Blog Highlights

- National Stock Exchange

- Reliance Industries Limited

- Tata Consultancy Services

- HDFC Bank

- Bharti Airtel

- ICICI Bank

- Infosys

- ITC Limited

- Larsen & Toubro (L&T)

- HCL Technologies

Top 10 Indian Companies Smart Investors Should Watch in 2025

India’s corporate landscape has witnessed tremendous growth in recent years, with companies reaching unprecedented market capitalizations.

The Indian economy is modestly thriving as of 2025, backed by robust financial markets and technological advancements. For investors looking for sustainable and high-yield opportunities, it is crucial to analyze the most valuable companies in the country.

This blog presents a much-awaited analysis of the Top 10 Most Valuable Indian Companies, their market capitalizations, sectors, and what makes them attractive investment options.

1) National Stock Exchange

Market Capitalization- Rs 4,70,250 Crores

Sector– Financial Services

The NSE, India’s leading stock exchange, has seen its valuation more than double, with a 201% increase over the past year. This surge reflects the growing investor confidence and the pivotal role the NSE plays in the Indian financial market ecosystem.

There are prominent reasons to be investing in the NSE-

- India’s Largest Stock Exchange

- Consistent Profit Growth

- Increasing Investor Participation

As of 2024, the NSE had commanded a market share of over 92% in the segment of equity derivatives and about 75% in transactions of the cash market. The Nifty 50 Index represents 50 of the largest and most liquid companies in the country, covering over 65% of the total market capitalization.

In 2022-23, NSE had reported a PAT of Rs 7356 Crores. The total revenue surged to Rs 12000 Crores in 2023, through increasing trading volumes, rising retail and growth in derivative markets. The ROE is above 45%, reflecting its ability to generate substantial returns for shareholders.

Demat accounts in India surged to over 130 million in 2023, growing at a CAGR of 25% over the last five years. Retail investors’ share in cash market turnover increased to 40%, indicating growing trust in stock markets. Buy Now!

2) Reliance Industries Limited

Market Capitalization- Rs 17,52,650 Crores

Sector– Oil & Gas, Retail, Telecommunications, Digital Services

Reliance Industries Limited remains India’s most valuable company in 2025. Under Mukesh Ambani’s leadership, the company has diversified significantly, expanding into digital services, retail, and green energy. Under the leadership of Mukesh Ambani, a really diverse portfolio has been created. The company’s digital arm Jio platforms aims to enhance its market presence.

Investing in reliance is a good choice because the much-awaited IPO of Jio is set for the year 2025, unlocking significant value for shareholders. The IPO is projected to raise over $10 billion, making it the nation’s biggest public listing ever. Jio has over 450 million subscribers as the largest telecom provider in the country.

Reliance Retail is aggressively growing, challenging e-commerce giants like Amazon and Flipkart. The company has been investing billions of rupees in initiatives of clean energy, that align with the sustainability goals of the country. The revenue for Reliance Retail crossed Rs 3.5 lakh Crores in 2024. The company has over 18000 stores across over 7000 cities. They have acquired brands like Metro Cash & Carry and Justdial to strengthen their market presence.

RIL has committed Rs 75000 Crores towards renewable energy projects, aiming to become a global leader in green hydrogen and solar power. India’s renewable energy sector is projected to be $500 billion by 2030, and RIL is positioned strategically to capitalize on this growth. Buy Now!

3) Tata Consultancy Services

Market Capitalization- Rs 16,10,800 Crores

Sector– Information Technology & Consulting

TCS, the IT powerhouse of India, is one of the largest software exporters in the world. The company has consistently delivered strong financial performance with a robust global presence.

TCS strikes as a key player in the $4 trillion global IT services industry. AI, cloud computing, and blockchain would drive a $1 trillion market opportunity by 2030. In 2023-2024, TCS had generated over 55% of its revenues from services of digital transformation. The company has strategic partnerships with AWS, Google Cloud, IBM Cloud, and Microsoft Azure. With a market cap of Rs 14.5 lakh Crores, and revenue for 2023 of Rs 2.25 lakh Crores, TCS has been growing at an 8-10% rate annually. The net profit for 2023 has been Rs 42000 Crores, with a profit margin of 18-20%, among the highest in the industry. The dividend yield has been over 3% annually and ROE 45%.

TCS has a strong digital transformation demand. With businesses globally investing in cloud computing, AI, and blockchain, TCS is positioned as a market leader.

Investing in TCS is also wise as they have a history of high dividend returns, which makes it a favorite for long-term investors. The organization has been continuing to acquire new clients across Europe and North America, who have contributed 70% of TCS’s revenue, for the demand of cloud migration, automation, and cybersecurity. Buy Now!

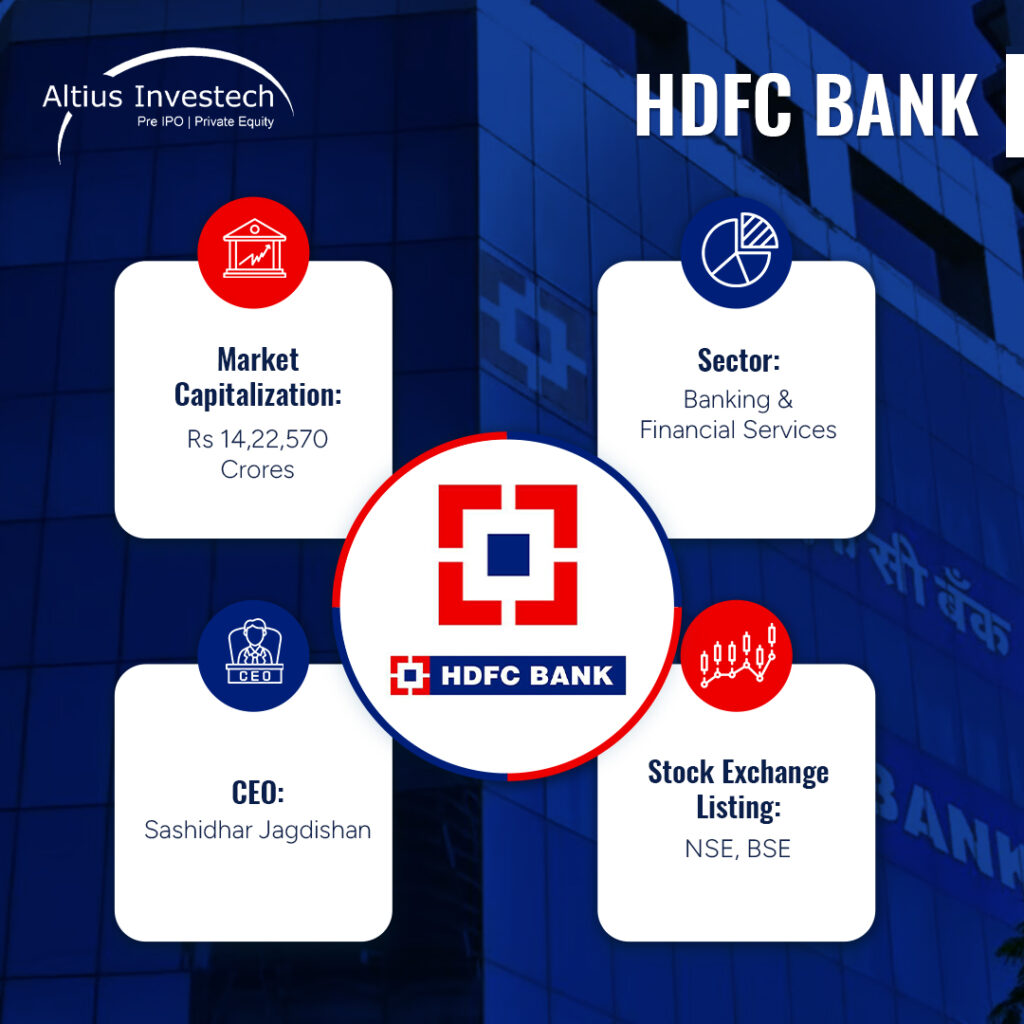

4) HDFC Bank

Market Capitalization: Rs 14,22,570 Crores

Sector: Banking & Financial Services

HDFC Bank remains India’s largest private-sector bank, offering a wide range of financial products. Its 2023 merger with HDFC Ltd. significantly boosted its asset base, making it the seventh-largest bank in the world by market capitalization.

The bank commands a dominant position in India’s financial sector. Its strong asset growth is reflected through a diversified portfolio that reduces risk and enhances profitability. Investments in AI-driven financial services increase customer engagement and operational efficiency. Its mobile banking and digital payment services cater to over 20 million active users, driving high transaction volumes.

The Net Profit for 2023-2024 had been Rs 44100 Crores, up 18% year-on-year. They have had total deposits of over Rs 22 lakh Crores, with a strong CASA (Current and Savings Account) ratio, allowing low-cost funding. The non-performing assets is among the lowest in this industry at just 1.3%. This reflects a strong risk management framework. The ROE has been noted to be 17.5%, making it one of the most profitable banks worldwide. Buy Now!

5) Bharti Airtel

Market Capitalization- Rs 9,74,470 Crores

Sector-Telecommunications

Bharti Airtel has seen a remarkable 75% growth in market value over the past year. Competing with Jio, Airtel has strengthened its 5G infrastructure and expanded into digital services. Airtel’s 5G services are live in 5000+ cities, covering more than 80% of urban India. Airtel has also invested Rs 50,000 Crores in 5G infrastructure, allowing superior quality network and speed. With India’s mobile data consumption deemed to grow 2x by 2026, Airtel has been poised to capitalize on this demand. The strong subscriber base also helps it gain high-value customers. The total subscriber base exceeds 370 million, making it one of the largest telecom players.

So why should you be investing in Airtel?

- 5G Expansion: Airtel is aggressively rolling out 5G services across India and Africa.

- Strong Subscriber Base: The company continues to add high-value postpaid customers.

- Diversification into Digital Payments: Airtel Payments Bank is gaining traction. Buy Now!

6) ICICI Bank

Market Capitalization-Rs 9,30,720 Crores

Sector– Banking and Financial Services

ICICI Bank is a major player in the private banking space, consistently delivering strong results. The emphasis on prudent risk management and digital banking solutions contributes to its market valuation and robust financial health.

It has been showing consistent profitability, through the high return on equity as well as stable asset quality. Their technology-driven services are shown through their strong digital banking infrastructure. They have a diverse loan portfolio, through their expansion into retail and corporate banking segments.

7) Infosys

Market Capitalization: Rs 7,99,400 Crores

Sector: Information Technology

Infosys is another IT giant that continues to dominate the software services industry globally. The company’s commitment to sustainability reinforces its reputation as a trusted partner for businesses that undergo digital transformation.

Infosys has strong revenue growth due to its expanding service lines in automation and AI. It has a large international client base, giving it stability in the US and European markets. The R&D focus has made them invest heavily in next-gen technology.

8) ITC Limited

Market Capitalization- Rs 5,80,670 Crore

Sector– FMCG, Hospitality, Agri-business

ITC, a diversified conglomerate, has successfully reduced dependency on tobacco revenue. Their business interests run beyond sectors like agriculture, packaged foods, and personal care. The company’s strong brand portfolio and strategic expansion contribute to its substantial market capitalization.

Why Invest in ITC?

- Strong FMCG Growth: Leading brands in packaged foods, and personal care.

- Sustainable Business Model: Strong presence in hotels and paperboards.

- High Dividend Yield: Attractive for long-term investors.

This sector has witnessed a 30% revenue growth post-pandemic. ITC is also India’s largest paperboard manufacturer. The business generates Rs 8000 Crores annually, growing at 10% to the demand for sustainable packaging. Also, ITC’s e-Choupal initiative connects 4 million farmers, allowing stable raw material sourcing. The segment contributes over Rs 15000 Crores in annual revenue.

ITC is one of the highest dividend-paying stocks in the country, making it a great choice for passive income seekers. The dividend yield is ~3.5% annually, the dividend payout ratio is over 80% of net profits, and cash reserves are Rs 30,000 Crores, allowing for steady dividends and buybacks.

Investing in ITC is surely a solid bet.

9) Larsen & Toubro (L&T)

Market Capitalization- Rs 5,42,770 Crores

Sector– Infrastructure & Construction

L&T remains India’s most valuable engineering and construction firm. It is a dominant force in engineering, technology services, and construction.

Why Invest in L&T?

- Major Government Contracts: Key player in infrastructure projects.

- Defense Manufacturing Expansion: Increasing involvement in defense contracts.

- Technological Innovations: Adoption of AI & IoT in construction.

10) HCL Technologies

Market Capitalization- Rs 5,18,170 Crores

Sector– Information Technology

HCL Tech is known for its strong digital transformation capabilities. HCL Technologies has made significant strides in the IT sector, offering a range of services including software development, infrastructure management, and business process outsourcing. The company’s global delivery model and client-centric approach have been key drivers of its growth.

One should invest in HCL Technologies for its-

- Growing Cloud Services Business

- Strong Deal Wins in Europe and the USA

- Robust R&D Investments

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

These top 10 companies represent the pillars of India’s economic growth in 2025. Whether you are a long-term investor or looking for stable returns, these companies offer strong fundamentals and future growth potential.

These top companies have a combined valuation that exceeds $1.1 trillion, which surpasses the GDP of Saudi Arabia! The remarkable growth is a reflection of the resilient and dynamic nature of the corporate sector in our nation. It surely offers promising opportunities for smart investors.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain