How Your Investment Grows in a Startup

Regarding the increase in value of their investments in businesses, many angel investors—including some experienced ones—have various conflicting and occasionally unclear ideas.

They mistakenly believe that if a startup’s valuation increases by a factor of 10, the value of their investments in that startup will similarly increase by a factor of 10. If the startup’s valuation rises, the investment’s worth will undoubtedly increase, though not by the same amount.

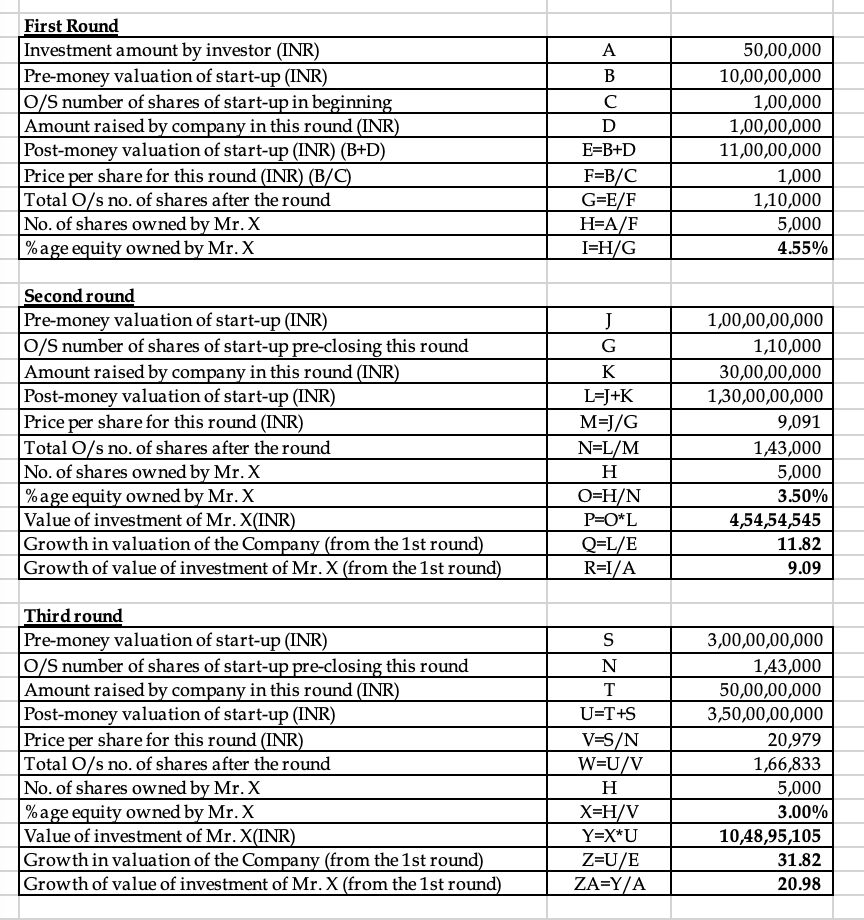

Assume Mr. X, an angel investor, invests INR 50 lakh in a start-up at an INR 10 crore pre-money valuation in a round of INR 1 crore. Mr. X will hold 4.55% of the startup’s equity at closing, with a post-money valuation of INR 11 crore.

Now, if this company does well and raises the next round of INR 30Cr at a pre-money valuation of INR 100 Cr, at the time of closing, Mr. X will own 3.50% stake in the start-up (due to 23% dilution in the company).

The value of his investment will be INR 4.54 Cr. after this round closes. The value of his investment increased only by 9X, despite the startup’s valuation increasing by roughly 12X.

He will hold a 3.0 percent share in the startup upon closing (due to 14% additional dilution in the company) when the start-up raises another round of INR 50 crore at a pre-money valuation of INR 300 crore.

The value of his investment will be INR 10.50 Cr. after this round closes. His investment only increased in value by 21X, whilst the start-up’s valuation increased by over 32X.

I used an illustration (like the one in the picture) to clarify the aforementioned two scenarios. If company raises more funds, the %age stake by Mr. X will continue to fall down and accordingly, value of his investment though would continue to grow, but not in the same proportion as of the valuation of the Company. It depends upon how much funds are raised by the Company in subsequent rounds.

Furthermore, even if Mr. X’s investment value increased 21X according to the example, would his exit value have increased by the same amount? Well, there are a lot of variables to consider, but that is for the next time!

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/