Northern Arc Capital Limited: Financial Information, IPO Plans & Latest Share Price

Northern Arc Capital Limited (NACL) is a prominent financial services company in India, specializing in enabling small and medium-sized NBFCs and fintech entities to access debt capital. Founded in 1989, Northern Arc Capital Limited is registered with the Reserve Bank of India. Over the years, Northern Arc has established itself as a key player in the financial ecosystem, particularly focusing on sectors that are often underserved by traditional financial institutions.

| Company Name | NORTHERN ARC CAPITAL LIMITED |

| Company Type | Unlisted Public Company . Buy Northern Arc Unlisted Shares from Altius Investech. |

| Industry | Financial Service-NBFC |

| Founded | 1989 |

| Registered Address | Chennai, Tamil Nadu, India |

Core Activities

Northern Arc Capital Limited’s primary operations include:

- Debt Facilitation and Lending: NACL assists NBFCs and fintechs in accessing debt capital through various means, including securitisation, debentures, and co-lending. It also provides direct loans to these entities and invests in subordinated tranches of securitisation pools.

- Lending to Corporates and Retail Customers: In addition to supporting NBFCs and fintechs, NACL also lends to mid-market corporates and retail customers.

- Microfinance and Sectoral Expansion: Initially focused on microfinance, NACL has diversified its NBFC activities to include affordable housing finance, small business loans, commercial vehicle finance, agricultural finance, corporate finance, and consumer finance.

Expansion and Diversification

Since its inception, Northern Arc has significantly expanded its scope and operations:

- Retail Segments: In the financial year 2022, NACL ventured into direct retail lending, including microfinance institutions, supply chain finance, loan against property, and education loans.

- Focus Sectors: NACL has developed expertise across six key sectors: MSME financing, microfinance, consumer finance, vehicle finance (including commercial vehicles, two-wheelers, and electric vehicles), affordable housing finance, and agriculture finance.

- Climate and Renewable Financing: The company is also building expertise in climate and renewable financing sectors.

Impact and Reach

Over the past 14 years, Northern Arc has facilitated financing amounting to over ₹1.50 trillion, positively impacting over 80.59 million lives across 682 districts in 28 states and 7 union territories of India. This extensive reach underscores NACL’s role in addressing the diverse credit needs of under-served households and businesses across the country.

Technology and Innovation

Northern Arc’s success is bolstered by its proprietary end-to-end integrated technology solutions:

- Nimbus: A curated debt platform that enables the complete processing of debt transactions.

- nPOS: A co-lending and co-origination technology solution utilizing application programming interfaces (APIs).

- Nu Score: A machine learning-based analytical module designed to aid Originator Partners in the loan underwriting process.

- AltiFi: An alternative retail debt investment platform that expands the company’s reach in retail debt investments.

Mission and Vision

Northern Arc’s mission is to cater to the diverse retail credit requirements of under-served households and businesses in India. Through its comprehensive financial services platform, NACL aims to create a significant impact on the retail credit ecosystem by leveraging its extensive domain expertise, innovative technology, and a scalable business model.

Subsidiary Companies

| Subsidiary | Description |

|---|---|

| Northern Arc Investment Adviser Services Private Limited | Facilitates investments and acts as an advisor to provide financial/investment advice to both Indian and foreign investors. |

| Northern Arc Investment Managers Private Limited | Carries on the business of an investment company and provides portfolio management services to offshore funds and all kinds of AIFs. |

| Pragati Finserv Pvt Ltd | Incorporated in FY21, offers small-ticket loans through a digital platform to under-served rural and semi-urban areas. |

| Northern Arc Foundation | Acts as the CSR arm for Northern Arc Capital, focusing on skill building, employment development, and education. |

| Northern Arc Securities Private Limited | Established as a 100% subsidiary to register as a stockbroker in the debt segment. Responsible for the operations of the AltiFi platform after broking registration. |

Management of the Company

P.S. Jayakumar: Non-Executive Independent Director and Chairman

P.S. Jayakumar, appointed as Non-Executive Independent Director and Chairman of the Board in 2020, brings over 30 years of experience spanning finance and real estate. A chartered accountant with a master’s degree in commerce and a postgraduate diploma in business management, he has held key positions at Citibank N.A., Bank of Baroda, and VBHC Value Home Private Limited. His diverse expertise and leadership skills make him a valuable asset to the board.

.

Dr. Kshama Fernandes: Non-Executive Non-Independent Director and Vice-Chairperson

Dr. Kshama Fernandes, currently Non-Executive Non-Independent Director and Vice-Chairperson, brings over 25 years of expertise in management, risk advisory, and academia. With a bachelor’s, master’s, and PhD from Goa University, she’s also a certified financial risk manager. Dr. Fernandes held key positions, including Managing Director and CEO of Northern Arc Capital, and served as Chief Risk Officer.

..

.

Ashish Mehrotra: Managing Director and Chief Executive Officer

Ashish Mehrotra is the Managing Director and Chief Executive Officer, brings over 25 years of extensive experience across Retail & Commercial Banking, Wealth Management, and Insurance sectors. He also serves as the Non-Executive Chairperson of Pragati Finserv, the rural finance arm of Northern Arc Group, and is a board member of Northern Arc Investment Managers. Previously, he held the position of MD & CEO at Niva Bupa Health Insurance and spent over 20 years at Citibank, where he served as Managing Director and Retail Bank Head for Citibank India. With a Master of Business Administration Degree, Ashish’s leadership and expertise drive the company’s growth and strategic initiatives.

Industry Overview

Economic Outlook for FY23 and FY24

The economic outlook for FY23 faced global challenges including the COVID-19 pandemic, geopolitical tensions, and inflation. Despite slower growth projections by the IMF, the global economy showed resilience amidst supply chain disruptions and rising inflation, with central banks and governments taking measures to stabilize markets and stimulate growth. In India, the economy grew by 7.2%, making it the fastest-growing large economy, with the Reserve Bank of India implementing off-cycle rate hikes to manage inflation.

The government’s increased capital expenditure in the Union Budget supported growth, particularly for pandemic-affected sectors. Looking ahead to FY24, the Economic Survey of India predicts GDP growth of 6-6.8%, with continued emphasis on fiscal prudence, green growth, and infrastructure, highlighted by initiatives like the National Green Hydrogen Mission to transition to a low carbon economy.

NBFC Sector Outlook in India

The Non-Banking Financial Companies (NBFCs) sector in India continues to play a pivotal role in facilitating access to financial products and services, operating across a wide range of asset classes from retail to wholesale loans. Despite challenges during the COVID-19 pandemic, NBFCs demonstrated resilience in FY23, witnessing strong growth and improving profitability. Diversified financial institutions and NBFC-MFIs led the sector’s growth, outperforming the industry average.

Looking ahead, the NBFC sector is expected to maintain its momentum, driven by macroeconomic factors, regulatory stability, and a favorable operating environment. Strong growth is anticipated in various asset classes, including microfinance, MSME finance, housing loans, vehicle finance, and consumer loans like personal loans and buy-now-pay-later financing, reflecting the broader trends in e-commerce.

Key Drivers:

- Rising Middle Class: A growing middle class with increasing disposable income creates demand for credit, a space NBFCs effectively fill.

- Financial Inclusion: NBFCs play a vital role in reaching underserved segments, particularly in rural areas, where traditional banks have limited penetration

- Government Support: Policy initiatives promoting financial inclusion and NBFC regulations foster a supportive environment for growth.

Regulatory Outlook

The regulatory landscape set forth by the Reserve Bank of India (RBI) in 2022 aimed to address various aspects of the financial sector, particularly Non-Banking Financial Companies (NBFCs) and digital lending platforms. Here’s a summary of the key regulations issued by the RBI during that year:

- Scale-based Regulations for NBFCs (April 2022):

- The RBI introduced scale-based regulations requiring NBFCs to make additional disclosures in their financial statements based on their size. This move likely aimed at enhancing transparency and accountability within the NBFC sector, ensuring that investors and stakeholders have access to more comprehensive information about these entities.

- Bank Credit to NBFCs for On-lending (May 2022):

- In May 2022, the RBI permitted commercial banks to extend credit to NBFCs for on-lending purposes, subject to certain limits. Specifically, banks were allowed to lend up to 5% of their total Priority Sector Lending (PSL) to NBFCs, while Small Finance Banks (SFBs) were permitted to lend up to 10% of their PSL to NBFC-MFIs and other MFIs. This move likely aimed to improve the flow of credit to priority sectors through NBFCs, thereby supporting financial inclusion and economic growth.

- Digital Lending Guidelines (August 2022):

- In August 2022, the RBI issued comprehensive digital lending guidelines. These guidelines likely aimed to regulate the burgeoning digital lending sector, which had seen rapid growth but also raised concerns about fair practices, consumer protection, and data privacy. By laying out a framework for online lending, the RBI sought to ensure that digital lending platforms operate within a transparent and responsible manner, safeguarding the interests of borrowers and maintaining the stability of the financial system.

Key Strengths of Northern Arc Capital Limited (NACL)

- Established Track Record of Operations:

- Over 10 years in the funding and debt issuance placement business.

- Strong relationships with a wide range of investors, including banks, NBFCs, mutual funds, offshore investors, and private wealth firms.

- Facilitated funding for over 200 partner institutions across various segments.

- Well-Established Risk Management Systems:

- Comprehensive risk management system approved by the Risk Committee.

- Strong underwriting guidelines and continuous credit risk assessment.

- Deployment of field-level personnel for portfolio monitoring and a robust risk analytics team.

- Revenue Diversification Through Fee-Based Income:

- Fund-based income from loans and fee-based income from securitization, loan syndication, bond, and structured finance transactions.

- Fee-based income of ₹56 crore in FY23.

- Presence in Diversified Asset Classes:

- Diversified into various segments including MFI, AHF, SBL, CV finance, agricultural finance, corporate finance, and consumer finance.

- Fund-based AUM grew by 25% in FY23 to ₹8,566 crore.

- Increasing focus on non-institutional credit, comprising 31% of AUM as of March 31, 2023.

- Comfortable Capitalisation Levels:

- Capital adequacy ratio (CAR) of 20.77% and Tier-I CAR of 20.15% as of March 31, 2023.

- Gearing levels at 3.8x, supporting growth initiatives.

- Diversified Funding Profile:

- Borrowings include bank term loans (61%), external commercial borrowings (27%), domestic NCDs (4%), loans from FIs (6%), CP (1%), and sub-debt (1%).

- Investor-wise borrowings include banks (75%), FIs (22%), and mutual funds/wealth management firms (4%).

- Stable Asset Quality Indicators:

- Maintained good asset quality with GNPA and NNPA at 0.77% and 0.40% respectively as of March 31, 2023.

- Effective monitoring and first loss default guarantee (FLDG) cover for non-institutional segments.

- Improved Profitability Indicators:

- Significant PAT improvement to ₹225 crore in FY23 from ₹164 crore in FY22.

- NIM improved to 6.88% in FY23 due to a higher proportion of non-institutional book.

- Pre-provision operating profit grew by 30% to ₹345 crore in FY23.

Key Weaknesses of Northern Arc Capital Limited (NACL)

- Client Concentration Risk:

- Significant exposure to wholesale lending with the top 10 exposures accounting for 16% of the AUM and 72% of the net worth as of March 31, 2023.

- Slippages in high ticket loans could significantly impact asset quality and profitability.

- Exposure to Marginal Risk Profiles:

- Investments in subordinated tranches of securitisation transactions, which carry higher credit risk compared to senior tranches.

- Exposures to subordinate tranches via sub-debt and Class-A units of alternate investment funds, though the share has been decreasing.

- As of March 31, 2023, 6% of securitisation exposure, 28% of loan exposure (excluding retail), and 1% of NCD exposure are rated below BB+ or unrated.

- Significant Increase in Non-Institutional Loan Book:

- Shift from institutional lending to retail credit, with a notable increase in direct retail segment exposure during FY23.

- The institutional and non-institutional composition stood at 69% and 31%, respectively, as of March 31, 2023.

- The performance of the non-institutional book remains a key monitorable factor.

Key Opportunities of Northern Arc Capital Limited (NACL)

- Industry leadership and dominant position provide a strong foundation for growth and influence in the market.

- Serving under-served retail markets presents an opportunity to tap into new customer segments and expand market reach.

- Revival in rural consumption offers the potential for increased demand and revenue generation.

- Exploring new growth avenues such as co-lending, direct retail lending, and wealth distribution diversifies revenue streams and fosters business expansion.

- Leveraging a strong brand pedigree and successful track record enhances credibility and customer trust.

- Building a robust distribution network strengthens market presence and facilitates efficient service delivery.

- Embracing digitalization and data-driven decision-making enhances operational efficiency, customer experience, and strategic insights.

Key Threats of Northern Arc Capital Limited (NACL)

- Regulatory challenges and credit availability constraints may hinder business operations and growth prospects.

- Impact on demand due to sustained inflation could affect consumer purchasing power and reduce market demand.

- Fast-changing interest rate environment poses risks to profitability and financial stability, requiring proactive risk management strategies and flexibility in adapting to market dynamics.

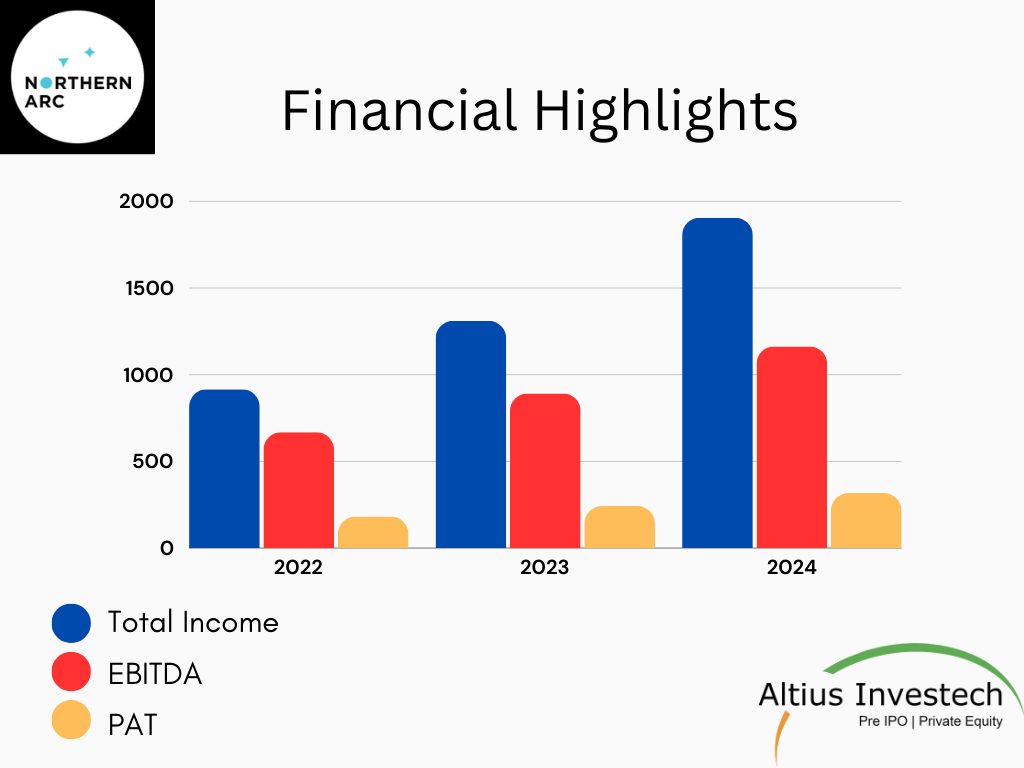

Financial Highlights

₹ in crores

| Particulars | FY 2023-24 | FY 2022-23 | FY 2021-22 |

| Total Income | 1906 | 1311 | 916 |

| EBITDA | 1163 | 892 | 668 |

| PAT | 317 | 242 | 182 |

| EBITDA Margin | 61% | 68% | 73% |

| Net Profit Margin | 17% | 18% | 20% |

| EPS | 24.38 | 25.85 | 19.52 |

In FY24, the company’s PAT rose to INR 317 crore from INR 242 crore in FY23, driven by improved yields and reduced credit costs. This led to a higher ROE of 12.6% and ROA of 2.8%. With healthy liquidity, marked by substantial cash reserves and unutilized bank limits, the company remained resilient against unforeseen challenges and agile in seizing opportunities. Total Income surged by 45% to INR 1906 crore, EBITDA by 30% to INR 1163 crore, and PAT by 31% to INR 317 crore, reflecting the company’s commitment to financial strength and operational excellence.

Revenue Breakup

₹ in crores

| Particulars | FY 2023-24 | FY 2022-23 |

| Financing Activity | 1840 | 1252 |

| Investment advisory services | – | 0.35 |

| Investment management services | 35 | 40 |

| Portfolio management services | 16 | 26 |

| Others | 106 | 38 |

| Total | 1999 | 1358 |

| Less: Intersegment revenue | (108) | (53) |

| Total Segment revenue | 1890 | 1304 |

AUM by Sector

| Particulars | As of September 30, 2023 | As of March 31, 2023 | As of March 31, 2022 | As of March 31, 2021 |

| MSME | 3,767 | 3,361 | 2,836 | 1,909 |

| MFI | 2,696 | 2,459 | 1,918 | 1,725 |

| Consumer finance | 2,449 | 1,892 | 1,096 | 416 |

| Vehicle finance | 729 | 865 | 829 | 819 |

| Affordable housing finance | 289 | 247 | 234 | 248 |

| Agriculture | 148 | 181 | 193 | 100 |

| Total AUM | 10,081 | 9,008 | 7,108 | 5,220 |

Dividend

Due to the need for deploying the funds back into the business for the growth of the Company, the directors of Northern Arc have not proposed any dividend on equity shares for the year under review.

ESOP

During the financial year 2022-2023, the company issued 1,23,750 equity shares under the Employees Stock Option Schemes of the Company.

Shareholding Pattern

| Shareholder | % of holding |

|---|---|

| IIFL Opportunities Fund, IIFL Opportunities Funds 2 to 7 | 25.61% |

| Leapfrog Financial Inclusion India (II) Limited | 22.56% |

| Augusta Investments II Pte Ltd. | 19.50% |

| Eight Roads Investments Mauritius (II) Limited | 10.25% |

| Dvara Trust | 7.48% |

| Individual shareholders (as per list enclosed) | 0.49% |

| Accion Africa Asia Investment Company | 5.80% |

| Sumitomo Mitsui Banking Corporation | 5.28% |

| Northern Arc Employee Welfare Trust + Others | 1.22% |

| Vested options | 1.82% |

| Total | 100.00% |

Peer Comparison

₹ in crores-FY 2024

| Particulars | Northern Arc Capital Limited | Five Star Business Finance Limited | Ugro Capital Limited | Arman Financial Services |

| Total Income | 1906 | 2195 | 1082 | 661 |

| PAT | 317 | 836 | 119 | 174 |

| Net Profit Margin | 17% | 38% | 11% | 26% |

| EPS | 24.38 | 28.58 | 12.86 | 165.67 |

| Market Cap (June 2024) | 5200 | 20787 | 2606 | 2382 |

| CMP (June 2024) | 400 | 711 | 281 | 2274 |

| P/E | 16 | 25 | 22 | 14 |

| P/B | 3.63 | 4.3 | 1.82 | 2.88 |

Latest Funding

On April 22, 2024 – Northern Arc announced an investment from the International Finance Corporation, a member of the World Bank Group.

- Investment Amount – $80Mn | Equal split of equity and debt, each contributing $40 million

- Security type – 84,91,048 CCPS | Face value – ₹20 | Share price – ₹391 | Amount – INR 331 Crs

On 16th April 2024, a private placement offer to RJ Corp

- Security type – 12,78,772 CCPS | Face value – ₹20 | Share price – ₹391 | Amount – INR 50 Crs

IPO Plans

Northern Arc Capital has refiled its preliminary papers with the SEBI for a public issue on February 2, comprising a fresh issuance of shares worth Rs 500 crore and an offer-for-sale of 2.1 crore equity shares by several investors. The company may also consider raising up to Rs 100 crore through a pre-IPO placement.

The IPO, which aims to bolster future capital requirements for lending activities, comes after its previous attempt in 2021. Despite a slight increase in non-performing assets, the company maintains a strong asset quality. ICICI Securities, Axis Capital, and Citigroup Global Markets India are managing the IPO.

Recent News

South Indian Bank and Northern Arc Capital Forge Strategic Partnership in Financial Sector

(May 2024) South Indian Bank and Northern Arc Capital have formed a strategic alliance to enhance their financial sector prospects. This partnership aims to optimize loan origination, underwriting, disbursement, and collection processes, focusing on co-lending and partnership lending activities. The collaboration is formalized by a MOU, highlighting their commitment to mutual growth.

Leveraging each other’s expertise, the institutions plan to capitalize on market trends, diversify portfolios, and offer innovative financial solutions to a broader consumer base. South Indian Bank will use Northern Arc’s nPOS technology platform for co-origination and pool buyouts, ensuring seamless borrower interactions. P R Seshadri, MD and CEO of South Indian Bank, and Ashish Mehrotra, MD and CEO of Northern Arc Capital Ltd, expressed confidence that this collaboration will drive innovation, set new benchmarks, and foster significant growth in the financial industry.

Karnataka Bank Partnered with Northern Arc Capital’s nPOS Platform for Co-lending & Pool Buyout

(January 2024) Karnataka Bank and Northern Arc Capital Limited have partnered to offer customer-centric financial solutions using Northern Arc’s nPOS technology platform for co-origination, co-lending, and pool buy-outs. This collaboration allows Karnataka Bank to digitally onboard NBFCs, expanding its customer base and enhancing outreach.

Shri Srikrishnan H, MD & CEO of Karnataka Bank, emphasized the strategic focus on co-lending to grow its Advances book. Ashish Mehrotra, CEO & MD of Northern Arc Capital, highlighted the alliance’s role in facilitating credit to underserved individuals and businesses. The agreement was exchanged in Bengaluru, underscoring both parties’ commitment to digital lending, risk management, and financial inclusion.

GET IN TOUCH WITH US:

- For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

- To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

- For Direct Trading, Visit – https://altiusinvestech.com/companymain.

- You can also checkout the list of Best 5 Unlisted Shares to Buy in India

- To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/