Vikram Solar: Know about the company

Vikram Solar Limited (VSL), founded in 2006 and headquartered in Kolkata, India, is a leading provider of solar energy solutions with a strong focus on the design, manufacturing, installation, and maintenance of photovoltaic (PV) modules and solar power systems. Led by Mr. Hari Krishna Chaudhary and Mr. Gyanesh Chaudhary, along with a team of seasoned professionals, VSL has established itself as a key player in the renewable energy sector. The company’s manufacturing facilities in Falta Special Economic Zone (FSEZ) in West Bengal and Chennai boast significant installed capacities, enabling VSL to produce and export high-quality PV modules to domestic and international markets.

In addition to manufacturing, VSL also undertakes engineering, procurement, and construction (EPC) projects for solar power plants, further solidifying its position in the industry. Noteworthy is VSL’s operation of a 10 MW solar power plant with a long-term power purchase agreement with the revered Tirupati temple, showcasing its commitment to sustainable energy solutions.

| Company Name | VIKRAM SOLAR LIMITED |

| Company Type | Unlisted Public Company. Buy Vikram Solar Unlsited Shares |

| Industry | Solar |

| Founded | 2006 |

| Registered Address | Kolkata, West Bengal, India |

Vikram Solar’s Journey

2005: Incorporation Vikram Solar begins its journey towards revolutionizing India’s solar energy landscape.

2011: Early Milestone Installed a 3 MW project under the National Solar Mission of India, marking a significant step forward in renewable energy implementation.

2013: Landmark Achievement Contributed to the solarisation of the first fully solarised airport in India – Cochin International Airport, Kerala, showcasing the potential of solar energy in large-scale infrastructure projects.

2014: Recognition and Innovation Earned the distinction of being India’s only Tier 1 module manufacturer and commissioned India’s first floating solar plant, demonstrating innovative approaches to solar energy deployment.

2015: Scaling Production Reached a production capacity of 500 MW/year, signalling substantial growth and commitment to meeting the rising demand for solar energy solutions.

2017: Industry Leadership Achieved a significant milestone by reaching a production capacity of 1 GW/year, solidifying its position as a leader in the Indian solar industry.

2019: Expansion and Impact Commissioned a 200 MW plant in Andhra Pradesh and East India’s largest single shed rooftop project, totalling 2.15 MW, contributing to both utility-scale and distributed solar energy generation.

2021: Scaling New Heights Reached a production capacity of 2.5 GW, firmly establishing itself as one of India’s largest solar module manufacturers, driving the nation’s transition towards clean and sustainable energy sources.

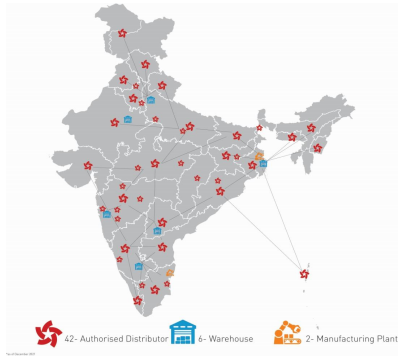

Vikram Solar’s Extensive Domestic Network

With an extensive domestic presence, Vikram Solar operates across 23 states and 3 union territories in India, supported by a robust network of 42 distributors, 56 trusted resellers, and 97 impanelled system integrators

Global Expansion

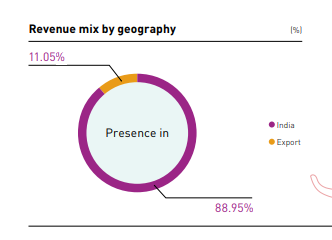

Vikram Solar has expanded globally with a sales office in the USA and a procurement office in China. They’ve supplied solar PV modules to clients in 32 countries. Domestically, key clients include NTPC, Rays Power Infra, and Hindustan Petroleum, while internationally, they serve companies like Amp Solar Development Inc. and Safari Energy LLC.

Manufacturing Prowess and Future Growth

Since its inception in 2009, Vikram Solar’s manufacturing capabilities have undergone exponential growth, scaling from 12 MW to 2.5 GW as of December 31, 2021. The company is strategically poised for further expansion, with plans underway to upgrade existing facilities and establish new manufacturing units, aiming to increase production capacity significantly.

Innovation and Recognition

Over its 12-year journey, Vikram Solar has developed robust engineering capabilities, earning recognition through prestigious awards such as India’s Leading Brand Rising Star in 2020. The company’s product portfolio includes high-efficiency PV modules, boasting efficiency levels between 17.01% and 21.47%, catering to diverse customer needs.

Diversified Revenue Streams

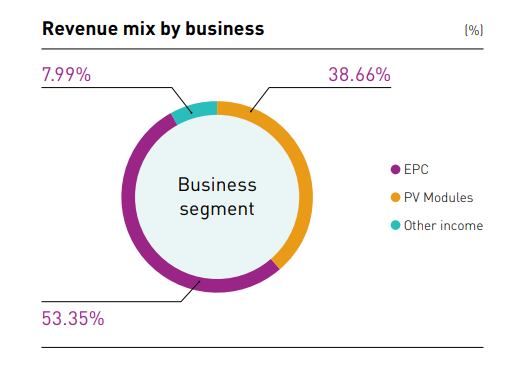

Vikram Solar’s business divisions span domestic sales, EPC and O&M services, and exports, enabling the company to diversify revenue streams and mitigate business risk effectively.

Strategic Focus and Market Presence

With a strategic focus on rooftop solar installations in India, Vikram Solar aims to achieve 40 GW by 2022 as per the SRISTI scheme. Leveraging an extensive distributor network of 42 distributors, the company has established a geographically diversified presence in India, ensuring robust market coverage.

Vision and Mission

Vision: Vikram Solar’s vision is to create a sustainable future by harnessing the power of the sun to meet global energy needs.

Mission: Their mission is to be a leading force in providing innovative solar solutions, empowering communities, and contributing to a cleaner and greener world.

Products and Services

Vikram Solar focuses on delivering innovative products to meet evolving customer needs. The company has consistently stayed ahead in the solar module manufacturing sector through its robust research and development capabilities. It has attained expertise in producing high-efficiency modules with the lowest Levelized Cost of Energy (LCOE) and in executing benchmark solar projects.

Business Divisions

1. Solar PV Module Manufacturing:

Vikram Solar manufactures high-efficiency solar modules using both monocrystalline and polycrystalline cell technology. Their products can be categorized based on the use of solar cell technology and cell size.

| Based on Use of Technology | Based on Size of Solar Cells |

|---|---|

| Monocrystalline Passive Emitter and Rear Cell (Mono PERC) modules | M6 size cell (166 mm x 166 mm) |

| Polycrystalline modules | M10 size cell (182 mm x 182 mm) |

| – | G12 size cell (210 mm x 210 mm) (a prototype under third-party lab testing) |

2. Solar EPC and Rooftop Solutions

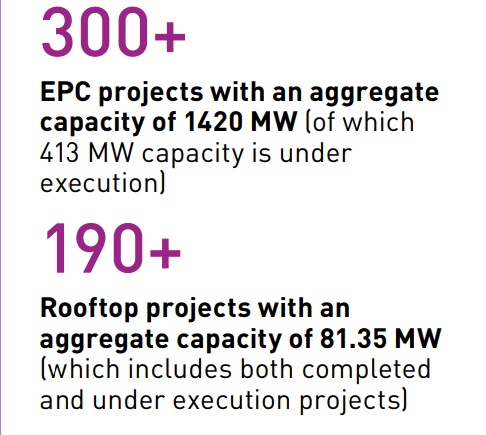

Vikram Solar stands as one of India’s top five Engineering, Procurement, and Construction (EPC) players, leveraging over a decade of experience and a robust portfolio comprising more than 300 projects as of March 31, 2024. The company’s proficiency in executing EPC projects for solar plants is widely acknowledged, cementing its prominent position within the industry. Vikram Solar’s capabilities span the entire project lifecycle, encompassing concept development, engineering, execution, commissioning, and ongoing operations and maintenance.

3. Operation and Maintenance Services

Over the years, Vikram Solar has established a sustainable O&M business division to provide customers with forward-integrated complete life cycle services. Their O&M services include repairs, ongoing maintenance, and complete operational solutions. These services are primarily offered for executed EPC projects as bundled value-added services. Vikram Solar provides these services across India and to clients in industries such as railways, airports, hospitals, defense, and automobiles.

Brand Portfolio

| Brand | Description | Application | Technology |

|---|---|---|---|

| Somera | Utility-scale projects in various markets. | Projects with land constraints in developing markets. | Mono PERC |

| Paradea | Maximizes bifaciality, suitable for reflective surfaces like snow or sand. | Maximizes bifaciality and is suitable for reflective surfaces like snow or sand. | Bifacial |

| Prexos | Lightweight module for rooftops with various roofing materials. | Rooftop projects, especially in heavy snowfall areas. | Lightweight |

| Smart PV | Niche module with app-based technology for remote monitoring. | Commercial and industrial rooftops with shadow issues. | Smart technology |

Vikram Solar doesn’t just make solar panels – they also provide complete solar energy solutions. They’ve built over 300 solar plants and are currently working on more, totalling 1.42 GW in capacity. Plus, they take care of these plants even after they’re built, offering maintenance services for over 900 MW of solar energy projects.

They’re also big on rooftop installations, having completed over 190 projects across different areas and industries, including some impressive ones like a massive 5 MW solar carport at Maruti Udyog Limited. To make sure everything runs smoothly, they’ve sorted out their supply chain, making it easier to get the materials they need on time and at a good price.

Revenue Breakup

As of FY 2021-2022

As of FY 2021-2022

Management of the Company

Sri Hari Krishna Chaudhary: Chairman

Sri Hari Krishna Chaudhary, Chairman of Vikram Group of Industries, is a respected leader known for his achievements in business and philanthropy. Through Vikram Solar Pvt. Ltd., he has spearheaded ventures into renewable energy, addressing India’s growing energy needs. Additionally, his dedication to education has led to the establishment and successful management of several schools and colleges, providing quality education to underprivileged communities. Sri H. K. Chaudhary’s commitment to ethical business practices and social responsibility sets a commendable example for corporate leaders.

Mr. Gyanesh Chaudhary: Managing Director

Mr Chaudhary is a dynamic business leader and solar energy pioneer, leading Vikram Solar to become one of India’s largest solar module manufacturers with a 2.5 GW annual production capacity. Under his guidance, Vikram Solar has emerged as a leading provider of solar energy solutions, recognized for its high customer satisfaction and contributions to the global sustainable energy mission. Ranked 32nd on Fortune India’s Next 500 list (2020 edition), Mr Chaudhary, a business graduate from the University of Wales and Harvard Business School, USA, is dedicated to addressing environmental and energy scarcity challenges through innovative business strategies and solutions.

Award and Recognition

Vikram Solar has garnered several prestigious awards and recognitions, affirming its position as a leader in the solar energy industry:

- ICC 2nd Green Urja and Energy Efficiency Award (2022): Recognized for innovative project development, Vikram Solar received the Jury Choice Award for Product Development at this esteemed event on March 23, 2022.

- Solar Quarter’s India Utility Solar Week Awards (2021): Vikram Solar clinched two awards in the categories of Company of the Year: EPC and Outstanding Product Innovation of the Year, showcasing its commitment to excellence and innovation in the solar energy sector.

- India Rooftop Solar Congress Awards (2022): Vikram Solar secured three awards, including EPC Company of the Year (Commercial), Company of the Year (Module), and Smart Technology Innovation of the Year (Solar Module), further highlighting its expertise and achievements in rooftop solar solutions.

- Solar Quarter’s Sundowner Award (Year): Mr. Gyanesh Chaudhary, the driving force behind Vikram Solar, was honored as one of the 100 Most Powerful Solar Business Leaders at this prestigious event, underscoring his significant contributions to the solar industry’s growth and innovation.

Industry Overview

Global Solar PV Market Forecast

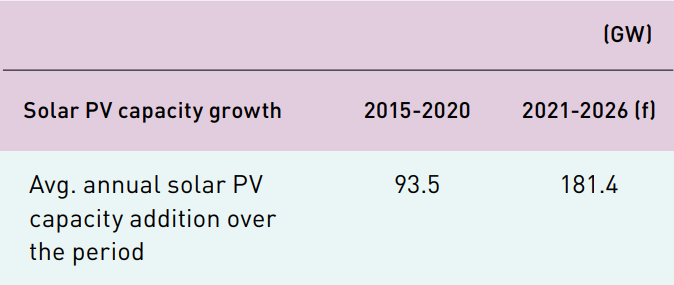

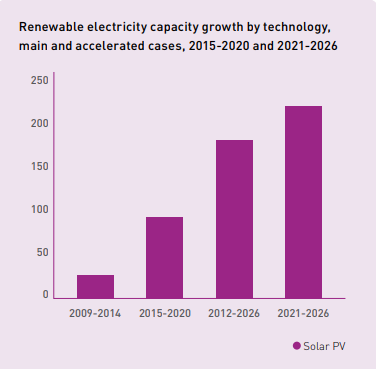

The global solar market is expected to grow at a faster pace over the next five years due to higher global renewable

installations driven by the more robust policy support and ambitious climate targets announced for COP26. The International

Energy Agency (IEA) forecasts that global solar capacity additions could reach approximately 1100 GW between 2021 and

2026, averaging 181.4 GW per year, nearly double the rate (93.5 GW) over the preceding five years.

Indian Solar Market

As India announced to reach 280GW in solar power, the

domestic solar market has the potential of an additional 230

GW of solar installations over the next nine years, which is

approximately 25 GW per year. In line with this ambitious

goal, the government of India proposed an additional

allocation of `19,500 crore for the Production Linked

Incentive for the manufacturing of high-efficiency modules

in the Budget 2022-23.

Key trends influencing the solar sector:

- Ambitious climate change targets by major countries across the world.

- Large market opportunities led to many new players.

- Innovation in solar is driven by demand for highly efficient modules and emerging customer needs.

- Short-term price pressure on solar PV manufacturers due to rising commodity prices.

Vikram Solar’s Response

To capitalize on the market opportunity, the company prioritized these focus areas:

- Boosting sales by tapping into high-potential markets.

- Ramping up production capacity and innovation to meet growing demand and emerging needs.

- Accelerating digitization to improve operation efficiency and customer experience.

- Enhancing process control to reduce cost.

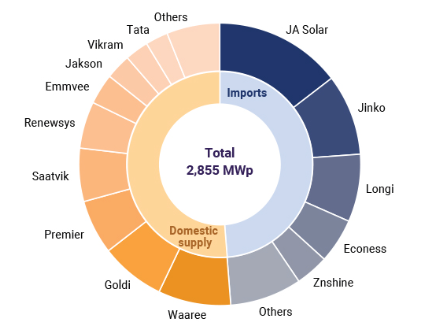

India PV Module Intelligence Brief | Q1 2023

Q1 saw a total solar capacity addition of 2,658 MW, almost unchanged from the previous quarter. Total module demand in the quarter was estimated at 3,367 MWp, split 23:37:34:6 between utility-scale, open access, rooftop solar, and off-grid solar, respectively. The share of domestic modules for projects commissioned in the quarter has again declined to 19% because of limited domestic capacity plus rising exports. Module and cell imports increased sharply over the previous quarter mainly because of demand from open-access projects. With the allocation of PLI tranche-ll by SECI in March, we expect polysilicon, cell, and module capacity to reach 30 GW, 42 GW, and 110 GW, respectively, by December 2026.

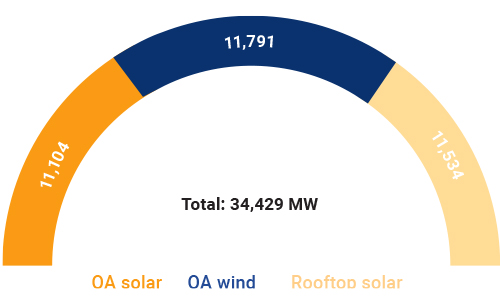

India Corporate Renewable Brief

India added 1,204 MW of corporate renewable capacity in Q4 2023, up 31% QOQ, accounting for 48% of total renewable capacity addition in the quarter. Total corporate renewable capacity is estimated to have reached 34,429 MW. The increase in capacity addition was mainly due to the ALMM waiver and low module prices.

Key developments from the quarter:

- Prices decline to near lows across the solar value chain.

- Marginal reduction in PPA tariffs across OA and rooftop solar segments.

- Supreme court clarification on requirements for captive projects.

- Neutral and negative policy changes in Gujarat and Rajasthan for corporate consumers.

- There is a sharp increase in REC issuance and redemption volumes.

Vikram Solar: Key Strengths

- Experienced Management and Established Relationships: Vikram Solar Limited benefits from a management team with over five decades of collective experience in the solar business. Led by Mr. Hari Krishna Chaudhary and Mr. Gyanesh Chaudhary, the company maintains robust relationships with customers and suppliers, contributing to a healthy order book and ensuring long-term stability.

- Healthy Order Book Position: With an unexecuted order book of approximately Rs. 11,500 crore as of November 2022, VSL enjoys strong revenue visibility in the near to medium term. The company’s ability to secure large orders from reputed clients, backed by its strong execution capabilities, reduces counterparty risks and ensures the timely realization of receivables. Additionally, VSL has received significant orders under variable price contracts with pre-decided EBITDA margins, further enhancing its revenue potential.

- Positive Industry Outlook: The Indian government’s emphasis on developing solar capacity, coupled with increased import duties and geopolitical factors such as anti-dumping duties on Chinese imports and Europe’s quest for alternative energy sources, bodes well for VSL’s sales and profitability margins. With the renewable energy sector poised for growth, VSL is well-positioned to capitalize on the opportunities presented by favorable government policies and evolving market dynamics.

- Significant Improvement in Performance: VSL has demonstrated substantial performance improvement in the current fiscal year, attributed to the execution of variable price contracts, optimized supply chain arrangements, and favorable negotiations on freight rates. Achieving a turnover of Rs. 1753.43 crores and an EBITDA of Rs. 150 crores in the 9MFY2023 reflects the company’s enhanced operational efficiency and profitability, signalling a promising trajectory for future growth.

Vikram Solar: Key Weaknesses

- Moderate Financial Risk: Vikram Solar Limited maintains a moderate financial risk profile with a healthy net worth and moderate gearing despite weak debt protection metrics. While tangible net worth declined to Rs. 435.62 crore as of March 31, 2022, the company’s Debt-to-Equity ratio stood at 1.50. However, weak Interest Coverage Ratio (ICR) and Debt Service Coverage Ratio (DSCR) present challenges, though an improvement is expected with enhanced accruals and no major debt-funded capital expenditure plans.

- Working Capital Intensity: VSL operates in a working capital-intensive environment, evidenced by high Gross Current Assets (GCA) and extended debtor periods. Despite this, inventory holding levels are comfortable, and Acuité anticipates improved working capital management due to the company’s focus on manufacturing activities and reduced reliance on EPC contracts.

Share Price of Vikram Solar (as of 29.04.2024)

- The buy price of Vikram Solar varies based on quantity, ranging from ₹275 for quantities between 100 – 250 shares to ₹266 for quantities between 2501 – 4878 shares, with corresponding rates per share.

- The 52-week high is ₹425, and the 52-week low is ₹1669, indicating the range of fluctuations in the share price.

Currently, Vikram Solar is trading at around Rs. 270/share. CLICK HERE to Invest.

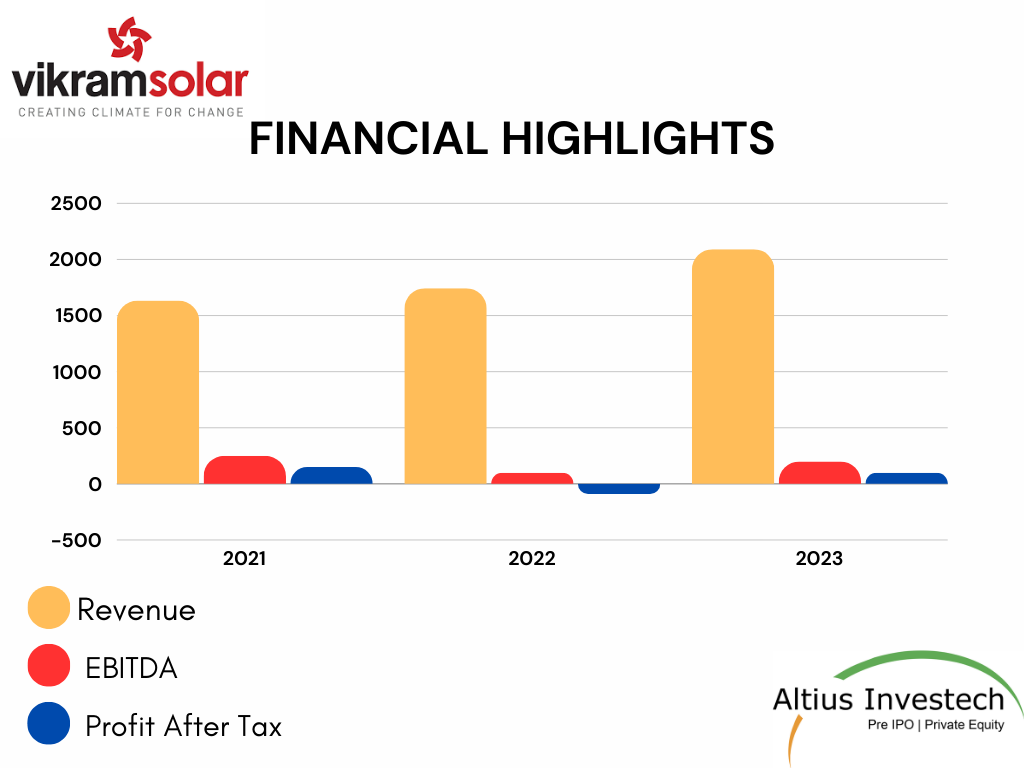

Financial Highlights

₹ in crores

| Particulars | FY 2020-2021 | FY 2021-2022 | FY 2022-2023 |

| Revenue | 1633.25 | 1743.04 | 2091.91 |

| EBITDA | 177.71 | 58.68 | 186.68 |

| Profit After Tax | 38.15 | (62.94) | 14.49 |

Peer Comparison

₹ in crores

| Particulars | Vikram Solar | Waaree Energies |

| Total Income | 2092 | 6860 |

| EBITDA | 187 | 944 |

| EBITDA Margins | 8.94% | 13.76% |

| PAT | 15 | 500 |

| Net Profit Margin | 0.7% | 7.3% |

| EPS | 0.56 | 21.82 |

| PEG ratio | 3.168 | 0.166 |

| Shares outstanding | 26 | 24 |

| Market Cap | 6988 | 48672 |

| CMP (29 April, 2024) | 270 | 2000 |

| P/E | 392.86 | 91.66 |

| P/S | 2.72 | 7.10 |

IPO Synopsis

Vikram Solar planned to raise Rs. 2000 crores through an IPO.

• Fresh Issue: Rs. 1500 Crs

• Offer for sale: 5 million shares

• DRHP Filing: 6th March 2022

The company might also consider selling shares for Rs. 300 crores before the IPO, which could change the original plan.

The people selling shares include Anil Chaudhary, Girish Kumar Madhogaria, Pushpa Madhogaria, and Vikram India Ltd. The leading companies helping with this process are JM Financial Limited and Kotak Mahindra Capital Company Ltd.

Objectives of The Issue

The proceeds from the issue will be used for

1. Worth Rs.1,238.80 crore funding capital expenditure for setting up 2000 megawatts integrated solar cell and solar module manufacturing facility in Tamil Nadu through its wholly owned arm VSL Green Power Pvt Ltd.

2. General corporate purpose.

Risks

- Vikram Solar’s success depends on how well it can build new factories and make more solar panels without spending too much money. This can be risky and uncertain.

- The company might not get the benefits of some government policies, like the PLI scheme, which could affect its business.

- Vikram Solar does not have long-term agreements with the people who supply them with materials to make solar panels. This means they could face problems if these materials become hard to get.

- The company makes most of its money from selling one main product.

- If the prices of the things they need to make solar panels, like wafers and solar cells, change a lot, it could affect Vikram Solar’s business.

ALSO READ OUR OTHER BLOGS

GET IN TOUCH WITH US:

For any query/personal assistance, feel free to reach out to us at support@Altiusinvestech.com or call us at +91-8240614850.

For Direct Trading, Visit – https://trade.altiusinvestech.com/