Apollo Green Energy Limited: About the Company

Apollo Green Energy Limited (AGEL), formerly known as Apollo International Limited, is a leading name in India’s renewable energy sector. Founded in 1994 and headquartered in Gurgaon, with a registered office in New Delhi, AGEL is part of the Apollo Group, a major Indian conglomerate with a wide-ranging portfolio.

AGEL specializes in delivering comprehensive solutions for renewable energy projects, with a strong focus on solar power, wind energy, and energy storage. Drawing on the Apollo Group’s extensive experience across diverse sectors, including tyres, healthcare, logistics, apparel, and footwear, AGEL is strategically positioned to drive green energy initiatives and contribute to India’s sustainability goals.

| Company Name | APOLLO GREEN ENERGY LIMITED |

| Company Type | Unlisted Public Company(Buy unlisted shares of APOLLO Green Energy) |

| Industry | Infrastructure | EPC | Logistics |

| Founded | 1994 |

| Registered Address | New Delhi, India |

Business Overview

AGEL operates through three main business verticals: Green Energy, Engineering Procurement & Construction (EPC), and Supply of Goods.

- Green Energy Division: This division focuses on providing end-to-end solutions for renewable energy projects, ensuring the seamless integration of solar power, wind energy, and energy storage systems.

- Engineering, Procurement & Construction (EPC) Division: Specializing in medium and large-scale infrastructure and industrial projects, this division undertakes turnkey projects in power, oil storage, transmission, solar, irrigation, and sugar processing sectors across international and domestic markets.

- Supply of Goods Division: Engaged in trading tyres, batteries, lubricants, white goods, and electronic goods, this division operates in India, Dubai, Singapore, and China, overseeing marketing and distribution operations in 70 countries.

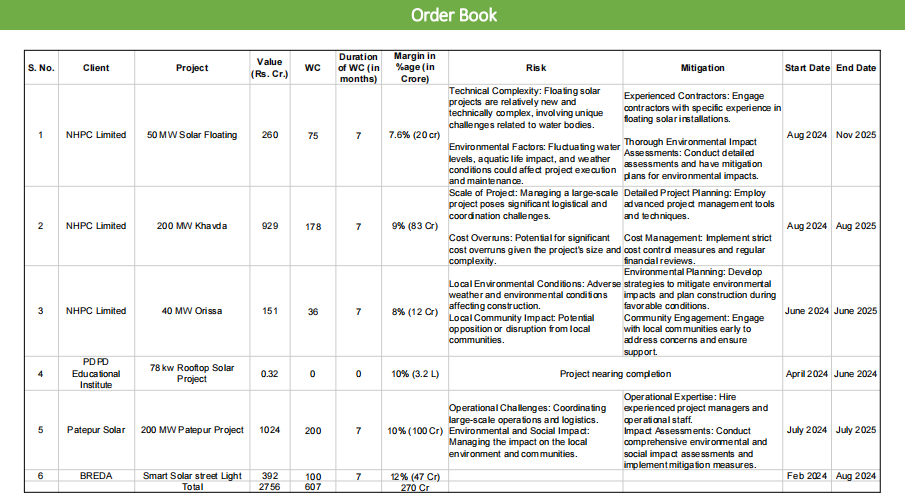

Projects Under Execution

AGEL has a diverse portfolio of ongoing and awarded projects:

- Photonics WaterTech: Installation of smart solar street lights in Bihar (₹392 Cr)

- Adani Green/Nesteye Insights Pvt. Ltd.: Solar panel installation for the 15 GW Adani Power Project in Gujarat (₹100 Cr)

- MB Power: Flue Gas Desulfurization (FGD) Systems for Anuppur Thermal Power Project in Madhya Pradesh (₹677.5 Cr)

- IOCL: Capacity expansion at Barauni refinery (₹313.72 Cr)

- IOCL: Petrochemical and Lube Integration Project in Vadodra, Gujarat (₹133.53 Cr)

- Municipal Council Palwal: Water supply system in Palwal, Haryana (₹42.9 Cr)

- State Water and Sanitation Mission: Rural water supply projects in Uttar Pradesh (₹75 Cr)

Projects Awarded:

- NHPC: 200 MW Solar PV Power Project in Gujarat (₹966 Cr)

- Patepur Solar Power Project (P) Ltd.: 200 MW EPC project in Bihar (₹1024 Cr)

- Joint Venture with Ambika Associate: Associated works of 11 KV Line in Bhopal (₹190 Cr)

- NHPC: 40 MW Solar Power Project in Odisha (₹151 Cr)

- NTPC/Sterling Wilson: EPC contract for 1250 MW NTPC Solar Park project in Gujarat (₹500 Cr, Pipeline)

- Municipal Corporation of Gurugram (EcoGreen Energy Pvt. Ltd.): Managing and processing waste, establishing a 25 MW Waste to Energy plant in Haryana (₹500 Cr, Pipeline)

The total value of projects under execution stands at ₹1735 Cr, with awarded projects amounting to ₹2330 Cr.

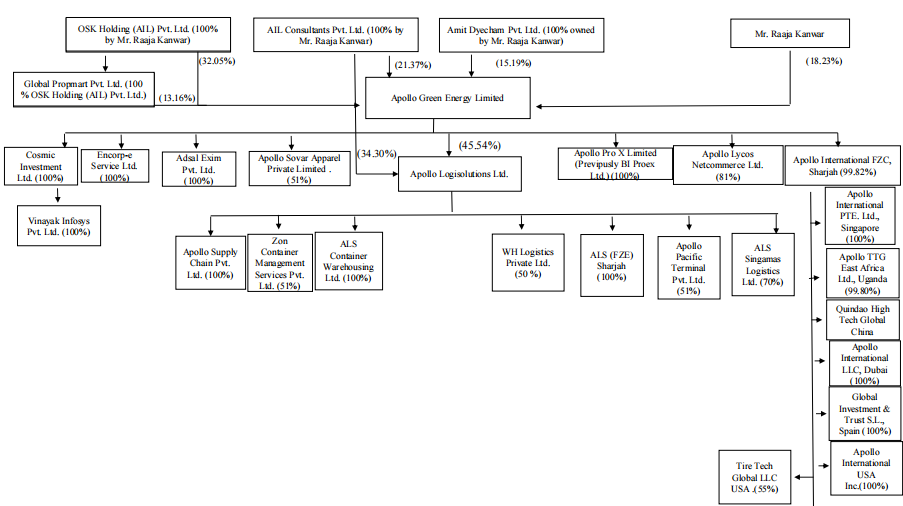

Subsidiary Companies

Apollo Green Energy Limited: This is the main or parent company at the top of the hierarchy.

Direct Subsidiaries of Apollo Green Energy Limited

- Apollo Logisolutions Ltd.: (45.54% owned by Apollo Green Energy Limited) Apollo Logisolutions Limited provides logistics solutions. The Company offers dry ports, freight forwarding, custom brokerage, and contract logistics solutions. ALS serves electronics, engineering, automobiles, pharmaceuticals, health care, retail, and e-commerce markets worldwide.

- WH Logistics Private Ltd. (50% owned by Apollo Logisolutions Ltd.)

- ALS (FZE) Sharjah (100% owned by Apollo Logisolutions Ltd.)

- Apollo Pacific Terminal Pvt. Ltd. (51% owned by Apollo Logisolutions Ltd.)

- ALS Singamas Logistics Ltd. (70% owned by Apollo Logisolutions Ltd.)

- Apollo Pro X Limited (Previously BJ Proex Ltd.): (100% owned by Apollo Green Energy Limited) Apollo Pro X is a comprehensive EPC partner delivering seamless large-scale industrial and infrastructure projects from conception to completion.

- Apollo Lycos Netcommerce Ltd. (81% owned by Apollo Green Energy Limited)

- Cosmic Investment Ltd. (100% owned by Apollo Green Energy Limited)

- Vinayak Infosys Pvt. Ltd. (100% owned by Cosmic Investment Ltd.)

- Encorep Service Ltd. (100% owned by Apollo Green Energy Limited)

- Adsal Exim Pvt. Ltd. (100% owned by Apollo Green Energy Limited)

- Apollo Sovar Apparel Private Limited (51% owned by Apollo Green Energy Limited)

- Apollo Supply Chain Pvt. Ltd. (100% owned by Apollo Sovar Apparel Private Limited)

- Zon Container Management Services Pvt. Ltd. (51% owned by Apollo Sovar Apparel Private Limited)

- ALS Container Warehousing Ltd. (100% owned by Apollo Sovar Apparel Private Limited)

- Apollo International FZC, Sharjah (99.82% owned by Apollo Green Energy Limited)

- Apollo International PTE. Ltd., Singapore (100% owned by Apollo International FZC, Sharjah)

- Apollo TFG East Africa Ltd., Uganda (99.88% owned by Apollo International FZC, Sharjah)

- Qinda High Tech Global China (ownership not specified)

- Apollo International LLC, Dubai (ownership not specified)

- Global Investment & Trust S.L., Spain (100% owned by Apollo International FZC, Sharjah)

- Apollo International USA Inc. (100% owned by Apollo International FZC, Sharjah)

- Tire Tech Global LLC, USA (55% owned by by Apollo International FZC, Sharjah)

Management of the Company

Raaja Kanwar: Managing Director

Raaja Kanwar, Chairman and Managing Director of the Apollo International Group, leads diverse projects in green energy, infrastructure, logistics, fashion, and trade across 45+ countries. A Drexel University graduate with a degree in Business Administration, Raaja co-founded UFO Moviez, revolutionizing digital cinema in India. He also chairs the CII Haryana State Council and is celebrated for his entrepreneurial skills and commitment to sustainability, earning titles like Best Logistics CEO and recognition among the World’s Greatest Leaders. Passionate about diversity, fitness, and purpose-driven business, Raaja drives impactful and innovative projects.

Sanjay Gupta: Chief Executive Officer

Mr. Sanjay Gupta, the CEO of Apollo Green Energy Limited, spearheads the company’s renewable energy initiatives, particularly in the solar sector. With over 35 years of experience in the power and infrastructure industries, he has extensive expertise from project conception to commissioning. Starting his career at NTPC Ltd., Mr. Gupta advanced to senior roles in project design and engineering. His tenure at LANCO Infratech Ltd. and leadership in the EPC vertical at WAAREE Energies Ltd. saw the successful implementation of large-scale solar projects.

Suman Lata Suri: VP-Head Legal & Company Secretary

Suman Lata is the VP-Head Legal & Company Secretary of Apollo Green Energy Limited. She holds degrees in Commerce, Law, and a PGDPM in Labour Law & Personnel Management, and is a qualified Company Secretary from the Institute of Company Secretaries of India. With extensive experience, she has served as Company Secretary for companies like IKF Technologies, Jaypee Group, and Jaypee Infratech Limited.

.

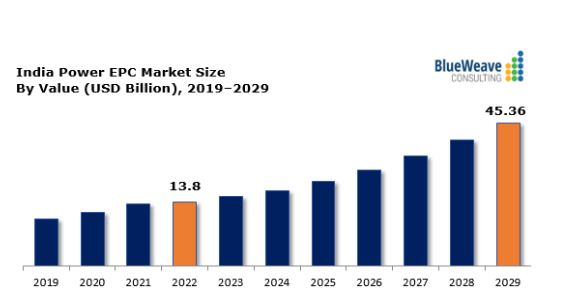

Industry Overview: India Power EPC Market

Market Snapshot

The India Power EPC (Engineering, Procurement, and Construction) market, valued at USD 13.8 billion in 2022, is set to grow significantly, with a projected CAGR of 21.94%, reaching USD 45.36 billion by 2029. This growth is driven by rising energy demand, government initiatives, and technological advancements.

Key Drivers

- Energy Demand: Rapid industrialization and urbanization are fueling the demand for power infrastructure.

- Government Initiatives: Programs like “Power For All” and the push for 500 GW of renewable capacity by 2030 are expanding market opportunities.

- Technological Advancements: Innovations in power generation and transmission, including supercritical plants and renewable energy, are driving market growth.

Market Segmentation

- By Power Generation: The thermal segment leads, with coal, oil, and natural gas dominating. Renewable energy is gaining prominence.

- By Power Transmission and Distribution: The transmission segment has a higher share due to increased investments in network enhancement.

- By Region: The market is divided into North, South, East, and West India, with varying regional demands and developments.

Challenges

- Regulatory Constraints: Complex regulations can delay projects and increase costs.

- COVID-19 Impact: The pandemic disrupted supply chains and project timelines but accelerated digital adoption.

Competitive Landscape

Key players include Bharat Heavy Electricals Limited (BHEL), Larsen & Toubro Limited, Tata Group, and Sterlite Power Transmission Limited. Companies are enhancing their positions through mergers, acquisitions, and new projects.

Apollo Green Energy: Solar Energy Verticles

Order Book

The working capital for Apollo Green Energy Limited’s solar projects has been secured through IREDA and commercial banks, ensuring funds for daily operations and procurement. Additionally, surety bonds for EMD and PBG have been sanctioned by New India Assurance (INR 50 Cr) and Bajaj Allianz (INR 18 Cr), totaling INR 68 Cr. These arrangements ensure smooth project execution, covering operational needs and financial guarantees for regulatory compliance.

Renewable Vision

- EPC and Large PSU Projects:

- Aim to secure an order book of INR 5000 Cr by obtaining substantial PSU projects.

- Focus on operational excellence and technological innovation for efficiency and quality.

- Establish AGEL as a trusted partner in large-scale projects.

2. Solar Development:

- Integrate seamlessly into the solar energy value chain.

- Leverage Government Power Purchase Agreements (PPAs) for growth.

- Excel in Engineering, Procurement, and Construction (EPC) projects for solar energy.

3. Diversification into Renewable Energy:

- Plan to diversify into wind energy, energy storage solutions, EV charging stations, and green hydrogen production over the next 3-5 years.

- Support expansion with investments in cutting-edge technologies and robust infrastructure.

- Offer comprehensive renewable energy solutions to meet market needs and contribute to a greener future.

India’s Vision 2030: Innovations Illuminated

- Renewable Energy Targets:

- 500 GW renewable energy capacity by 2030.

- 50% of energy requirements from renewable sources by 2030.

- Reduce projected carbon emissions by 1 billion tonnes by 2030.

- Decrease carbon intensity of the economy by under 45%.

- Achieve net zero carbon status by 2070.

- Energy Independence by 2047:

- Mix of electric mobility, CNG & piped natural gas, 20% ethanol blending, and green hydrogen production.

- Aim for 90% of energy from renewable sources.

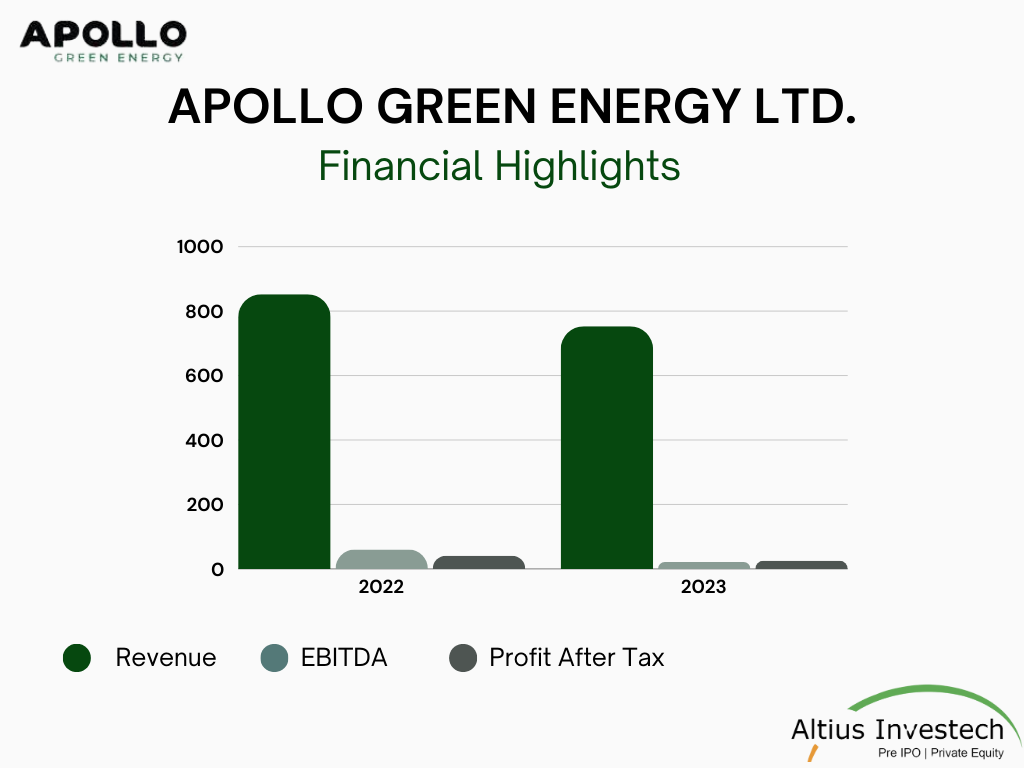

Financial Highlights

₹ in crores

| Financials | FY23 | FY22 | % decrease |

| Revenue | 790 | 852 | 8% |

| PAT | 25 | 41 | 39% |

| EBITDA | 21 | 60 | 65% |

Share Outstanding and Fundraising Details

Funding Rounds:

| Investors | Date | Number of Shares |

| Kamal Mavji, Ankush Kedia, Marfatia Stock Broking, Mohit Vinodkumar Aggarwal | July 1, 2024 | 2,47,500 |

| Omas Securities, AS Finalysis Venture, Noida Holding Pvt ltd | July 2, 2024 | 6,65,454 |

| Ritu Gupta, Ajeet Modi, India Ahead Venture Fund | July 3, 2024 | 3,92,536 |

| Green Portfolio Pvt Ltd, Resonance opportunity Fund | July 4, 2024 | 11,13,840 |

| Utsav Pramodkumar Shrivastav, Green Portfolio Pvt Ltd, Dinero Finance and Investment | July 10, 2024 | 2,59,241 |

| Raaja Kanwar (Promoter) | July 30, 2024 | 50,00,000 |

| Total Fundraised | 76,78,571 |

Share Outstanding as of 31st July 2024:

| Particulars | Date | Number of Shares |

|---|---|---|

| Number of Equity Shares Outstanding | March 2024 | 1,90,00,000 |

| Compulsorily Convertible Preference Shares | March 2024 | 22,03,416 |

| Total Fundraised in July | July 1 to July 30 | 76,78,571 |

| Total Outstanding Shares | 2,88,81,987 |

Valuation

| Particulars | FY 2023 |

| Revenue | 790 |

| EBITDA | 21 |

| PAT | 25 |

| Outstanding shares (as of July 2024) | 2,88,81,987 |

| Share Price (July 2024) | 480 |

| Market Capital | 1382.40 |

| P/E | 55.30 |

| P/S | 1.75 |

Peer Comparison

₹ in crores- as of FY 2023

| Particulars | Apollo Green Energy Ltd | Zodiac Energy Ltd | Ganesh Green Bharat Ltd. | Bondada Engineering Ltd |

| Revenue | 790 | 140 | 90 | 371 |

| PAT | 25 | 3 | 8 | 17 |

| Share Price (July 24) | 480 | 729 | 433 | 2543 |

| Market Capital | 1382 | 1069 | 1074 | 5493 |

| P/E Ratio | 55.30 | 356.33 | 134.25 | 323.11 |

| P/S Ratio | 1.75 | 7.69 | 11.93 | 14.80 |

Apollo Green Energy Ltd appears to be undervalued with the lowest P/S ratio of 1.75 and lowest P/E ratio of 55.30, suggesting it may offer good value relative to its revenue. Despite company’s relatively low share price and moderate market capitalization compared to its peers, its revenue is notably higher, and its profitability is also superior in most cases. Overall, Apollo Green Energy Ltd could be a compelling choice for value investors looking for a reasonably priced stock with growth potential.

SWOT Analysis

Strengths:

- Diverse Revenue Streams: AGEL’s operations span across green energy, EPC projects, and goods supply, reducing dependency on any single sector.

- Strong Financial Position: Robust capital structure with a gearing ratio of 1.05 times and strong interest cover ratios.

- Healthy Order Book: Significant order book in the EPC segment valued at approximately ₹1240 crore, indicating revenue visibility and growth potential.

- Global Presence: Extensive geographical reach, operating in over 70 countries, which provides stability and resilience.

Weaknesses:

- Volatile Profitability: Operating margins have been inconsistent (6-10%) due to disruptions like COVID-19, impacting Return on Capital Employed (RoCE).

- High Working Capital Requirements: Increased gross current asset (GCA) days, currently at 263 days, indicating potential liquidity issues.

- Project Execution Risks: Exposure to execution risks such as time and cost overruns, land acquisition issues, and political interference.

Opportunities:

- Expansion in Renewable Energy: Plans to diversify into wind energy, energy storage solutions, and EV charging stations offer growth potential.

- Government Initiatives: Benefiting from India’s Vision 2030 targets for renewable energy, including 500 GW capacity and net-zero goals.

- Technological Advancements: Investing in cutting-edge technologies and innovations in the renewable sector to enhance competitiveness and efficiency.

Threats:

- Commodity Price Risks: Fluctuations in commodity prices can impact project costs and margins.

- Tender-Based Risks: Dependency on tenders for EPC projects introduces uncertainty and potential delays.

- Regulatory and Environmental Risks: Navigating complex regulatory environments and meeting environmental standards can pose challenges.

Read Our Other Blogs

Matrix Gas and Renewables Limited

Sterlite Power Transmission’s Journey and Impact on Power Infrastructure

Northern Arc Capital Limited Company Detail: Financial Information , IPO Plans & Latest Share Price

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also check out the list of Best 5 Unlisted Shares to Buy in India

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/