Blog Highlights

- Early Life and Education

- Career Journey

- Net Worth of Shankar Sharma

- Portfolio and Investments of Shankar Sharma

- List of Companies/Stocks Shankar Sharma Has Invested

- Investment Insights & Strategy

- Lessons Learnt from Shankar Sharma’s Journey

Shankar Sharma remains celebrated for his contrarian investment strategies as well as astute market predictions. Being the founder of GQuant Investech and former Vice-Chairman of First Global, Sharma’s investment choices are analyzed meticulously by investors and market enthusiasts alike. In 2024, his portfolio has reflected a blend of emerging industries and traditional sectors, that underscored his dynamic approach to wealth creation.

Shankar Sharma Portfolio: Top Investments and Key Holdings

Early Life & Education

Born with an inclination for finance and numbers, Shankar’s early life set a foundation for his later success. As he grew up in an era when financial markets in the country were burgeoning, he developed a fascination with the methods of wealth creation. Sharma pursued his education in business and finance, which could sharpen his analytical skills through rigorous academic training. His educational background, along with his curiosity and ambition, has laid the groundwork for a career that could redefine the investing landscape in the country.

Career Journey

Shankar Sharma’s career took off in the financial markets during the 1980s and 90s. He co-founded First Global, a leading brokerage and research house that has pioneered in-depth market analytics in India and abroad. Sharma’s work at First Global allowed him to delve deeply into global financial trends, cultivating a research-based approach that often helped him predict market shifts.

As he remained known for taking a high-stakes position in stocks and sectors that most investors could overlook, his journey has been filled with substantial rewards and bold calls. His contrarian approach has met with success time and again, which could cement his reputation as a market maverick. Sharma’s influence over the years expanded beyond India, where he built an international clientele, further establishing his credibility globally.

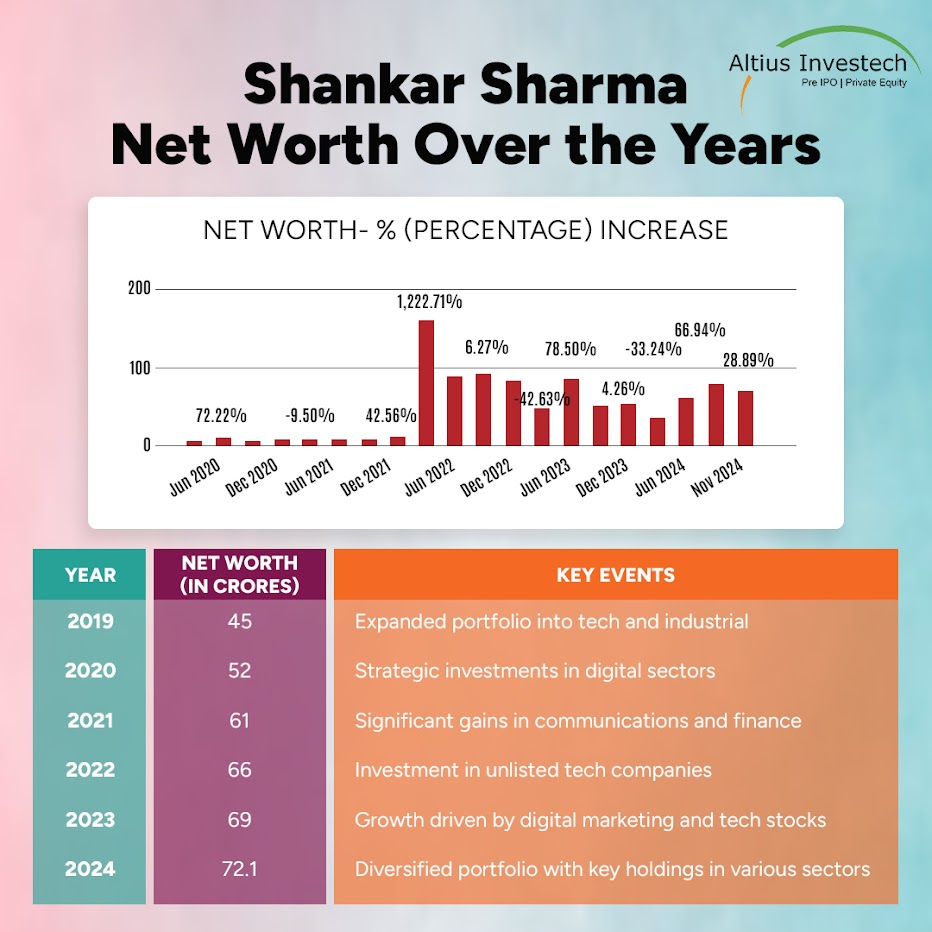

Net Worth of Shankar Sharma

Shankar Sharma’s net worth reflects his successful predictions over decades. His worth is highly attributed to the high-reward investment approach. His portfolio included holdings in sectors like consumer goods, technology, and infrastructure, illustrating a careful diversification strategy, enabling him to not simply preserve but also grow his wealth substantially.

As per the current shareholdings filed, Shankar Sharma publicly holds 4 stocks with a net worth of over Rs 72.1 Cr.

As per November, 2024.

- Shankar Sharma’s portfolio net worth fell by -14.0% to Rs 69.55 Crores

- Shankar Sharma made their latest buy in Thomas Scott (India) Ltd., increasing their stake by 2.49%.

Portfolio and Investments of Shankar Sharma

Shankar Sharma’s 2024 portfolio demonstrates his strategy of balancing established industries with emerging growth sectors. His investment approach spans digital marketing, communications, manufacturing, and niche areas like drone technology and home decor. This diversified structure enables him to mitigate risk while capitalizing on sectors with high growth potential.

| Stock | Holding Value (In Rupees) | Quantity Held | Sept 2024 Holding % |

| Rama Steel Tubes Ltd | 33.3 Cr | 24,375,000 | 1.6% |

| Thomas Scott Ltd | 14.9 Cr | 700,000 | 6.2% |

| Valiant Communications Ltd | 11.7 Cr | 200,000 | 2.6% |

| ACE Software Exports Ltd | 11.7 Cr | 236,000 | 3.7% |

| Brightcom Group Ltd | 18.2 Cr | – | 1.10% |

This table showcases Sharma’s strategic choices in sectors with resilient demand, highlighting his preference for companies with both stability and growth potential.

List of Companies/Stocks Shankar Sharma Has Invested In

1) Rama Steel Tubes Ltd

A prominent manufacturer of steel tubes and pipes, catering to different sectors including construction, automotive, and infrastructure. Sharma’s investment in this organization aligns with his strategy of identifying growth potential in the infrastructure sector, which is quite significant in India’s economic development. Shankar Sharma holds 24,375,000 shares in Rama Steel Tubes Ltd., valued at Rs 25.3 Crores, representing 1.57% of his portfolio.

2) Valiant Communications Ltd

It specializes in manufacturing communication, transmission, and synchronization equipment, serving critical infrastructure sectors. The innovative solutions and expanding global footprint of the organization contribute to its overall investment appeal. He holds 200,000 shares in Valiant Communications Ltd., valued at ₹12.8 Crores, which constitutes 2.62% of his portfolio.

3) Thomas Scott Ltd.

It operates in apparel and textiles and offers a range of clothing products. Sharma’s significant holding shows his belief in the potential of our country’s textile industry, benefitting from both domestic consumption and export opportunities. The focus of the company on expanding market presence and quality aligns with Sharma’s criteria for investment. He holds 700,000 shares in Thomas Scott (India) Ltd., valued at Rs 14.9 Crores, making up 6.20% of his portfolio.

4) Brightcom Group Ltd.

Brightcom Group Ltd. is a global provider of digital transformation solutions, including IT consulting, software development, and cloud computing services. The strong presence of the company in Europe, Asia, and the USA, alongside its comprehensive service offerings, positions it well to capitalize on the growing demand for digital solutions. Brightcom Group Ltd. features prominently in Shankar Sharma’s portfolio with a holding of 22,925,000 shares, valued at Rs 18.2 Crores, comprising 1.10% of his investments.

5) Vertoz Advertising Ltd

It is a leading ad-tech company leveraging artificial intelligence to provide data-driven marketing and advertising solutions. Sharma’s stake in the company reflects his strategic focus on the burgeoning digital advertising sector, experiencing considerable growth due to increased online engagement. In his portfolio, Vertoz Advertising Ltd accounts for 400,000 shares, making up 2.20% of his total holdings.

6) Droneacharya Aerial Innovations Ltd.

Sharma’s investment in this company highlights his foresight in recognizing the potential of drone technology across various sectors, including agriculture, logistics, and surveillance. The innovative solutions as well as its early-mover advantage position it well in the emerging drone industry.

7) Priti International Ltd.

is a leading Indian furniture brand specializing in contemporary designs for homes and businesses. It indicates his confidence in the growth of the Indian consumer goods sector, which is mainly driven by rising disposable incomes as well as evolving lifestyle preferences.

8) Ishan Dyes and Chemicals Ltd

The company’s strong market presence and expansion plans contribute to its potential for long-term growth.

They are a manufacturer of pigments and dyes, serving various industries.

9) Insider Trades & SAST Disclosure

Shankar Sharma’s recent trades reflect his strategic portfolio adjustments in prominent companies. On July 3, 2023, he disposed of 1,720 equity shares of HDFC Asset Management Company Ltd. at an average price of Rs 2,296, as disclosed to the exchange under SEBI’s (Prohibition of Insider Trading) Regulations, 2015.

More recently, on July 17, 2024, he acquired an additional 300,000 shares of Thomas Scott (India) Ltd., reported under SEBI’s SAST (Substantial Acquisition of Shares and Takeovers) Regulations. These transactions showcase Sharma’s dynamic approach, highlighting how he balances disposals and acquisitions while refining his portfolio with an eye on high-growth opportunities.

Investment Insights & Strategy

Shankar Sharma’s 2024 portfolio exemplifies his adaptability and strategic acumen to the evolving market dynamics. Aspects of the investment strategy include-

- Contrarian Approach: Sharma often invests in sectors or companies that are undervalued or overlooked by the market, anticipating their potential for turnaround and growth.

- Long-Term Perspective: He emphasizes holding investments over an extended period, allowing the underlying businesses to realize their growth potential.

- Research-Driven: Being a meticulous researcher, he could dive deep into data, trends, and fundamentals before making decisions.

- Diversification: His portfolio spans various sectors, including infrastructure, technology, consumer goods, and emerging technologies, mitigating risks associated with sector-specific downturns.

- Focusing on Fundamentals: Sharma prioritizes companies with strong management, robust financials, and clear growth trajectories, ensuring a solid foundation for his investments.

The meticulous selection of companies aligning with these principles, lets Shankar Sharma continue to build a growth-oriented and resilient portfolio, showcasing his deep understanding of market trends and a commitment to creating wealth in the long run. As his portfolio continues to evolve, it’s clear that Sharma’s insights and strategies will influence the next generation.

Lessons Learnt from Shankar Sharma’s Journey

Here are some key takeaways from Sharma’s investment journey, that can present as a checklist for aspiring investors.

- Research and Analysis – Thoroughly analyzing companies before investing has been critical for his success.

- Adaptability – His success underscores the significance of evolving with market trends

- Patience and Long-term Focus -His emphasis on long-term growth has made his portfolio weather market volatility.

- Balanced Management of Risks – Through careful diversification, Sharma can balance high-growth investments with safer choices.

Final Thoughts

Shankar Sharma’s 2024 portfolio showcases a blend of strategic foresight, diversified risk management, and industry knowledge. The investments reflect a commitment to long-term growth that is based on value. It should combine traditional industries with cutting-edge technologies. Individuals looking to emulate his approach should take his portfolio as an exemplary model of informed, balanced investing.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Shankar’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain

FAQs

Ans:- Shankar Sharma’s 2024 portfolio includes notable companies such as Rama Steel Tubes, Valiant Communications, Brightcom Group, and Thomas Scott, along with unlisted investments like Droneacharya Aerial Innovations and Priti International.

Ans:- Sharma targets sectors with growth potential and resilience, particularly those benefiting from technological advancements and robust consumer demand.

Ans:- His unlisted portfolio includes Droneacharya Aerial Innovations and Priti International, showcasing his interest in early-stage, high-growth companies.

Ans:- His portfolio has shown steady growth, with Sharma’s net worth increasing consistently due to his strategic diversification and focus on high-performing sectors.

Ans:- His principles include contrarian investing, long-term vision, sectoral diversity, and an emphasis on future-oriented technologies.