Blog Highlights

- Early Life & Career

- Investments in Listed Shares

- Unlisted Shares Investments

- Ramesh Damani Net Worth in 2024

- Net Worth Growth

- Investment Principles

A look inside Ramesh Damani Portfolio & Net Worth in 2024

Ramesh Damani has carved out a distinguished place in the investment world, building a portfolio that reflects his sharp financial insights and substantial gains. His journey from a budding investor to a revered market expert is filled with strategic decisions and noteworthy achievements.

In this blog, we will delve into the details of Damani’s investment journey, tracing the steps that led him to where he is today. We’ll explore his current portfolio, examining the key holdings that showcase his investment strategies and the reasoning behind his choices. Additionally, we’ll look at his net worth in 2024, analyzing how his financial acumen has translated into significant wealth.

Ramesh Damani Early Life & Career

Damani was born into a family that had a strong financial background.

His early interest in investments occurred as his father was also avidly involved in the stock market. He completed his MBA from California State University and then returned to our nation to join the BSE or the Bombay Stock Exchange.

At the start, his objective was to make money through brokerage. However, he soon realized how much long-term investments could offer.

Despite a rough start initially, where he lost Rs 10,000 for his initial investment challenge. Damani only had a strengthened reward which led him to pursue a membership with BSE.

Earlier bets on companies like CMC and Infosys show his passion for investing and legendary status in this community.

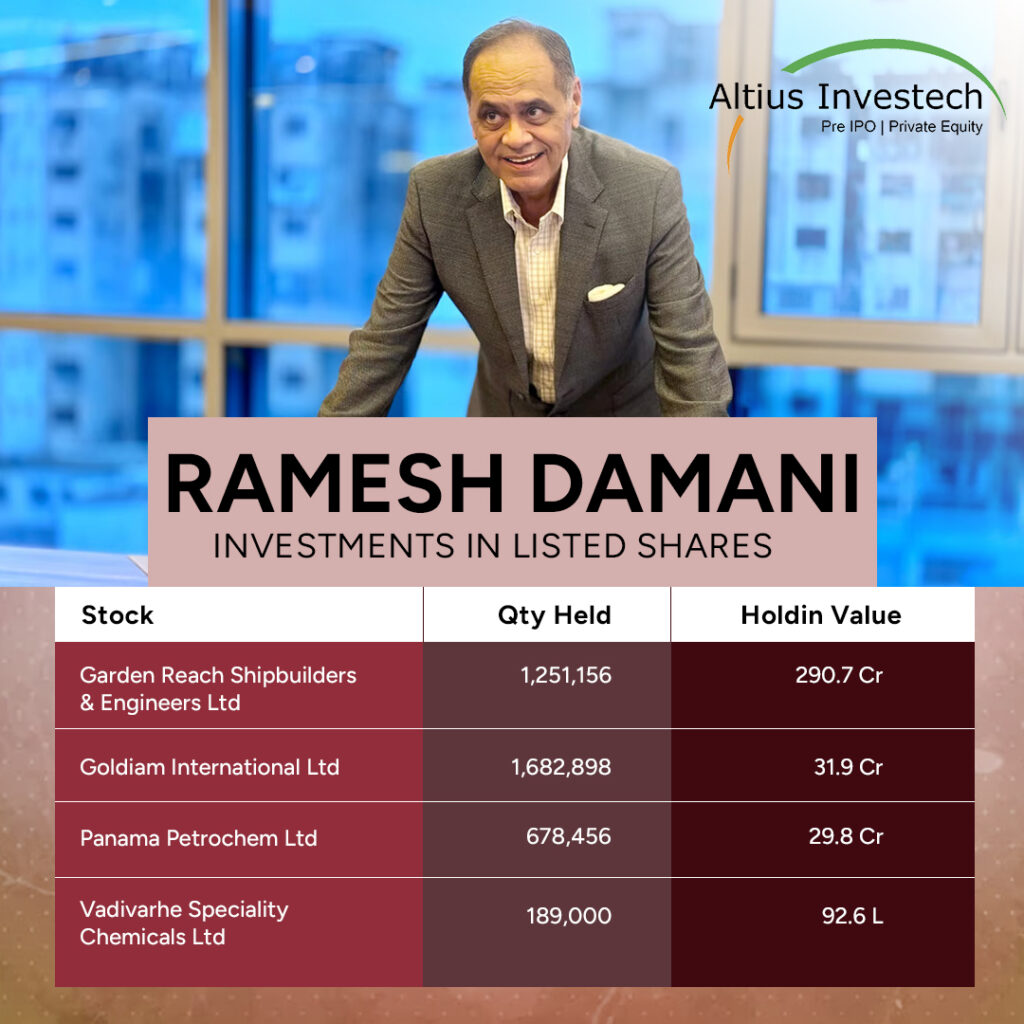

Ramesh Damani’s investments in Listed Shares

One highly notable holding in Damani’s portfolio is GRSE or Garden Reach Shipbuilders & Engineers Ltd. He holds a significant stake that is valued at over Rs 75.3 Crores. It is a promising shipbuilding company in the country that caters primarily to the defence sector. Damani’s investment in GRSE showcases his confidence in the organization’s robust fundamentals and long-term growth potential.

1) CMC & Infosys

Damani’s investments in CMC and Infosys during the 1990s pivotally established his reputation when these investments converted into multi-baggers. He had invested around Rs 10 lakh in these companies, which could eventually grow 100x fold.

As per current records of shareholder exchanges, Ramesh Damani holds 4 stocks publicly. These are shares held by Damani as per the shareholding data filed within the exchanges.

2) Garden Reach Shipbuilders & Engineers Ltd

The holding value for this share is Rs 276 Crores, with the holding % for June 2024 being 1.1%.

Operating through divisions in shipbuilding, engineering, and engine production, the company produces warships, deck machinery, portable steel bridges, marine pumps, and overhauls MTU diesel engines. Its shipbuilding unit is at Rajabagan Dockyard, India.

The company’s market cap is Rs. 16,721.16 crore, with a monthly return of 26.29% and a one-year return of 133.69%. The stock is 29.00% below its 52-week high.

3) Vadivarhe Speciality Chemicals Ltd

The holding value for this share is Rs 92.6 Lakhs, with the holding % for June 2024 being 1.5 %.

Vadivarhe Speciality Chemicals Ltd, based in India, manufactures a variety of organic, inorganic, and bio-chemicals, as well as bulk drugs, drug intermediates, and active pharmaceutical ingredients.

The company has a market cap of Rs. 47.99 crore, with a monthly return of 13.82% and a one-year return of 47.11%. The stock is 27.05% below its 52-week high.

4) Goldiam International Ltd

The holding value for this share is Rs 31.9 Crores, with the holding % for June 2024 being 1.6 %.

Goldiam International exports to the US and Europe and has subsidiaries including Goldiam Jewellery Limited, Diagold Designs Limited, Eco-Friendly Diamonds LLP, and Goldiam USA, Inc.

The company’s market cap is Rs. 1,863.04 crore, with a monthly return of -13.52% and a one-year return of 24.30%. The stock is 31.45% below its 52-week high.

5) Panama Petrochem Ltd

The holding value for this share is Rs 29.8 Crores, with the holding % for June 2024 being 1.1 %.

Panama Petrochem Ltd, based in India, produces a wide range of petroleum products for industries such as printing, textiles, rubber, pharmaceuticals, cosmetics, and power generation. The company operates four manufacturing facilities in Ankleshwar, Daman, and Taloja.

Panama Petrochem Ltd has a market cap of Rs. 2,100.64 crore, with a monthly return rate of -7.67% and a one-year return rate of 18.32%. The stock is 15.59% below its 52-week high.

Ramesh Damani’s Unlisted Shares Investments

Additionally, Ramesh Damani has also made strategic investments in various unlisted companies. These investments include burgeoning enterprises and startups that have significant upside potential. Damani’s inclination in the unlisted space showcases his capability to recognize promising ventures at their early stages that can leverage his overall market expertise and also drive substantial returns.

Damani’s track record suggests that he has a keen eye for innovative business models and disruptive technologies, aligning with his long-term investment mindset. It is also driven by the belief in their prospects and levying confidence in the management teams.

If you want to grow your investments like Ramesh Damani and are willing to take minimal risks for double or even triple the returns, unlisted shares are your best bet. Purchase them from a trusted platform like Altius Investech and maximize your revenues.

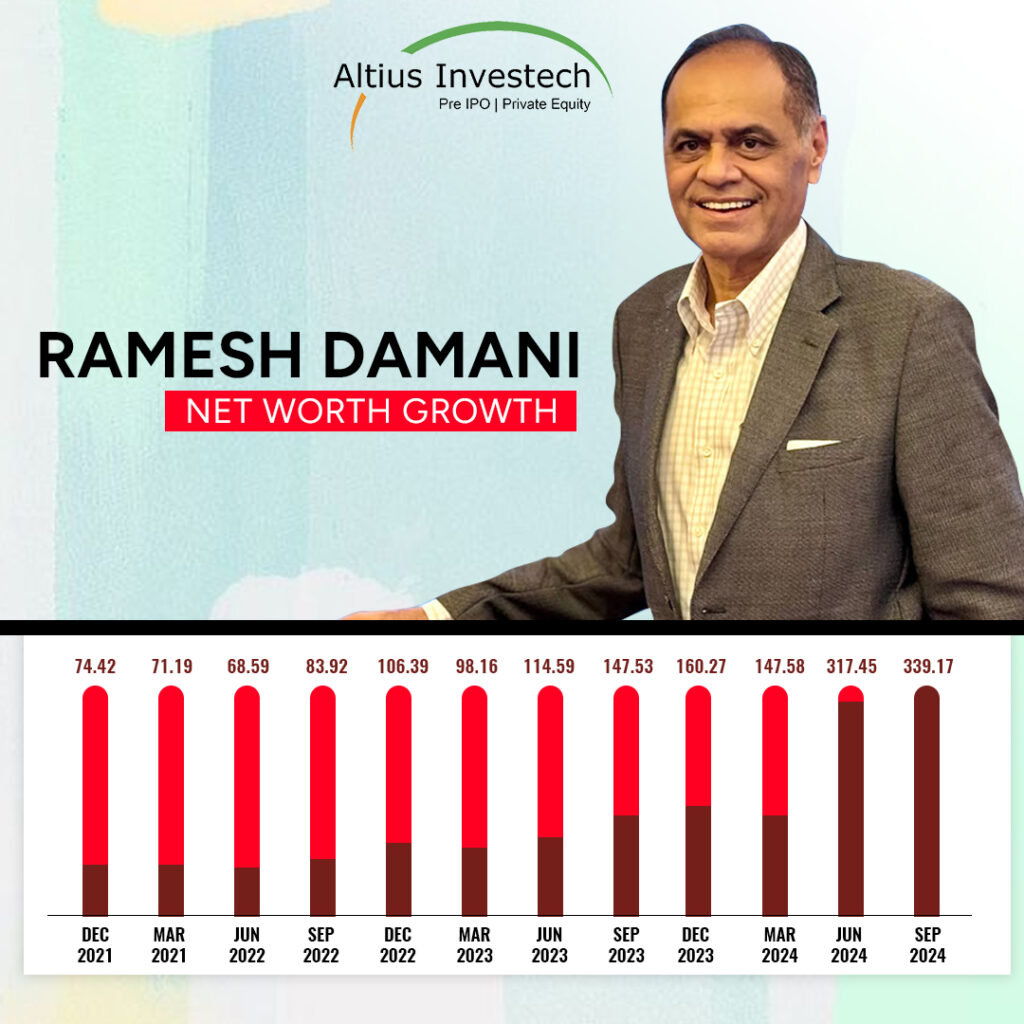

Ramesh Damani Net Worth in 2024

As per current reports on shareholdings, Ramesh Damani’s net worth has been estimated to be over Rs 363 Crores.

It testifies to his successful investment endeavors and his ability to navigate within the volatile stock market so fulfilling. This wealth trajectory highlights the efficacy of his investment principles alongside his unwavering commitment to value-based investments.

Net Worth Growth

Ramesh Damani Investment Principles

1) Value Investments

Damani seeks shares that have strong growth potential despite being undervalued. The principles of Warren Buffet are put in high regard, in perspective of his making investments in companies that have robust fundamentals.

2) Continuously Evolve

His journey from being a novice investor to now being acclaimed as a market expert shows the importance of continuously evolving by learning from losses. The early setbacks in the US market were critical learning experiences for him.

3) Think Long-Term

He advocates for the horizon of long-term investments. He gained substantially from his early company investments, which demonstrated how strategic foresight and patience are rewarded.

4) Diversify

Despite the portfolio being concentrated in places in terms of several stocks, it is diverse across sectors, including both unlisted and listed shares. Balance is meant to mitigate risks while maximizing returns.

Final Thoughts

Damani’s portfolio is almost like a masterclass in levying strategic investments. Considerable stakes in various organizations like GRSE alongside early successful best on CMC and Infosys, the investments reflect a deep understanding of the market as well as having a long-term growth view. The diversified approach blended with value investments continues to inspire seasoned and new investors alike.

If you enjoyed reading this, consider learning about the portfolios of other powerful tycoons in the Indian financial world.

- Vijay Kedia’s Latest Portfolio & Networth

- Raamdeo Agrawal’s Investment Empire – His Portfolio & NetWorth

- An Inside Look at Porinju Veliyath’s Investment Portfolio

- Decoding Ashish Dhawan Portfolio

- Inside Radhakishan Damani’s Successful Portfolio & Net Worth

FAQs

A1: Ramesh Damani was born on August 26, 1955. As of 2024, he is 68 years old.

A2: Ramesh Damani’s wife is Amita Damani.

A3: Yes, Ramesh Damani and his wife Amita have children.

A4: Ramesh Damani is a renowned Indian investor and stock market expert. He is well-known for his successful investment strategies and his insights into the stock market.

A5: Ramesh Damani holds a bachelor’s degree in Commerce from HR College, Mumbai, and an MBA from California State University, Northridge, USA.

A6: As per current reports on shareholdings, Ramesh Damani’s net worth has been estimated to be over Rs 363 Crores.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.