NSDL: About the Company

Established in August 1996, NSDL stands as one of the world’s largest depositories, managing the majority of securities held and settled in dematerialized form within the Indian capital market. Despite India’s longstanding and dynamic capital market, which spans over a century, the reliance on paper-based settlement methods posed significant challenges. The implementation of the Depositories Act in August 1996 laid the groundwork for NSDL’s establishment. As a SEBI registered Market Infrastructure Institution (MII), NSDL has been instrumental in shaping India’s capital markets, pioneering the concept of dematerialization of securities. Fast forward to March 31, 2023, NSDL has solidified its position as the largest depository in India, leading in terms of issuers, active instruments, market share in demat value of settlement volume, and assets under custody (AUM).

| Company Name | NATIONAL SECURITIES DEPOSITORY LIMITED |

| Company Type | Unlisted Public Company(Buy NSDL unlisted share) |

| Industry | Depositories |

| Registered Address | Mumbai, Maharashtra, India |

Key Facts

Product and Services

- eServices:

- SPEED-e: Submission of Delivery Instructions.

- IDeAS for Clients & CMs: Viewing of Instructions and holding.

- NSDL SPEED-e App: Access balances, download eCAS, Client Master Report, etc.

- SPICE for eDIS & POA: Client mandate for trading obligations.

- STeADY: Electronic Contract notes for institutional clients.

- CMS: Collateral management system for efficient collateral management.

- Issuer Service Offerings:

- e-AGM: Secure participation in General Meetings.

- e-Voting: Electronic voting for shareholder resolutions.

- CP Issuance Platform: Online handling of commercial paper issuance.

- Issuer Portal: Portal for various issuer services including ISIN allocation.

- Security and Covenant Monitoring using DLT: Blockchain-based solution for monitoring bond compliance.

- System Driven Disclosure: System for continual disclosures under SEBI regulations.

- FILM: Central system for FPI registration.

- Corporate Bond Database: Centralized database for corporate bond information.

- Value Added Products: Tax Services, Reference Data Products, e-notice, Bank account update, email ID update.

- Digital Integrations:

- Digital LAS: Secure pledging of securities in demat accounts.

- Demat Account Validation: Authenticity validation of demat accounts.

- MF conversion and Redemption: Electronic conversion and redemption of mutual funds.

- eDIS and margin pledge: Facility for electronic delivery and pledging of securities.

- Open Architecture System: Collaboration with bank-based DPs for trading facility.

Business Overview

- Asset Classes in Demat Accounts: NSDL holds various asset classes in dematerialized form, including equities, funds, debt instruments, and electronic gold receipts.

- Depository Charges: Recently introduced slab-wise fee structure based on transaction volumes to incentivize depository participants.

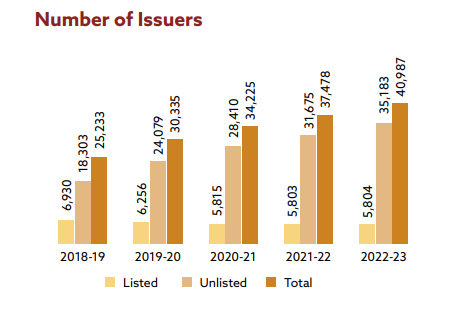

- Unlisted Securities: Continues to lead in dematerialization, with a total of 40,987 listed & unlisted companies live at NSDL as of March 2023.

- Custody Value: NSDL holds approximately 84% and 88% of total securities in terms of numbers and values, respectively, as of March 31, 2023.

- Settlement Value: Shares settled in demat form at NSDL amounted to ₹49,603 billion in 2022-23.

- Debt Securities: NSDL holds almost 97% market share of the industry in the demat value of debt securities, with a market share of 97.84% of the demat value of listed corporate debt securities.

- Technology: NSDL leverages technology for operational resilience and efficiency, offering services like mobile applications, e-voting, and distributed ledger technology for corporate bonds.

- Cyber Security Initiatives: Maintains an in-house SOC with round-the-clock operations to detect, analyze, and respond to cyber security events, ensuring real-time monitoring and response capabilities.

Business Initiatives and Progress at NSDL

Operations in GIFT City (IFSC)

NSDL is actively engaged in operations at the International Financial Services Centre (IFSC) in GIFT City, collaborating with the Market Infrastructure Institution (MII) Consortium. As a 20% stakeholder in the India International Bullion Holding IFSC Limited (IIBH), NSDL contributes its software system to the India International Depository IFSC Limited (IIDL), facilitating the issuance of Unsecured Depository Receipts (UDR) on NASDAQ & NYSE listed companies. With approximately 130 clients holding demat accounts in IIDL as of March 31, 2023, NSDL plays a significant role in promoting international depository services and enhancing financial market activities within IFSC.

NSDL Mobile App Enhancements

NSDL has introduced significant enhancements to its SPEED-e Mobile Application, offering clients the ability to update KYC attributes such as Email ID and Income Range directly through the app. In adherence to SEBI guidelines, clients are now required to authenticate margin pledge initiation requests via OTP authentication, a feature seamlessly integrated into the NSDL mobile app for added security and convenience.

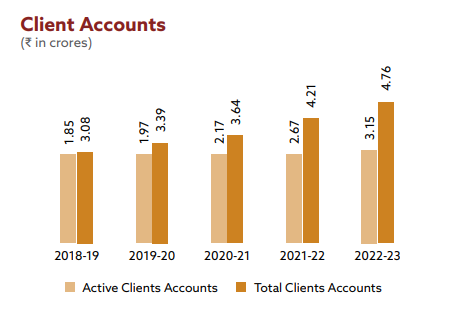

Client Account

During FY 22-23, 55 lakh new accounts were opened at NSDL, taking the total number of demat accounts opened so far till March 31, 2023 to 4.76 crore. Whereas the number of active depository accounts increased from 2.67 crores to 3.15 crores in FY-23.

Issuer

During the year, the number of Issuers who signed agreements with NSDL to avail dematerialisation facilities continued to grow and crossed 40,987 by March 31, 2023 as compared to 37,478 as on March 31, 2022.

Foreign Portfolio Investors (FPI)

- During FY 22-23, a total of 1,196 new FPI applications were registered by DDPs on NSDL FPI registration portal as against 1195 in 2021-22.

- DDPs have also renewed the registration validity of 3,467 FPIs during 22- 23 on the NSDL FPI portal as against 2,437 during 2021-22.

- As on March 31, 2023, the total number of FPIs which were registered on NSDL FPI website are 11,081.

Depository Participants

The total number of Depository Participants stood at 283 as on March 31, 2023. These Participants provide depository services from more than 59,401 service centers/branches located in more than 2,036 cities/towns. The category wise break-up of Participants is as follows (as on March 31, 2023):

| Sr. No. | Category | Total no. of Participants |

|---|---|---|

| 1 | Bank | 45 |

| 2 | Clearing Corporation / Clearing House | 3 |

| 3 | Custodian | 7 |

| 4 | Financial Services Company | 4 |

| 5 | Foreign Bank | 6 |

| 6 | NBFC | 2 |

| 7 | Registrar & Transfer Agent | 2 |

| 8 | Stock Broker | 214 |

| Total | 283* |

Performance Highlights

Management of the Company

Mr. Parveen Kumar Gupta: Chairman, Public Interest Director

Mr. Parveen Kumar Gupta, a seasoned banking professional, retired as Managing Director (Retail & Digital Banking) from the State Bank of India after a distinguished career of over 37 years. With extensive experience in various key roles within the SBI group, including MD (Compliance & Risk) and MD&CEO of SBI Capital Markets Ltd, he has been instrumental in shaping the strategic direction of SBI’s operations. Holding a bachelor’s degree in commerce and memberships in esteemed professional institutes, Mr. Gupta’s contributions extend beyond corporate realms, as evidenced by his service on expert committees, including the one on Micro, Small & Medium Enterprises constituted by RBI.

Ms. Padmaja Chunduru: Managing Director & CEO

Ms. Padmaja Chunduru is a seasoned banking professional with 37 years of experience in India and USA. Holding a Master’s degree in Commerce with a specialization in Banking & Finance from Andhra University, she has held significant roles such as Deputy Managing Director at State Bank of India and Country Head of US Operations at SBI. Ms. Chunduru’s extensive expertise also extends to her directorial positions in esteemed institutions like the Indian Banks’ Association and the Insurance Regulatory and Development Authority of India. Her contributions have been instrumental in shaping the landscape of banking and financial services.

Dr. Rajani Gupte: Public Interest Director

Dr. Rajani Gupte is the Vice Chancellor of Symbiosis International with over thirty years of experience in higher education. As a professor and researcher, she has taught at universities worldwide, including Oakland University, Michigan, US, and Bremen University of Applied Sciences, Germany. Dr. Gupte played a crucial role in establishing the Symbiosis Institute of International Business in 1992. She is recognized for her expertise in economics, holding a Doctorate degree from the Gokhale Institute of Economics and Politics, Pune. Dr. Gupte’s insights have been sought after by prestigious committees, including those formed by NITI Aayog, showcasing her significant contributions to academia and education policy.

Subsidiary/Associate Companies

| Company | Type | Gross Income (₹ crore) | Profit/Loss before Tax (₹ crore) |

|---|---|---|---|

| NSDL Database Management Limited | Subsidiary | 87.69 | 42.37 |

| NSDL Payments Bank Limited | Subsidiary | 541.41 | 8.06 |

| India International Bullion Holding IFSC Limited | Associate | 4.12 | (24.23) |

Overview of capital markets in India

The Indian capital markets have witnessed growth at a very fast pace since Financial Year 2017 till Financial Year 2023. The market capitalization of shares listed on National Stock Exchange (“NSE”) grew at 14% CAGR during March 2017 to March 2023. The number of companies traded on BSE and NSE (Cash Segments) increased from 4,613 in Financial Year 2017 to 6,466 in Financial Year 2023. The total demat accounts increased from 27.85 million in March 2017 to 114.50 million in March 2023 growing at 26.57% CAGR during the period. The AUM of mutual funds increased from ₹17,456 billion in March 2017 to ₹39,420 billion in March 2023 growing at a 14% CAGR from during the period, whereas the total SIP contribution saw a growth at 24% CAGR from March 2017 to March 2023 increasing from ₹439 billion to ₹1,560 billion.

The turnover in the cash market and equity derivatives market at NSE grew at a stupendous 15% CAGR and 85% CAGR, respectively, from Financial Year 2017 to Financial Year 2023. The dual barometers of Indian stock markets, Sensex and Nifty touched multiyear highs recently with intermittent corrections. BSE Sensex and NSE Nifty increased by 0.7% and decreased by 0.6% respectively at the end of March 2023 form their closing levels in March 2022. As of March 31, 2023, the indices stood at 58,992 and 17,360 respectively.

Type of asset classes available for dematerialization

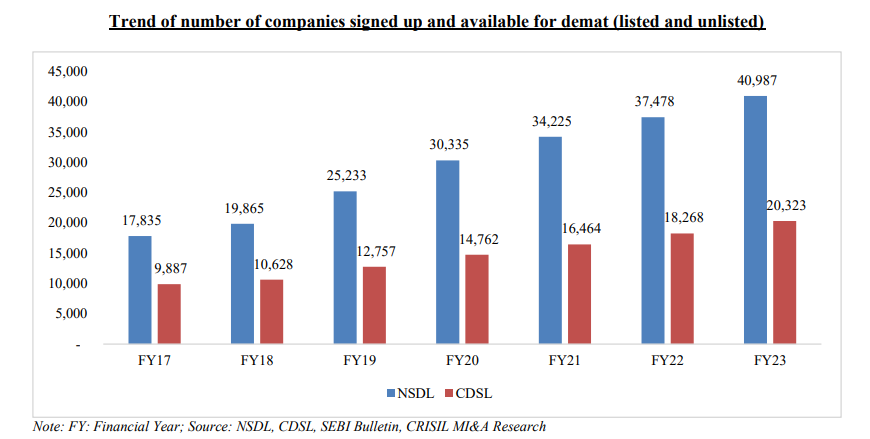

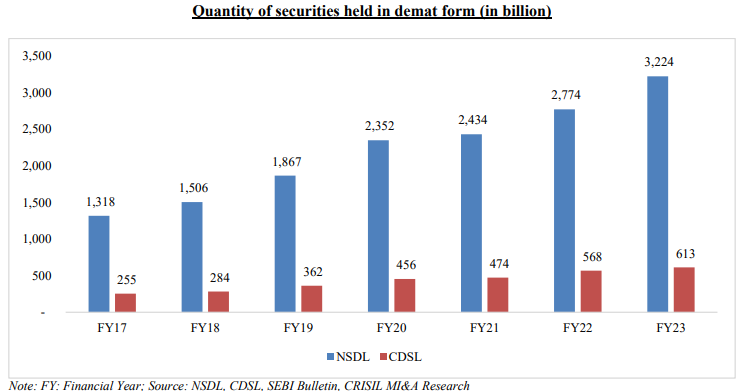

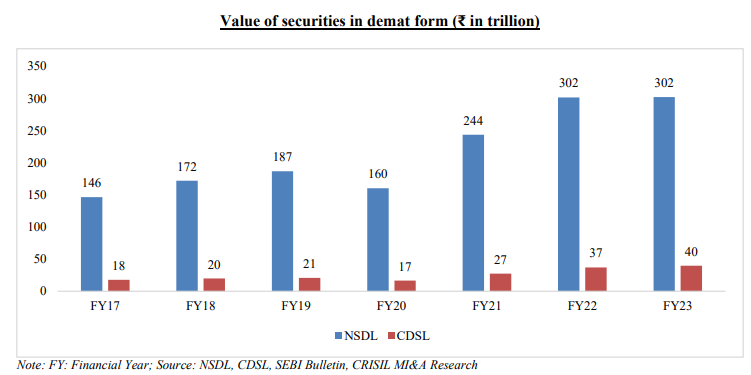

Depository Statistics for NSDL and CDSL witness a steady growth trajectory

Securities such as common equity shares, preferential shares, mutual fund units, debt instruments, government securities, certificates of deposit, commercial papers and others are available to be held in electronic or dematerialized (demat) form by the investors. The number of companies having their securities in demat form have seen an increase from 17,835 in Financial Year 2017 to 40,987 in Financial Year 2023 seeing a growth at 15% CAGR for NSDL and 9,887 to 20,323 from Financial Year 2017 to Financial Year 2023 growing at a 13% CAGR for CDSL.

Amongst the depositories, NSDL holds a dominant market share in terms of progress in dematerialisation

NSDL holds a higher share compared to CDSL amongst the two depositories across the number of companies available for demat, the quantity and value of securities held in demat form.

Share Price of NSDL (as of 30.04.2024)

- The buy price of NSDL varies based on quantity, ranging from ₹845 for quantities between 1000 – 1999 shares to ₹825 for quantities between 10000 – 24999 shares, with corresponding rates per share.

- The 52-week high is ₹866, and the 52-week low is ₹675 indicating the range of fluctuations in the share price

Currently, the NSDL Share Price is trading at around Rs. 840/share CLICK HERE to Invest.

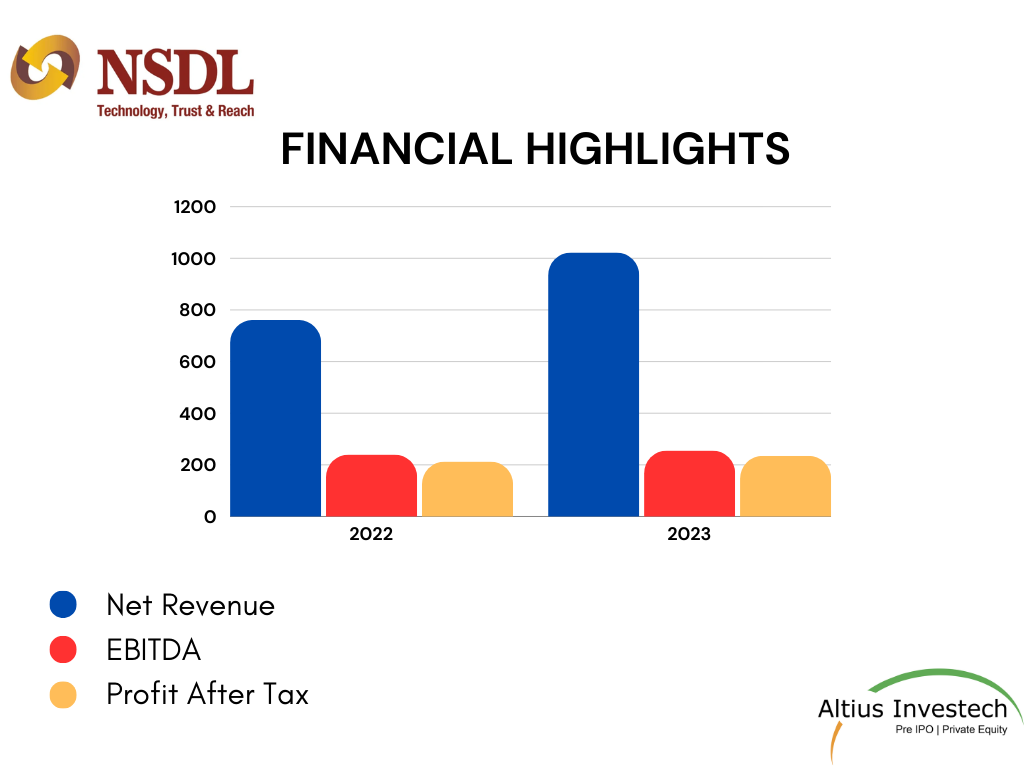

Financial Highlights

₹ in crores

| Particulars | FY 2023 | FY 2022 | % change |

| Net Revenue | 1,021.99 | 761.11 | 34% increase |

| EBITDA | 255.25 | 240.52 | 6% increase |

| Profit After Tax (PAT) | 234.81 | 212.59 | 10% increase |

| Earning Per Share (EPS) | 11.74 | 10.63 | – |

Revenue from Operations increased to 1,021.99 crore in FY 2022-23 as compared to 761.11 crore in the previous year, a growth of 34.3 %. Profit before Tax and Exceptional Items increased to 305.04 crore in FY 2022-23 as compared to 278.20 crore in the previous year. Profit after Tax (PAT) increased to 234.81 crore in FY 2022-23 as compared to 212.59 crore in the previous year, a growth of 10.5%. Earnings per Share (EPS) of the Company increased to 11.74 in FY 2022-23 as compared to 10.63 in the previous year. The net worth of the Group as on March 31, 2023 increased by 17.9% to 1,428.86 crore as compared to 1,211.62 crore a year ago.

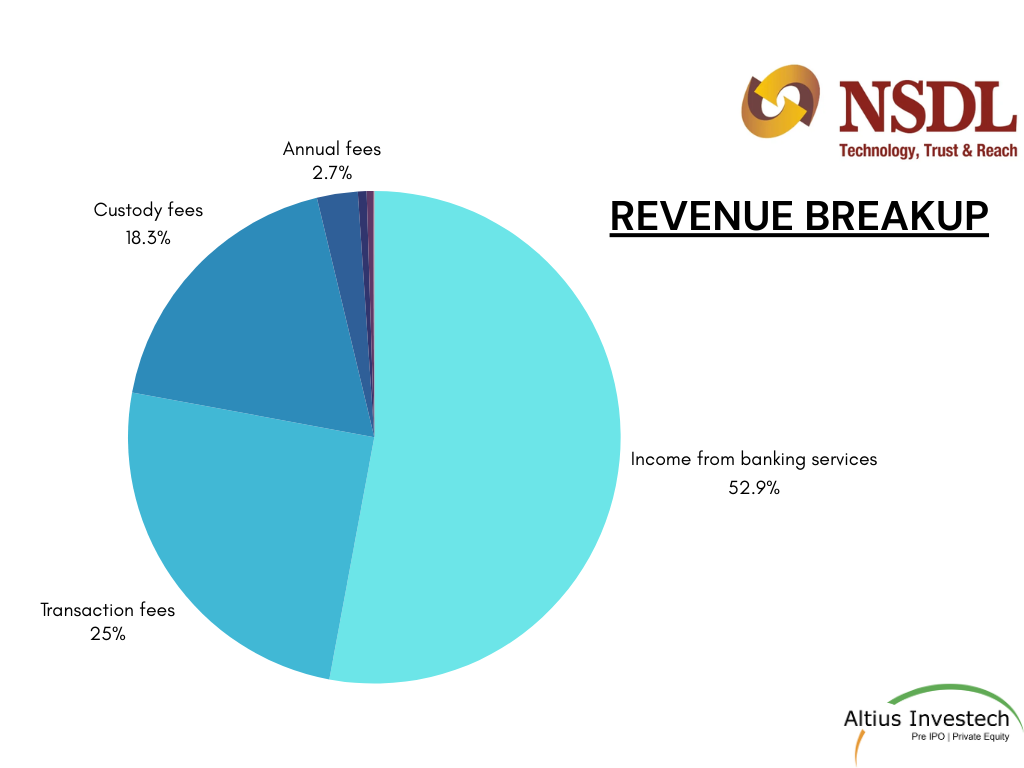

Revenue Breakup

| Particulars | ₹ in crores |

| Income from banking services | 540.77 |

| Transaction fees | 255.38 |

| Custody fees | 187.50 |

| Annual fees | 27.37 |

| Registration fees | 5.85 |

| Communication fees | 4.34 |

| Other operating income | 0.56 |

| Software license fees | 0.19 |

| Total | 1021.98 |

Dividend

The Board of Directors of the company recommended a dividend of ₹1.00 on twenty crore equity shares with a face value of ₹2/- each (i.e., 50%) for FY 2022-23, compared to ₹5.00 per share with a face value of ₹10/- each for FY 2021-22. This recommendation was made for consideration by the shareholders. The dividend distribution resulted in a cash outflow of ₹20.00 crore.

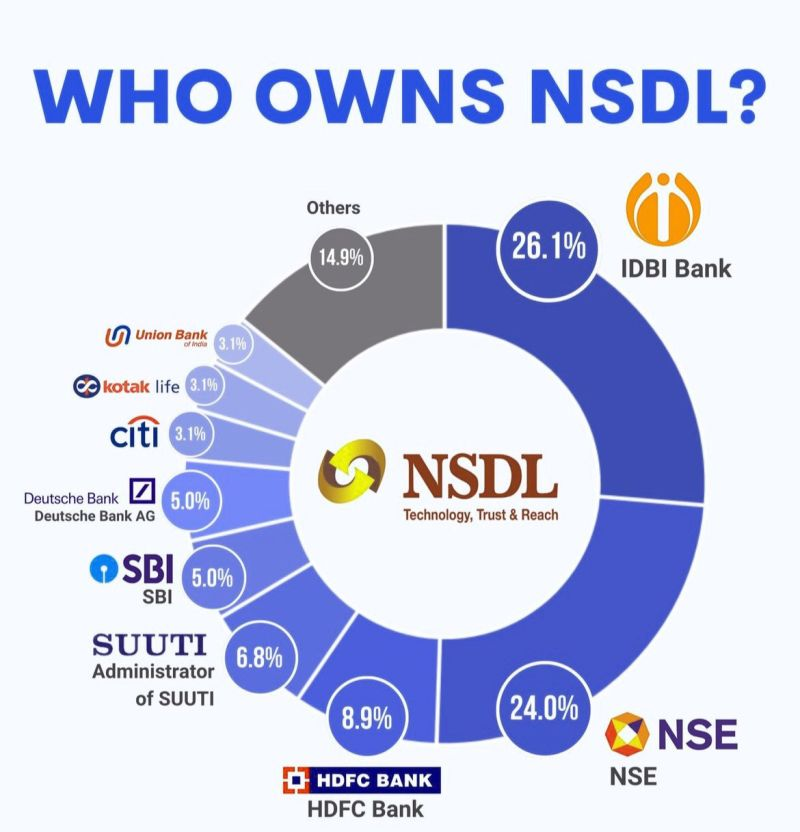

Shareholding Pattern

Details of Shares held by each Shareholder holding more than 5% :

| Company | Shares Held | % Holding |

|---|---|---|

| IDBI Bank Ltd. | 5,22,00,000 | 26.10 |

| National Stock Exchange of India Ltd. | 4,80,00,000 | 24.00 |

| HDFC Bank Limited | 1,78,99,500 | 8.95 |

| Administrator of the Specified Undertaking of the Unit Trust of India- Unit Scheme 1964 | 1,36,60,000 | 6.83 |

- NSDL is a company without promoters, and as of the DRHP date (July, 2023) there are 76 public shareholders.

- The top 12 shareholders hold a stake of 93.33% in the company.

Peer Comparison

Operational Metrics of NSDL & CDSL

| METRIC | NSDL | CDSL |

|---|---|---|

| Market Share | Greater market share in terms of the number of DEMAT accounts | Lower market share in terms of the number of DEMAT accounts |

| Companies with Securities in Demat Form | 40,987 | 20,323 |

| Demat Custody Value (FY23) | ₹302.19 lakh crore | ₹39.71 lakh crore |

| FPI-held Securities Serviced (Mar 31, 2023) | 99.99% | – |

| Operating Markets | The principal functioning market is the Bombay Stock Exchange (BSE) | Principal functioning market is the Bombay Stock Exchange (BSE) |

Financial Performance Comparison: NSDL vs. CDSL

₹ in crores (FY 2022-23)

| PARTICULARS | NSDL | CDSL |

|---|---|---|

| Total Income | 1100 | 621 |

| Total Expenditure | 758 | 232 |

| EBITDA | 342 | 389 |

| PAT | 235 | 276 |

| EBITDA Margins | 31% | 63% |

| Net Profit Margin | 21% | 44% |

| EPS | 11.74 | 26.41 |

| DPS | 1 | 16 |

| Dividend Payout Ratio | 9% | 61% |

| Net worth | 1429 | 1213 |

| ROE | 17% | 23% |

| Shares outstanding | 20.00 | 10.45 |

| CMP (30th April,2024) | 840 | 2108 |

| Market Cap | 16800 | 22029 |

| P/E | 68 | 75 |

| P/S | 15 | 33 |

NSDL IPO Plans

NSDL previously filed for a DRHP on July 2023, offering an OFS of 5.7 crore shares at a valuation of 15,000 crore with a size expected to be around 3,000 crore. SEBI has put the IPO of NSDL in abeyance due to the pending investigation against NSE which is the primary shareholder of NSDL. As per the news NSDL’s IPO is expected in FY-24.

Milestones of NSDL: A Journey of Innovation and Growth

- 2018: Launch of Digital Loan Against Shares facility for banks, revolutionizing lending practices in the financial sector.

- 2020: The value of securities held in dematerialized form at NSDL surpasses ₹200 lakh crores, reflecting the increasing trust and adoption of digital securities.

- 2021: The value of securities held in the dematerialized form at NSDL crosses ₹300 lakh crores (equivalent to $4 trillion), marking a significant milestone in the digitization of India’s capital markets and launch of Digital Commercial Paper Issuance process, streamlining and modernizing the issuance of commercial papers.

- 2022: Introduction of a blockchain-based market platform to manage and monitor the security & covenant related to the issuance of bonds, enhancing transparency and efficiency in bond markets and release of a commemorative postage stamp on NSDL’s Silver Jubilee Celebration, recognizing its significant contribution to the financial sector.

- 2023: “Market ka Eklavya” initiative crosses 250+ programs, demonstrating NSDL’s commitment to education and empowerment within the financial community. Launch of T + 1 rolling settlement cycle in the equity market, optimizing trade settlement processes and enhancing market efficiency.

Awards & Recognition

- Ms. Padmaja Chunduru, MD & CEO, received Business Today’s “Most Powerful Women in Business Award” from Honorable Minister Ms. Smriti Irani.

- Ms. Padmaja Chunduru, MD & CEO, was felicitated as India’s Best CEO – BFSI at Business Today’s Best CEO Award by Honorable Minister Mr. Piyush Goyal.

- Ms. Padmaja Chunduru, MD & CEO, was honored at the Women Directors Conclave 2022 by Ms. Ekta Kapoor.

- Ms. Padmaja Chunduru, MD & CEO, was awarded Fortune India’s “India’s Most Powerful Women (MPW) in Business” by Honorable Minister Ms. Smriti Irani.

- Mr Pramit Sen, CHRO, received the HR Innovator and HR Topmost Leader awards.

- Mr. Vishal Gupta, Head – Digital Products and Service, was awarded the Big CIO Awards – Top 100 Innovators at the 12th Edition of Big CIO Show.

- Mr. Sunil Batra, CTO, was honored with the Top 100 BFSI Leader in India award.

- NSDL won the Best Blended Learning Strategy Award at the #LnDConfex2023.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/