of Fiscal 2023, with a CAGR of around 11.07% from Fiscal 2019. This segment is anticipated to grow at a CAGR of 16-18% from Fiscal 2023 to 2027, potentially reaching around 21 trillion INR. For the MSME sector, NBFCs typically operate with yields between 18-20%, and profitability is projected to rise by approximately 4% in Fiscal 2024 due to lower credit costs and increased interest yields.

Product Portfolio:

1. Vehicle Financing: SK Finance focuses on financing used and new light and medium commercial vehicles (LCVs and MCVs). They had a notable 77.41% share in used vehicle finance as of December 31, 2023.

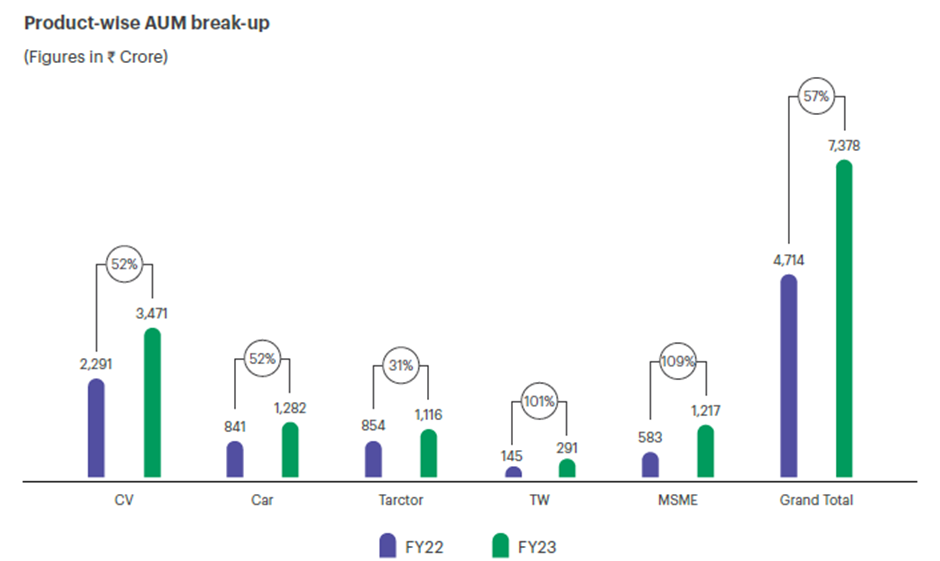

As of March 2023, their AUM for this segment was ₹3,471 crore (47% of overall AUM), with a 52% year-on-year growth driven by ₹2,731 crore in disbursements. SK Finance’s verticals encompass financing for commercial vehicles, cars, tractors, and two-wheelers. AUM for the car segment is 1282 with a 52% year-on year growth. AUM for the Tractor segment is 1116 with a 36% year-on year growth. AUM for the Tractor segment is 291 with a 101% year-on year growth.

2. MSME Financing: Since 2016, SK Finance has focused on providing asset-backed loans for working capital requirements to MSMEs, targeting mid to low-income, self-employed, unbanked, or underbanked individuals in rural and semi-urban areas.

As of March 2023, the AUM was ₹1,217 crore (16% of overall AUM), with a 109% year-on-year growth and ₹879 crore in disbursements.

This segment’s growth was driven by expanding branches and improved productivity, with MSME financing offered from 238 out of 447 branches.

Distribution:

- Branch Network: SK Finance operates 535 branches across 11 states and one UT, focusing on rural and semi-urban areas. Out of their 535 branches, they provide secured business loans to the MSME sector through 322 branches.

- Employee Composition: As of December 31, 2023, they have a total of 10,725 employees.

Management Details:

Amar Lal Daultani – Chairperson and Non-Executive Independent Director:

The management team of SK Finance is led by Amar Lal Daultani, who serves as the Chairperson and Non-Executive Independent Director. With a bachelor’s degree in science from Agra University, Mr. Daultani brings over 34 years of experience in various domains such as credit, forex, treasury, risk management, and other banking operations, having previously worked at Allahabad Bank and Corporation Bank.

.

Rajendra Kumar Setia – Managing Director and Chief Executive Officer:

Rajendra Kumar Setia, the Managing Director and Chief Executive Officer, holds a bachelor’s degree in science from the University of Rajasthan and has more than 29 years of experience in financial services. His leadership and achievements were recognized when he was named one of the “ET Business Leaders of Rajasthan 2019” by the Times Group.

,

.

Awards and recognition:

As of FY24

- Mr. Yash Setia, whole-time director of SK Finance, was honoured with the prestigious Rajasthan Gaurav Award 2024

- At BFSI Leadership Awards 2024, Mr. Atul Arora Honoured as CFO of the Year – NBFC, Mr. Girish Dangayach Receives Best Digital Transformation Initiative – NBFC , Mrs. Anubha Khandelwal Recognized as Chief Compliance Officer of the Year – NBFC

- The Economic Times honoured SK Finance as Best Brand of 2023

- ITOTY Awards’23 for Fastest Growing Tractor Financer in India

,

Financial Highlights:

₹ in Cr.

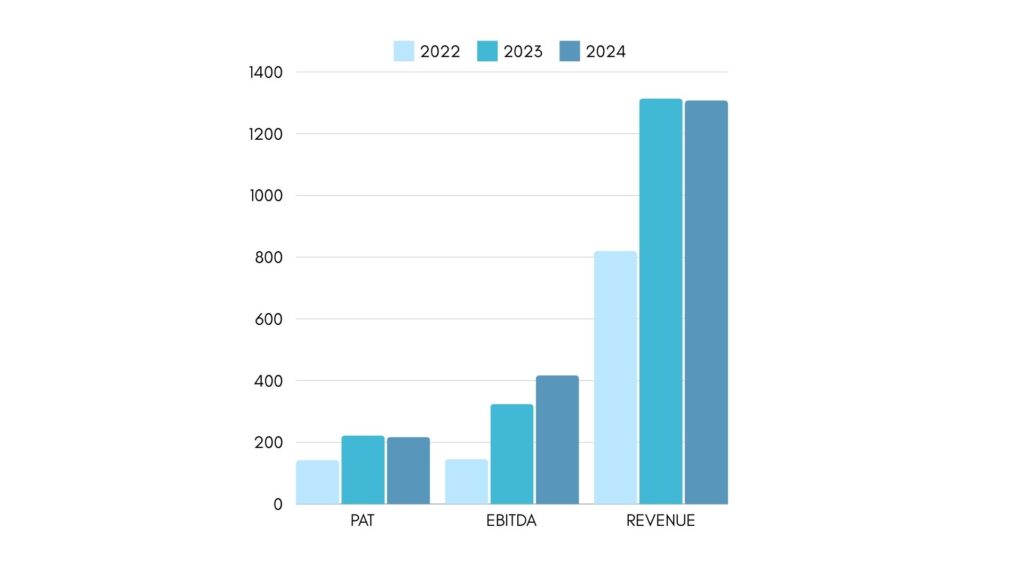

| Financials | FY24 | FY 2023 | FY 2022 | % Increase |

| Revenue | 1798 | 1314.2 | 820.7 | 60.1% |

| EBITDA | 417.3 | 324.6 | 145.5 | 123.1% |

| PAT | 312 | 222.8 | 142.9 | 55.9% |

| PAT Margins | 17% | 24% | 17% | 4% |

| EPS | 17.78 | 76.4 | 50.5 | – |

Peer Comparision:

| Particulars | SK Finance Ltd. (2024) | MAS Financial Services Ltd. (FY24) |

| Total Income | 1798 Crs. | 1297 Crs. |

| AUM | 10476 Crs. | 9672 Crs. |

| PAT | 312 Crs. | 254 Crs. |

| Net Profit Margins | 17% | 19% |

| CMP (Sep 2024) | ₹ 945 | ₹ 297 |

| Market Cap | ₹ 12649 Crs. | ₹ 5,391 Cr. |

| P/E Ratio | 38.26 | 21.6 |

| P/B Ratio | 4.07 | 2.7 |

Valuations:

| Share Price ( as Sep 2024) | 945 |

| Outstanding Shares | 13.3 |

| MCAP | 12649 |

| P/E Ratio | 38.26 |

| P/S Ratio | 7.04 |

| P/B Ratio | 4.07 |

| Book value per share | 232.18 |

SWOT Analysis:

Key Strengths:

- Profitable Track Record: SK Finance has been profitable since inception, maintaining robust net interest margins exceeding 15% over the past three years.

- Effective Credit Management: Despite pandemic challenges, controlled asset quality measures led to effective management of credit costs, with significant reductions seen in fiscal 2022.

- Stable Returns: Stable return on managed assets (RoMA) ranging between 2% to 3% over the last four fiscal years.

- Strong Capitalization: Net worth increased approximately 3.5 times in the last three years to Rs 1901 Crs. as of June 30, 2023, with 90+ dpd at 2.0% and comfortable capital adequacy.

Weaknesses:

- Geographical Concentration: Despite a broad distribution network, SK Finance faces challenges in scaling operations while maintaining asset quality. Their significant focus on rural and semi-urban areas could lead to increased risk if not managed carefully.

- High Dependence on Vehicle Financing: The company’s substantial focus on vehicle financing, particularly used vehicles, may pose risks if market conditions for this segment weaken.

- Limited Diversification in MSME Financing: While the MSME segment is growing rapidly, SK Finance’s MSME financing is still a relatively smaller portion of their portfolio compared to vehicle financing. This could limit the benefits of diversification.

Opportunities:

- Expanding Rural Market: Rural areas represent a significant growth opportunity, as they received only 8% of overall banking credit despite contributing 47% of India’s GDP. SK Finance’s strong rural presence positions it well to capitalize on this under-served market.

- Growth in Vehicle Financing: The vehicle financing segment is expected to grow at a CAGR of 16-18% through 2027, offering SK Finance opportunities to expand its market share in this lucrative sector.

- Increasing MSME Demand: With the MSME sector’s profitability increasing and the rise in asset-backed loans, there is potential for SK Finance to further grow its MSME portfolio and leverage higher yields.

- Technological Advancements: Investments in technology and digital transformation can enhance operational efficiency, customer acquisition, and service delivery, providing a competitive edge.

Threats:

- Regulatory Risks: Changes in financial regulations and compliance requirements can impact operational processes and increase costs. Regulatory scrutiny on NBFCs could pose challenges.

- Economic Downturns: Economic slowdowns or downturns can adversely affect asset quality and increase default rates, impacting the financial performance of SK Finance.

- Competitive Pressure: Intense competition from other NBFCs and traditional banks could pressure SK Finance’s margins and market share, particularly in the vehicle financing segment.

- Geopolitical and Market Volatility: Fluctuations in market conditions, including interest rate changes and geopolitical instability, could affect the overall financial stability and growth prospects of SK Finance.

.

SK Finance unlisted shares are currently trading at ₹ 945, CLICK HERE to Invest.

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/