Blog Highlights

- Early Life & First Investment

- Education of Buffett

- Net Worth of Buffett in Every Decade

- Cigar Butt Investing Strategy

- Buffett’s Investment Philosophy

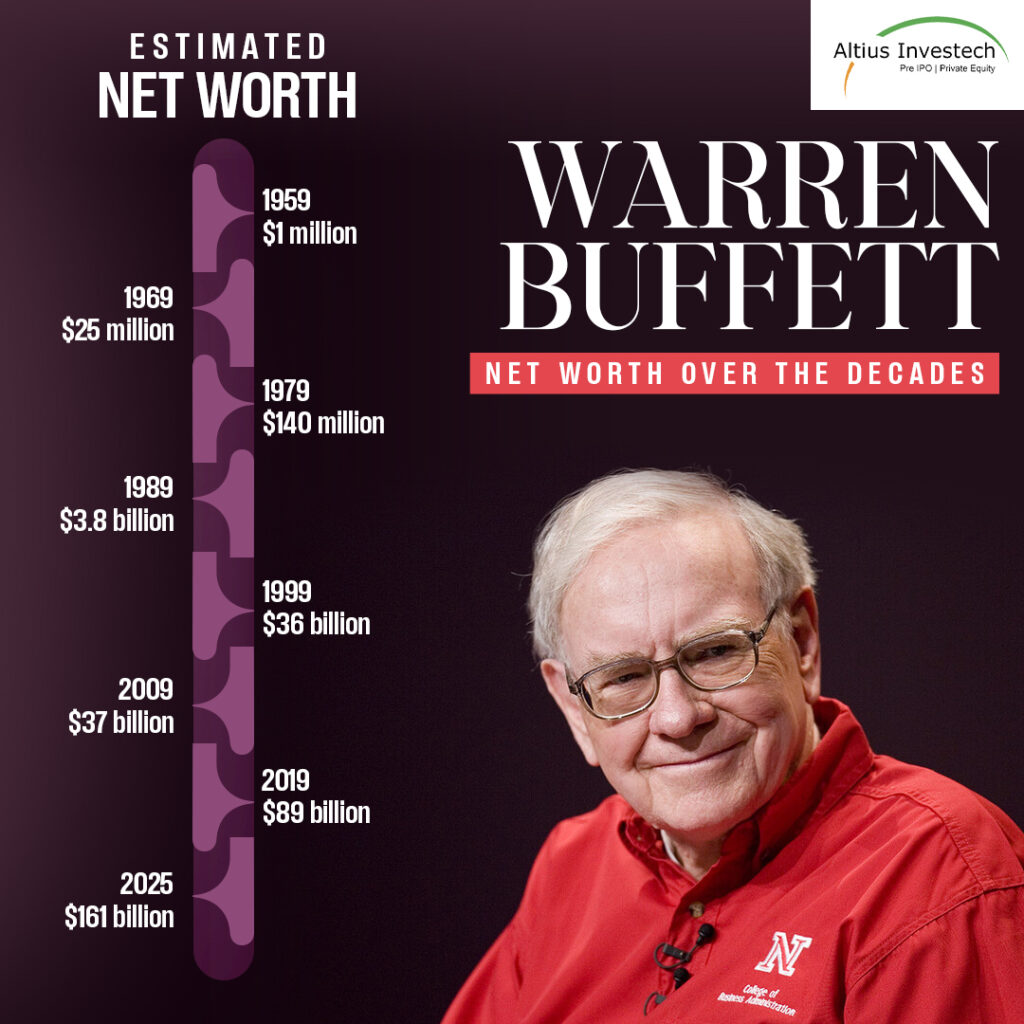

How Warren Buffett’s Net Worth in Rupees Has Grown Over the Decades

“I always knew I was going to be rich. I don’t think I ever doubted it for a minute”

Confidence, clarity, and a deep understanding of value, these traits shaped Warren Buffett’s path from a newspaper-delivering teenager in Omaha to one of the richest and most respected investors the world has ever known.

With a fortune that has grown from mere thousands to over $160 billion as of 2025, Buffett’s journey is not just a tale of financial acumen but a lesson in patience, discipline, and strategic thinking.

This extensive analysis traces the evolution of Buffett’s net worth over the decades, exploring the decisions, investments, and principles that propelled him from a precocious investor to a globally respected billionaire philanthropist.

Buffett’s Early Life & First Investments

Born on August 30, 1930, in Omaha, Nebraska, Buffett showed an early knack for business and investing. By the age of 11, he had bought his first stock called ‘Cities Service Preferred’. It was at $38 per share. He sold it at $40, only to watch it rise further. It taught him a lasting lesson in patience.

By the time he was 15, Buffett was already earning substantial sums through various ventures, including delivering newspapers and selling golf balls. His early savings allowed him to buy 40 acres of farmland with a friend. These formative experiences shaped his investment philosophy based on value, long-term thinking, and frugality.

Education of Buffett

The Groundwork for Wealth (1950s)

In 1951, Buffett graduated from Columbia Business School under the mentorship of Benjamin Graham, the father of value investing. After working briefly for Graham’s firm, he returned to Omaha and launched Buffett Partnership Ltd. in 1956 with $105,000 from family and friends.

By the end of the 1950s, his partnerships were growing rapidly. Using Graham’s principles, Buffett identified undervalued stocks like “cigar butts”, and acquired them at bargain prices. His early returns were astounding, with some years yielding more than 30% growth.

The Berkshire Hathaway Takeover (1960s)

In 1962, Buffett began purchasing shares of a struggling textile manufacturing company called Berkshire Hathaway. Though originally a value play, by 1965, he had taken full control and transitioned it into a holding company.

Recognizing that the textile industry had limited upside, Buffett began using Berkshire as a vehicle to acquire insurance companies like National Indemnity. This was a pivotal moment. Insurance firms generated “float”, which Buffett could reinvest. Float is when premiums are collected before claims are paid.

By 1969, Buffett dissolved his partnerships and focused solely on growing Berkshire. His net worth had multiplied many times over.

Net Worth of Warren Buffett in Every Decade (In Rupees)

1) Net Worth of Buffett in 1970s: $25 Million (2.06 Billion INR)

The 1970s saw the U.S. economy grappling with inflation and stagnation, but Buffett stayed the course. He focused on acquiring companies with strong brands, durable competitive advantages, and competent management.

Key moves included investing in The Washington Post, GEICO, and See’s Candies—all acquired at reasonable valuations and held for decades.

By the end of the 1970s, Buffett’s net worth had continued its steady ascent. Berkshire Hathaway shares were becoming increasingly valuable, and Buffett’s reputation as a savvy investor was growing.

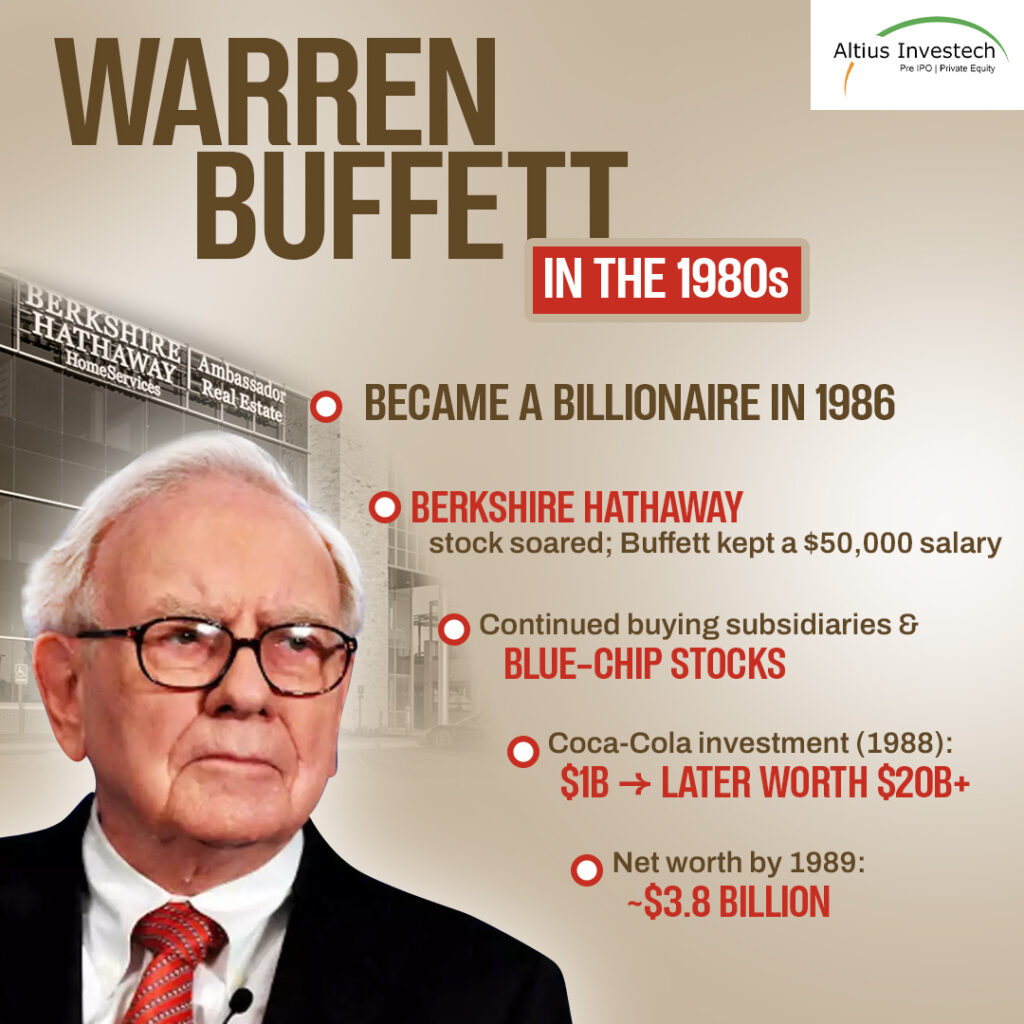

2) Net Worth of Buffett in 1980s: ~$140 Million (₹11.97 Billion INR)

In 1986, Buffett officially became a billionaire. Berkshire Hathaway shares had appreciated significantly, and Buffett maintained a modest salary of just $50,000 annually, choosing to reinvest almost all earnings.

Berkshire continued acquiring wholly owned subsidiaries and large minority stakes in blue-chip companies. Coca-Cola was one of the most notable buys of the decade, Buffett purchased $1 billion worth of stock in 1988, a decision that would earn Berkshire over $20 billion in future decades.

3) Net Worth of Buffett in 1990s: ~$3.8 Billion (₹313.5 Billion INR)

It’s a decade of compound growth for Buffett as his net worth grew rapidly in the 1990s, thanks to compounding and smart capital allocation. Berkshire Hathaway’s Class A shares went from under $8,000 in 1990 to over $70,000 by 1999.

Major investments included American Express, Gillette, and Wells Fargo. While Buffett stayed clear of the dot-com bubble, his caution was vindicated when the bubble burst in 2000.

He was also deeply involved in philanthropy planning, even though he hadn’t started giving significantly yet.

4) Net Worth of Buffett in 2000s: ~$36 Billion (₹2.97 Trillion INR)

In 2006, Buffett made headlines by announcing he would donate 99% of his wealth to philanthropic causes, primarily the Bill & Melinda Gates Foundation. He began distributing Berkshire shares annually to charity.

Despite market turbulence, including the 2008 financial crisis, Buffett’s investments in financial institutions, such as Bank of America and Goldman Sachs, helped stabilize the U.S. economy and proved profitable.

By 2008, he briefly overtook Bill Gates as the world’s richest man with a net worth of $62 billion.

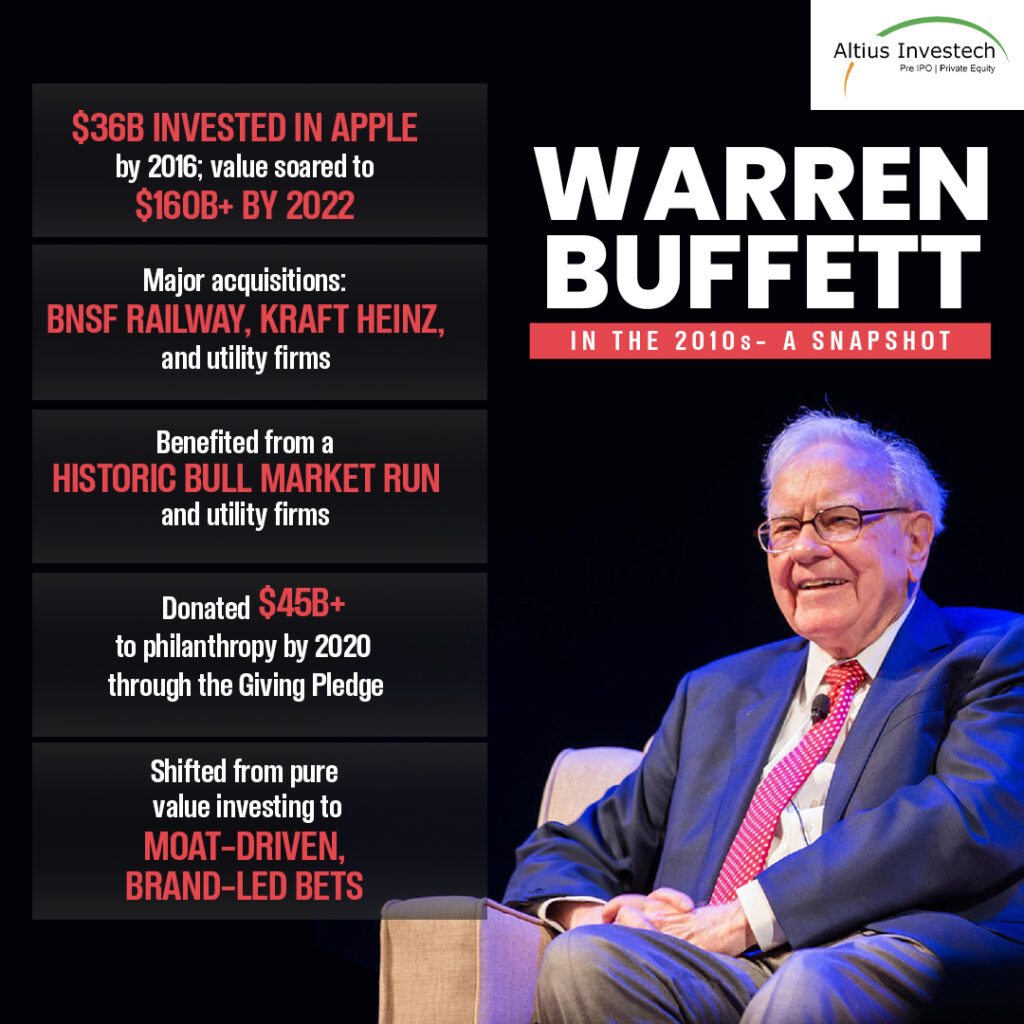

4) Net Worth of Buffett in 2010s: ~$37 Billion (₹3.05 Trillion INR)

The 2010s marked an era of massive wealth growth for Buffett. Despite initially being tech-averse, he invested heavily in Apple, purchasing shares worth $36 billion by 2016. By 2022, the value of this stake had ballooned to over $160 billion.

Other major moves included investments in Kraft Heinz, BNSF Railway, and numerous utility companies. Buffett also increased his philanthropic giving, with over $45 billion donated by the end of the decade.

5) Net Worth of Buffett in 2020s: ~$89 Billion (₹7.34 Trillion INR)

He officially crossed the $100 Billion Mark. Despite the COVID-19 pandemic and global economic uncertainty, Buffett’s wealth continued to grow. Berkshire Hathaway’s diversified portfolio, especially its Apple holdings, buoyed performance.

In 2021, Buffett officially joined the ‘centibillionaire’ club with a net worth surpassing $100 billion. Even as he gradually handed over daily operational responsibilities to his successors, he remained the guiding force behind Berkshire.

6) Net Worth of Buffett in 2025: ~$161 Billion (₹13.28 Trillion INR)

Discover the net worth of other influential figures in India.

- Aman Gupta

- Ashneer Grover

- Radhika Gupta

- Vineeta Singh

- Ritesh Agarwal

- Virat Kohli

- Ms Dhoni

- Rakesh Jhunjhunwala

Buffett’s Investment Philosophy

- Value Investing: Inspired by Benjamin Graham, Buffett looks for stocks trading below intrinsic value.

- Long-Term Focus: He famously said his favorite holding period is “forever.”

- Economic Moats: He invests in companies with durable competitive advantages.

- High-Quality Management: Buffett places great trust in leadership and often avoids micromanaging his acquisitions.

- Avoiding Debt: Conservative capital structures are a hallmark of his strategy.

- Frugality: Despite his wealth, Buffett lives in the same Omaha house he bought in 1958 for $31,500.

The Cigar Butt Investing Strategy

Imagine finding a discarded cigar on the street. It has one good puff left, unattractive, but the last puff is free and might give you a quick hit of satisfaction.

The metaphor, in investing terms, refers to:-

“Buying very cheap, troubled companies (usually in declining industries) that might still have a small bit of value left, i.e. a “free puff.” You buy them below their intrinsic value, hoping to get a quick gain when the market corrects the price.”

Buffet used this approach in his early days, as inspired by Benjamin Graham. He picked up ultra-cheap stocks irrespective of their business quality. It is because they were trading far below book value or liquidation value. An example mentioned by him is Dempster Mill Manufacturing, which was a windmill and farm equipment company that he bought for a fraction of its working capital.

With time, Buffet evolved. He became influenced by Charlie Munger and shifted toward buying great businesses at fair prices, instead of gaining fair businesses at great prices.

Buffett Said- “It’s like picking up a discarded cigar butt with one puff left in it. Sure, you get a puff, but it’s not exactly a rewarding experience.”

Currently, he prefers companies with durable competitive advantages, great management, predictable earnings, and high returns on capital.

Buffett’s Philanthropy

1) Giving While Living

Buffett’s commitment to philanthropy is as legendary as his investing. He has donated more than $50 billion to date, primarily through the Gates Foundation.

He co-founded the Giving Pledge with Bill and Melinda Gates, urging billionaires to commit at least half their wealth to charitable causes. As of 2025, over 240 ultra-wealthy individuals and families have signed on.

Buffett believes wealth should serve humanity.

“If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”-his pragmatic yet profound philosophy.

2) Legacy and Future Outlook

Warren Buffett turned Berkshire Hathaway into a conglomerate valued at over $800 billion, with holdings spanning railroads, insurance, energy, and tech.

His legacy isn’t merely his net worth, but the thousands of books, lectures, and investors inspired by his teachings. Buffett proved that investing isn’t about quick gains but disciplined, long-term thinking.

As he approaches his mid-90s, Buffett has laid out a succession plan, with Greg Abel expected to lead Berkshire into the future.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Buffett’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

From delivering newspapers as a teenager to becoming one of the richest and most respected people in the world, Warren Buffett’s story is the ultimate example of compound growth, intelligent investing, and purposeful living.

His journey across the decades showcases that wealth isn’t just about stock picks but principles. With a net worth exceeding $160 billion in 2025, Warren Buffett remains a beacon for investors and philanthropists alike, an enduring testament to what can be achieved through patience, integrity, and relentless curiosity.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain