Blog Highlights

- Components of the Finnifty Index

- Difference between Finnifty & Nifty

- Composition of Finnifty

- Factors That Influence Finnifty

- Calculation of the NIFTY Financial Service Index

- Criteria for Finnifty Inclusion- Selection of Stocks

- Trading in Finnifty

- Why Invest in Finnifty?

- Popular Finnifty Stocks

Fin Nifty Overview: Everything You Should Know About This Index

The financial market is intricate, vast, and continuously evolving, comprising numerous indices that can track the performances of specific segments. Fin Nifty is one such index that has garnered substantial attention for its relevance and focus. The blog highlights the concept of Fin Nifty, its importance, composition, and obvious role in the stock market.

Fin Nifty, an abbreviation of Financial Nifty, is the index within the broad Nifty family of indices as managed by the NSE or National Stock Exchange of India. These Nifty indices reflect the performance of various segments and sectors in the Indian economy. Fin Nifty specifically tracks the performance of the financial services sector, including insurance companies, financial institutions, and banks.

Components of the Finnifty Index

Fin Nifty comprises 20 stocks across insurance companies, banks, housing finance companies, NBFCs, and miscellaneous financial institutions or service companies.

This includes insurance companies providing risk management through policies, banks that offer a wide range of financial services, housing finance companies specializing in providing loans for residential properties, and Non-Banking Financial Companies (NBFCs) offering financial services like banks, but not holding a banking license. The index also includes stocks from other financial institutions or service companies through various specialized services.

Difference between Finnifty & Nifty

| Factor | Fin Nifty | Nifty |

| Coverage | Tracks 20 leading financial organizations on NSE | Tracks 50 large and liquid companies across different sectors on the NSE. |

| Launching Date | Sep 2011 | April 1996 |

| Base Value and Base Date | Base Value- 1000 Base Date- Jan 1, 2004 | Base Value- 1000 Base Date- Nov 3, 1995 |

| Sector | Financial Sector (Banks, Insurance, Financial services, Housing Finance, NBFCs) | Diversified Sector (IT, Consumer Goods, Energy, Metals, Pharma) |

| Risk and Volatility | High risk and Volatility Sensitive to various economic conditions, policies, and market sentiments affecting the financial sector. | Low risk and volatility Balanced, represents the overall market. |

Finnifty in India

Nifty Financial Services Index was launched by the NSE Indices Limited on Sept 7, 2011, with a base date of January 1, 2004, and with 1000 as an initial value. As a three-tier structure including the Index Advisory Committee, the Index Maintenance Sub-committee, and the Board of Directors governs it, the index occurs to be a key player in the financial domain.

The FINNIFTY Index has excelled since its inception, providing investors with diversified exposure across various sectors of the Indian economy.

Acting as a “risk management tool” for those involved in the financial services sector, FINNIFTY has consistently outperformed both the Nifty Bank and Nifty 50 indices. With a compound annual growth rate (CAGR) of 18.7%, it surpasses the 13.9% CAGR of Nifty 50 and the 16.9% CAGR of Nifty Bank.

This impressive performance is attracting more investors and traders to the NSE, highlighting the importance of solid market fundamentals, experience, and patience for achieving good returns over time.

If you are looking to gain good profits from your investments, you can also consider investing in NSE unlisted shares. The starting price is Rs 3199.

Composition of Finnifty

The Fin Nifty index consists of a diverse range of organizations covering the sector of financial services.

- Insurance – Firms that offer health, life, and products of general insurance.

- Banks – Major public and private sector banks play a critical role in the economy through the provision of essential financial services.

- NBFCs or Non-banking financial Companies – Organizations that provide a wide range of financial services without holding banking licenses.

- AMCs or Asset Management Companies – Firms that manage mutual funds along with other investment products.

- Housing Finance Companies – Entities that specialize in giving housing loans.

Factors That Influence Finnifty

Various factors can have an impact on the performance of Fin Nifty, such as

- Monetary Policy – Changes in monetary policy and interest rates by the RBI or Reserve Bank of India can affect financial institutions and banks, thereby affecting Fin Nifty.

- Global Events – Political events, international trade policies, and geopolitical events, can also affect the financial sector and thereby consequently the Fin Nifty Index.

- Economic Conditions – Economic indicators like inflation rates, GDP growth, as well as employment figures can impact investor sentiment and the performance of financial stocks. With a growing economy and low interest rates, financial stocks would be performing well.

- Company-Specific News – Development-based news concerning the various companies within Finnifty would be able to have an impact on the share price. Positive affirmations like reports of strong earnings or new product launches would lead to a rise in the share price. Similarly, negative news like regulatory issues or scandals would observe a decline.

- Regulatory Changes – Regulatory developments affect the financial sector such as banking regulations, NBFC guidelines, changes in tax laws, and insurance policies can directly impact Fin Nifty.

Calculation of the NIFTY Financial Service Index

The index of financial services is calculated based on a free-float market capitalization of the 20 stocks that are included in the index.

The index needs to ensure that it reflects the market accurately and so it is calculated using this method. It means that only the shares that are available for trading should be considered in the calculation and promoters’ holdings or other locked-in shares should be excluded.

Index Value = Current Market Value of Constituents/ Base Market Capital x Base Index Value

The approach ensures that the index accurately reflects market movements and provides a fair representation of the performance of the financial sector.

Criteria for Finnifty Inclusion- Selection of Stocks

- Listed on NSE

- Part of the NIFTY 500 and Financial Services sector

- Preferably traded on NSE’s F&O segment

- Recent IPOs meeting criteria can be included for three months

- Quarterly capping limits: 33% for a single stock, 62% for the top 3 stocks combined.

Trading in Finnifty

1) Index Funds Tracking Finnifty

- Index Funds and mutual funds tracking the Fin Nifty Index.

- They provide diversification benefits.

- One needs to trade once a day at the end of the session at NAV or Net Asset Value price.

2) ETFs Tracking Finnifty

- ETFs or Exchange-traded funds(ETFs) are funds that trade like stocks on exchanges.

- They offer exposure to the top 20 financial companies in Fin Nifty.

- One can buy and sell ETF shares at market prices throughout the day.

3) Direct Investment in Finnifty Stocks

- Purchase shares of individual Fin Nifty companies that are listed on the NSE.

- It requires analysis and research of each company’s performance.

- It involves risks associated with individual stock picking.

Why Invest in Finnifty?

- Diversification – Spreads the risk across numerous top financial companies.

- Reduced Non-Systematic Risk – Mitigates risks like falling sales, rising costs, shrinking margins, strikes, and natural disasters.

- Focus on Leaders – Involves the best-performing finance firms having high market capitalization.

- Engaging Opportunity – It offers exposure to a diverse portfolio consisting of leading players in the financial industry.

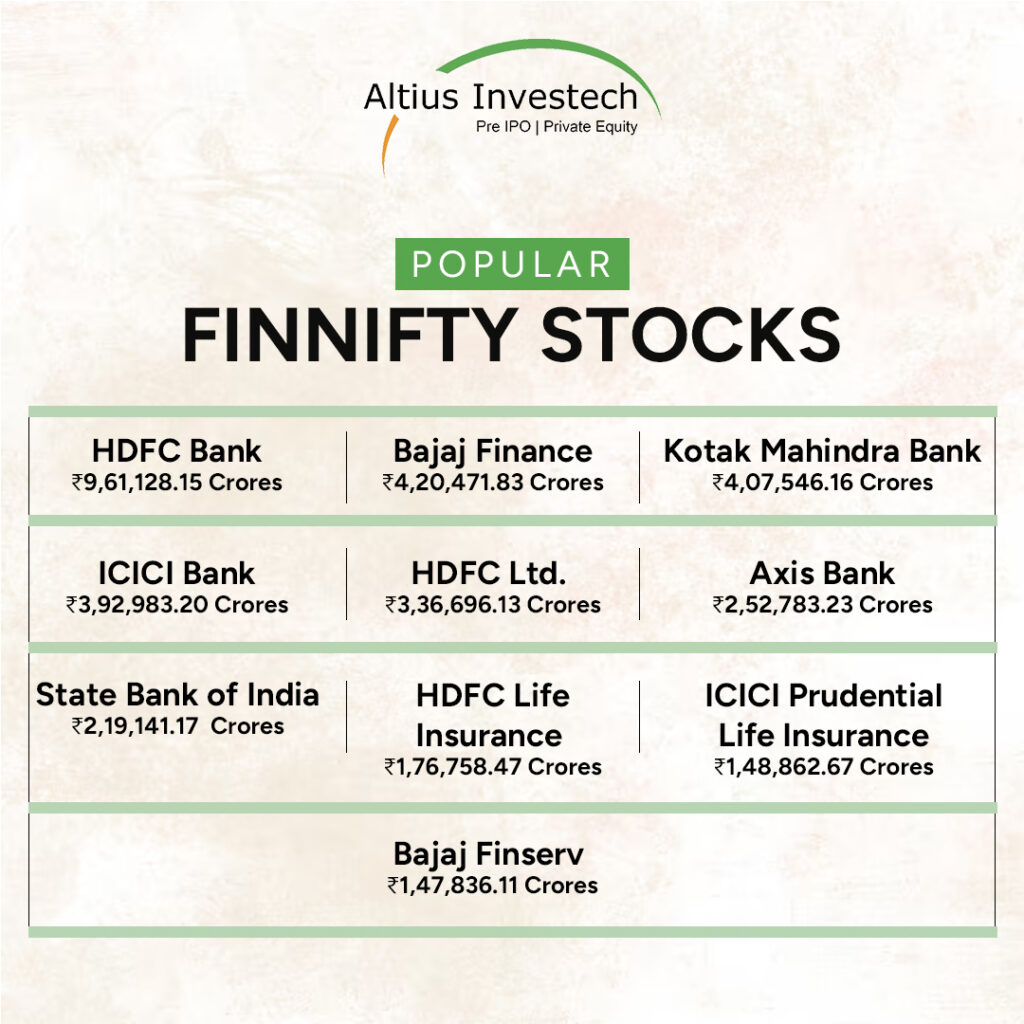

Popular Finnifty Stocks and their Market Capital

Final Thoughts

Nifty financial services let investors attain an opportunity to invest in the financial sector while diversifying their portfolios.

It offers various benefits like transparency, liquidity, and diversification. Careful consideration of risk tolerance and investment goals is imperative before levying investment in the Finnifty index.

Always remember as investment in the stock market is deemed to be a risky domain, do your homework or consult with experts before making investment decisions! Head to Altius Investech for valuable insights and worry-free trading.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

For Direct Trading, Visit – https://altiusinvestech.com/companymain

ALSO READ OUR OTHER BLOGS