Blog Highlights

- Oyo Unlisted Share Price Analysis: Monthly Performance in 2024

- Financial Indicators

- Industry Perspective

- Business Evolution- The Transformation of OYO

- What makes OYO Shares gain attention now?

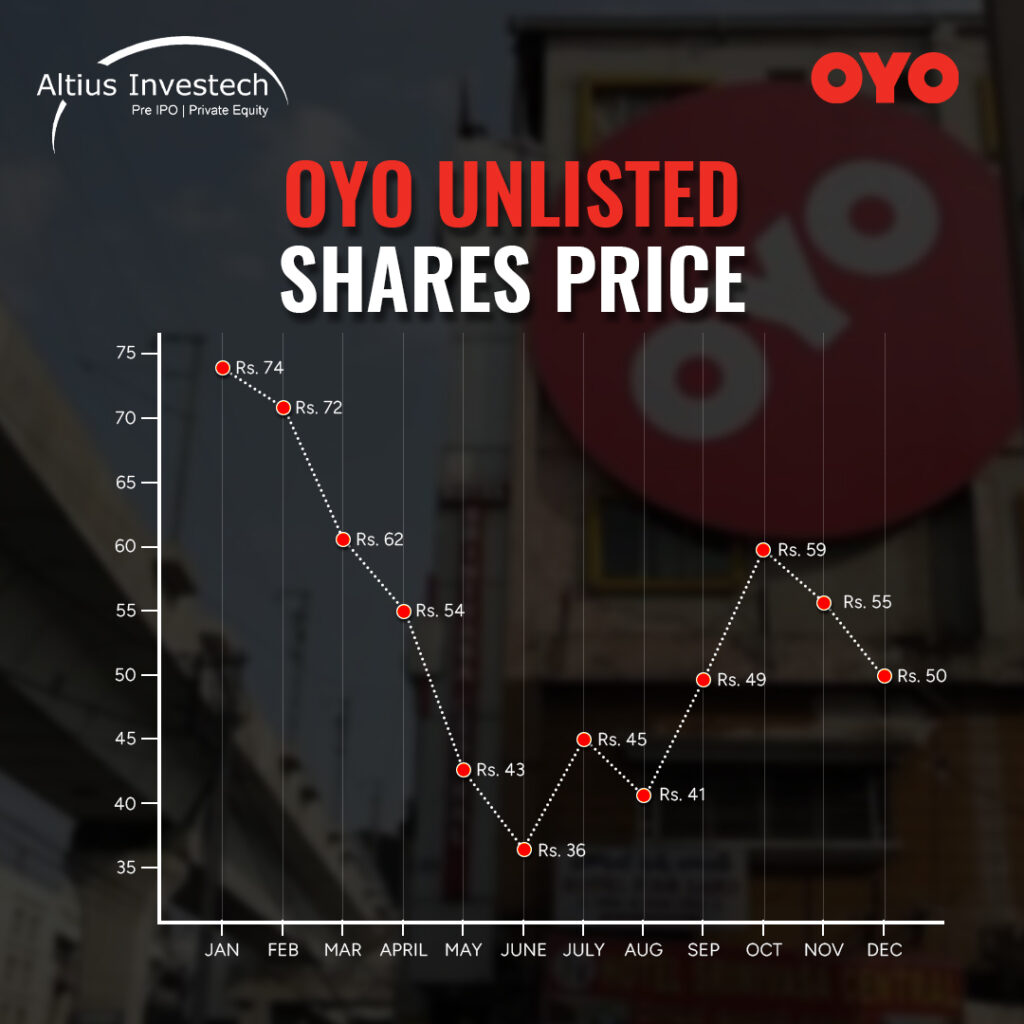

Oyo Unlisted Share Price Analysis: Monthly Performance in 2024

OYO Rooms has witnessed an exhilarating journey, from its humble beginnings in 2013 to becoming a global giant in the industry. Operating over 450,000 listings across 5,000 cities in countries such as India, Malaysia, UAE, Nepal, China, and Indonesia, OYO has transformed the meaning and landscape of hospitality. But how does its OYO unlisted share price reflect this evolution? Let us delve into the month-wise price trajectory, performance indicators, and future prospects.

OYO Unlisted Shares Price 2024

January

OYO’s unlisted share price started the year at Rs 74, reflecting stability in the market. The company’s profitability and streamlined operations garnered investor confidence, ensuring the shares maintained steady traction. OYO’s shift to a franchise model, coupled with its growing global footprint, provided a solid foundation for long-term growth.

February

The OYO’s share price was Rs 72, reflecting robust market sentiment. The optimism was fueled by OYO’s consistent focus on expanding its global footprint and enhancing its franchise model, which reassured investors of its growth trajectory.

March

In March, the price saw a dip to Rs 62, signaling a market correction. This drop was largely attributed to early investors’ short-term profit booking. However, the company’s strong fundamentals and ongoing global acquisitions, such as Motel 6 and Checkmyguest, maintained long-term confidence.

April

April witnessed further consolidation as the price settled at Rs 54. The market responded positively to news of OYO achieving profitability. Investors viewed this as a sign of financial discipline and operational efficiency, underscoring the company’s readiness for future growth.

May

The price dropped to Rs 43 in May, reflecting broader market uncertainties. Despite this, analysts noted that OYO’s asset-light and revenue-sharing model continued to align its growth objectives with those of its partners, ensuring resilience amid external pressures.

June

June showed the lowest price in the year with Rs 36, a decline that could raise questions about valuation. However, market experts attributed this to temporary external affairs instead of company-specific issues. The strong operational performance as well as profitability kept it on the radar for all long-term investors.

July

The share price rebounded to Rs 45 in July, driven by renewed investor interest and positive updates on OYO’s upcoming IPO. This recovery highlighted the market’s recognition of OYO’s ability to adapt and grow, reinforcing confidence in its business model.

August

In August, the price dipped slightly to Rs 41, reflecting minor fluctuations. However, the company’s continuous innovation, coupled with its acquisitions in Europe and North America, reassured investors of its long-term growth potential.

September

September brought an uptick to Rs 49, as OYO announced significant milestones in its IPO readiness. The market responded positively to the company’s focus on diversifying its offerings and achieving profitability, signaling a promising outlook.

October

October could see a surge in price to Rs 59, which was bolstered by reports of strong operational performance. Investors were encouraged by OYO’s consistent growth of revenues, driven by its global presence and franchise model. It was positioned as a leader in the sector of hospitality.

November

In November, the price consolidated at Rs 55, reflecting steady investor confidence. The company’s continued efforts to optimize its operations and expand its global footprint played a significant role in maintaining market stability.

December

OYO shares ended the year at Rs 50, marking a full-circle moment after a year of fluctuations. The company’s resilience amid market challenges and its focus on long-term growth provided a solid foundation for its IPO plans in 2025.

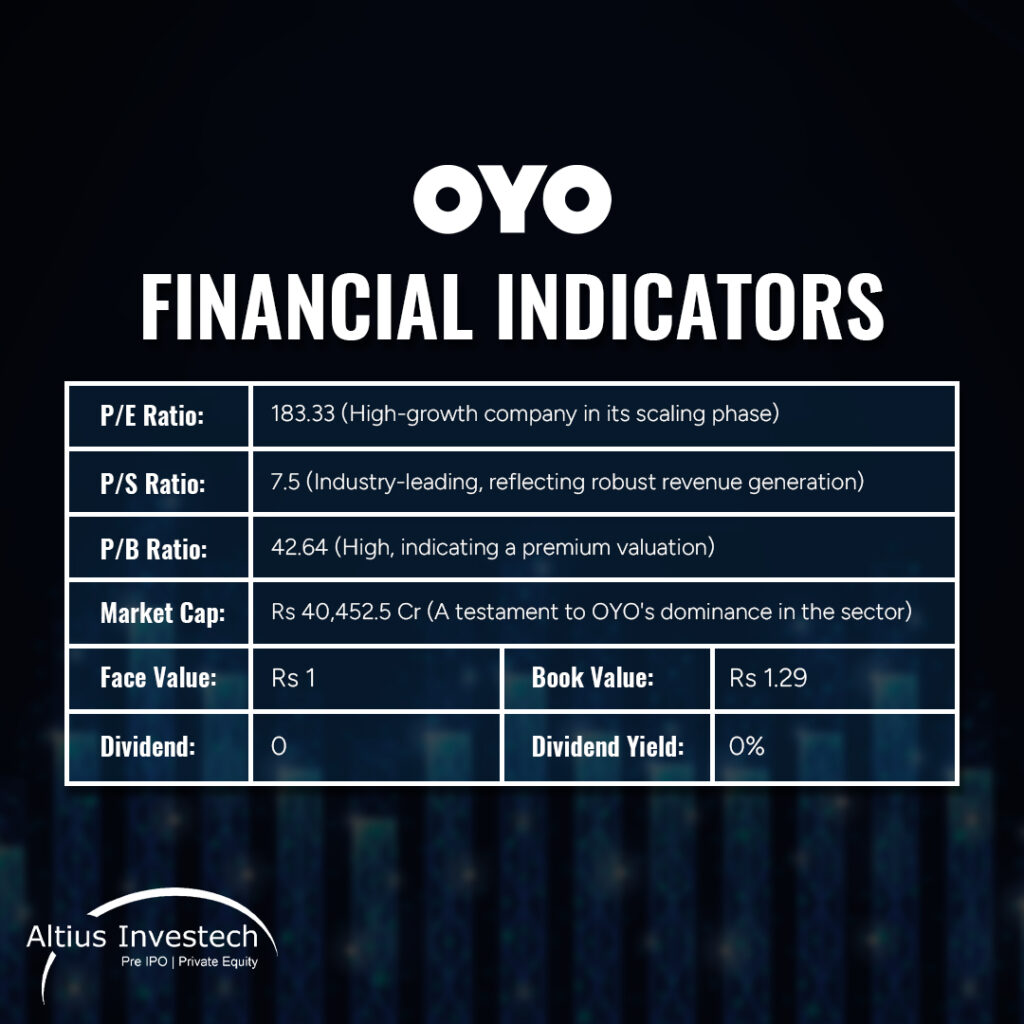

Financial Indicators

- P/E Ratio: 183.33 (High-growth company in its scaling phase)

- P/S Ratio: 7.5 (Industry-leading, reflecting robust revenue generation)

- P/B Ratio: 42.64 (High, indicating a premium valuation)

- Market Cap: Rs 40,452.5 Cr (A testament to OYO’s dominance in the sector)

- Face Value: Rs 1 | Book Value: Rs 1.29

- Dividend: 0 | Dividend Yield: 0%

Industry Perspective

With an industry P/E of 0, OYO’s metrics emphasize its unique standing in the hospitality domain. The company’s asset-light, technology-driven model differentiates it from traditional hotel chains, justifying its premium valuations.

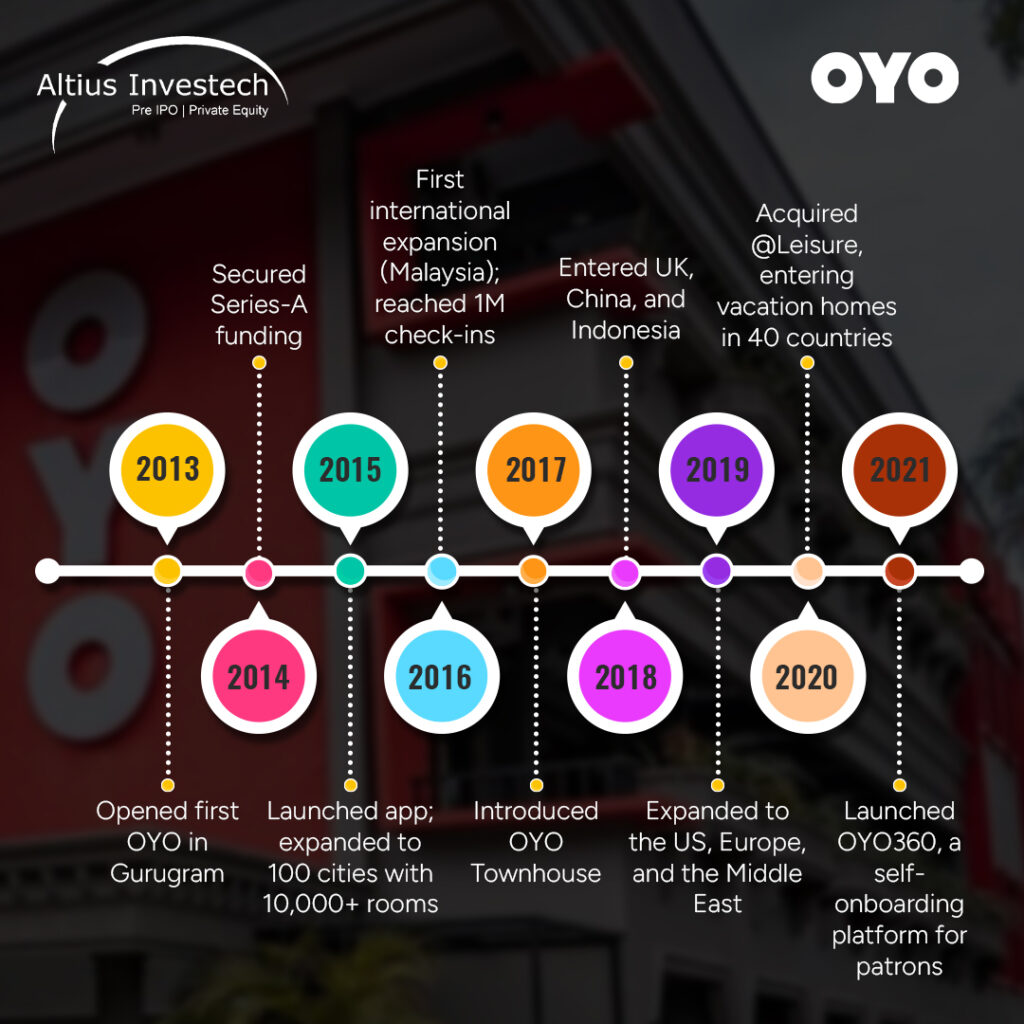

Business Evolution- The Transformation of OYO

1) Leasing To Franchising

OYO shifted from leasing rooms to a franchise model, enabling property owners to manage their hotels while adhering to OYO’s quality standards. This strategic pivot reduced operational overhead and amplified scalability.

2) Revenue Sharing Model

Under its revenue-sharing model, OYO earns 20-35% of booking revenues. This approach aligns its interests with property owners, fostering a mutually beneficial relationship and enhancing revenue streams.

3) Global Acquisitions

Acquisitions like Motel 6 in North America and checkmyguest in Europe show OYO’s commitment to global diversification. It bolsters its footprint in budget hotels, vacation homes, and short-term rentals.

What Makes OYO Shares Gain Attention Now?

1) Investor Confidence and Valuation Reset

In 2022, OYO’s shares traded at Rs 150, however, a correction brought them to Rs 33 by mid-2024. Irrespective of this dip, the company’s turnaround and profitability have regained investor interest. The recent acquisition of 1.89 crore shares by Nuvama at Rs 53 per share, valuing the company at Rs 38,500 Cr, shows its potential further.

2) IPO on the Horizon

With plans to go public in September 2025, OYO presents a compelling pre-IPO investment opportunity. The correction in its unlisted share price offers a chance for early movers to benefit from its future growth trajectory.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

An innovative startup to a global leader- how great it has been for OYO as it reflected its resilience and adaptability. With its unlisted shares currently trading at competitive prices and a promising IPO on the horizon, OYO offers a unique opportunity for investors to be part of a transformative growth story. You could be a seasoned investor or a new entrant, OYO’s journey is one to watch closely.

Invest in the Future, Invest in OYO.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain