Blog Highlights

- Who is Vijay Kedia ?

- Educational Qualifications of Vijay Kedia

- Vijay Kedia Investment Strategy

- Vijay Kedia Portfolio and Top Holdings

- Vijay Kedia networth in 2024

An In-Depth Analysis of Vijay Kedia’s Current Portfolio and Net Worth

Vijay Kedia’s journey from rags to riches is marked by his reputation as a market master, with historical returns in his portfolio delivered over the years. Acclaimed for his sharp intellect, he did not own fancy degrees or have priced goods to sell; his mind turned out to be his biggest asset.

“One needs to scout for companies that have good management,” says the maestro, who believes that management would outperform peers and the economy in the long run. Investing in these companies would not let anything go wrong. We commend his belief and persistence.

Kedia grew up in a family that practiced stock broking. He belonged to Calcutta, where he was avidly involved with stocks from a young age.

Education and Career

Vijay’s foray into the financial scape started at a very young age. His investments in the stock market started at 19, right after his father’s untimely demise.

He formally owns a degree in commerce, but his education has come from the roads of Bombay, in Dalal Street, where he could hone his skills as an investor and stockbroker. His early successes were marked in stocks like Aegis Logistics and Atul Logo, which in turn cemented his reputation as a remarkable investor.

Vijay Kedia’s Notable Investments

Vijay Kedia’s portfolio testifies to his strategic acumen. In 2024, his portfolio involved a mix of small-cap, mid-cap, and large-cap stocks spread across multiple sectors.

Some of the noteworthy holdings are-

- Atul Auto Ltd- Kedia has held a substantial stake in this company, yielding returns of over 1000% in the last decade.

- Cera Sanitaryware Ltd- Returns have exceeded 500% over a span of ten years.

- Precision Camshafts Ltd- The stock has given over 200% returns, to reflect Kedia’s knack for choosing winners in the sector of automobiles.

- Neuland Laboratories Ltd- It holds a stake of 1.3%, valued at about Rs 60.7 Crores.

- Sudarshan Chemical Industries Ltd- Having a 1% stake which was worth Rs 47.6 Crores, the investment displays his interest in the sector of chemicals.

Vijay Kedia’s Latest Portfolio and Shareholdings in 2024

His portfolio has been diverse across multiple sectors–

- Automotive– It includes stocks such as Precision Camshaft and Atul Auto.

- Chemicals and Pharmaceuticals– Holdings in Sudarshan Chemical Industries and Neuland Laboratories.

- Hotels and Hospitality– Investments in Resorts India Ltd and Mahindra Holidays.

- Engineering– Companies such as Patel Engineering.

- FMCG– Companies like Heritage Foods.

Vijay Kedia’s name has appeared in the shareholding pattern of Global Vectra Helicorp Ltd, an airline company. His investment was levied in this multi-bagger stock individually and through Kedia Securities. He holds a 1.46% stake in the company through individual capacity and 1.46% through the name of his company, Kedia Securities, owning 204,400 shares each. In a year, the share price for Global Vectra has ascended from Rs 54 a piece to Rs 158.75 per share on NSE, showcasing a 200% increase in the time frame.

Mr Kedia bought about 40,00,000 shares of the Reliance Group Infra Stock with a 1.01% stake in the company. Currently, as per figures of June 2024, Reliance Infrastructure has gained a 5.17% raise to be priced at 157.70 per share, from Rs 149.95 per share.

Reliance Retail has shown a year of high revenue, margin expansion, and EBITDA despite slow consumer demand and a risky market environment.

The company is the country’s most successful and largest retailer. The organized retail market is supposed to reach US $230 Billion by the year 2025.

The buying price for reliance retail unlisted shares is Rs 1362. Invest now!

Furthermore, Vijay Kedia stayed put on stocks for Panasonic Energy over 31 quarters in one row. He held 93,004 shares, with a 1.24% stake in the company as per current data. Also read about Raamdeo Agrawal portfolio & Ashish Dhawan Portfolio.

Buy stocks for Panasonic Appliances Unlisted Shares for prices as low as Rs 285!

Here’s a list of company stocks he has invested in, placed from highest to lowest order in terms of valuation in Crores

| Stock Name | Value (In Rs, In Cr) | Shares held | Stock price (In Rs) |

| Atul Auto Ltd. | 281.51 | 5,802,017 | Rs 485.2 |

| Tejas Networks Ltd. | 248.30 | 3,200,000 | Rs 776.0 |

| Elecon Engineering Company Ltd. | 177.28 | 1,499,999 | Rs 1181.9 |

| Vaibhav Global Ltd. | 125.36 | 3,325,152 | Rs 377.0 |

| Neuland Laboratories Ltd. | 103.32 | 140,000 | Rs 7380.2 |

| Mahindra Holidays & Resorts India | 80.82 | 2,025,000 | Rs 399.1 |

| Reliance Infrastructure Ltd. | 75.30 | 4,000,000 | Rs 188.3 |

| Repro India Ltd. | 72.16 | 906,491 | Rs 796.0 |

| Patel Engineering Ltd. | 70.92 | 12,000,000 | Rs 59.1 |

| Sudarshan Chemical Industries | 63.01 | 1,000,000 | Rs 630.1 |

| Affordable Robotic & Automation | 56.75 | 1,010,800 | Rs 561.4 |

| Innovators Facade Systems Ltd. | 36.39 | 2,010,632 | Rs 181.0 |

| Om Infra Ltd. | 31.20 | 2,400,000 | Rs 130.0 |

| Precision Camshafts Ltd. | 22.92 | 1,100,000 | Rs 208.4 |

| Talbros Automotive Components | 19.33 | 625,000 | Rs 309.3 |

| Siyaram Silk Mills Ltd. | 18.16 | 455,000 | Rs 399.1 |

| Global Vectra Helicorp Ltd. | 7.89 | 409,300 | Rs 192.8 |

Three Inactive Stocks in his portfolio include

- Ramco Systems Ltd

- Panasonic Energy India Company Ltd

- Heritage Foods Ltd

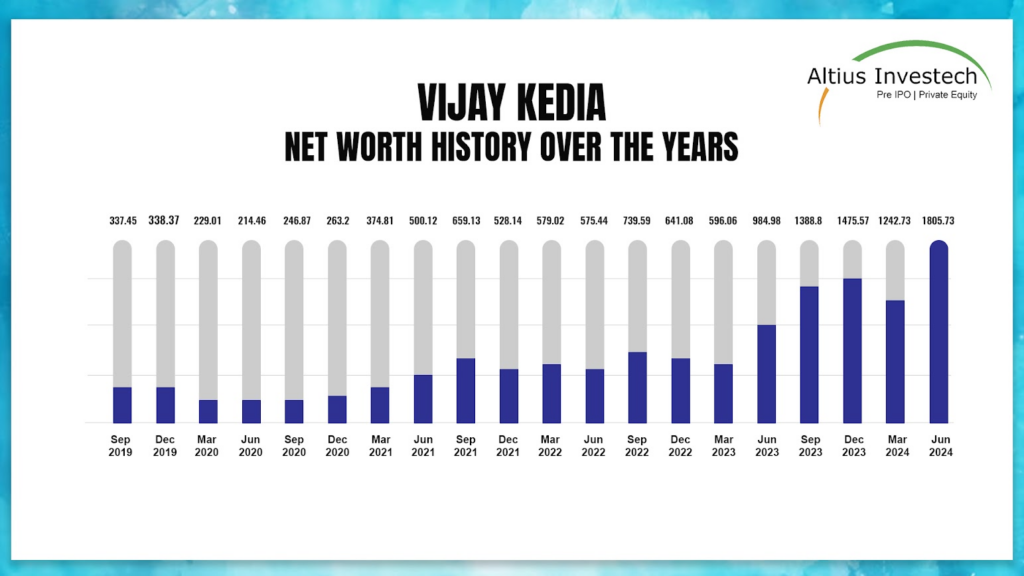

Vijay Kedia Net Worth

Vijay Kedia’s current net worth is estimated to be approximately Rs 1667 Crores as of this year. According to the latest corporate shareholding records, he holds 17 publicly listed stocks with a combined net worth of Rs 1490.63 Crore

The substantial wealth accumulation has resulted from his long-term investment strategy, along with his ability to recognize high-potential organizations that are early in their growth cycles.

Vijay Kishanlal Kedia’s net worth from his Portfolio has risen by 45.30% to Rs 1805.73 Crores. Also read about Ashneer Grover’s Net Worth & Radhakishan Damani’s net worth

Vijay Kedia’s Investment Strategy

Vijay Kedia focuses on the SMILE principle in his investments- meaning “Small Size, Medium Experience, Innovative Management, Large Aspiration, and Extra-Large Market Potential.

He has focused on organizations with strong fundamentals, significant potential for growth, and competent management standards. This strategy emphasizes patience in long-term holdings, where one does not rely on the stock market for daily essentials. It has helped him gain phenomenal returns over the years.

These are the shares held by Dr Vijay Kedia based on the information available in the exchanges.

As opined by the visionary himself

“One needs to be scouting for companies that have good management..find good management, very honest management, seeing the product in which the management would grow, outperform its peers and the economy; invest in the companies for the next 10-15 years, and one will never go wrong”

Vijay Kedia

- He intends to aim big and ride through tough times.

- Even when he knows luck plays a major role in share market investments, he claims that one would need patience, courage, and knowledge to be successful in their endeavors.

Conclusion

The success story for Vijay Kedia highlights long-term, strategic investing. The diversified portfolio has been grounded in having a keen eye toward growth potential, offering invaluable lessons for investors. Following the SMILE strategy, Kedia continues to exude a guiding light showcasing the significance of thorough research, strategic thinking, and patience in wealth creation.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

FAQ

Vijay Kedia is a renowned Indian investor and businessman known for his successful stock market investments. He has a significant presence in the Indian stock market with a diverse portfolio.

Vijay Kedia began his career in the stock market at a young age, driven by his passion for investing. He has built a reputation through his astute investment choices and deep understanding of the market.

Kedia has made several notable investments in companies across various sectors, including Elecon Engineering, Repro India, and Vaibhav Global. These investments have significantly contributed to his wealth.

As of 2024, Vijay Kedia’s net worth is estimated to be around Rs 1667 Crores.

Analyzing Kedia’s portfolio and strategies reveals a disciplined and insightful approach to investing, emphasizing patience, thorough research, and a focus on sustainable growth.