Blog Highlights

- Early Life and Education

- Professional Journey

- Net Worth of Anil Singhvi

- Financial Portfolio

- Shares Held by Anil Singhvi

Anil Singhvi’s Portfolio: Top Investments and Insights for 2025

Anil Singhvi, a distinguished figure in India’s financial journalism landscape, has significantly influenced investors with his insightful market analyses and stock recommendations. As the Managing Editor of Zee Business, his expertise has guided many in making informed investment decisions.

Early Life and Education

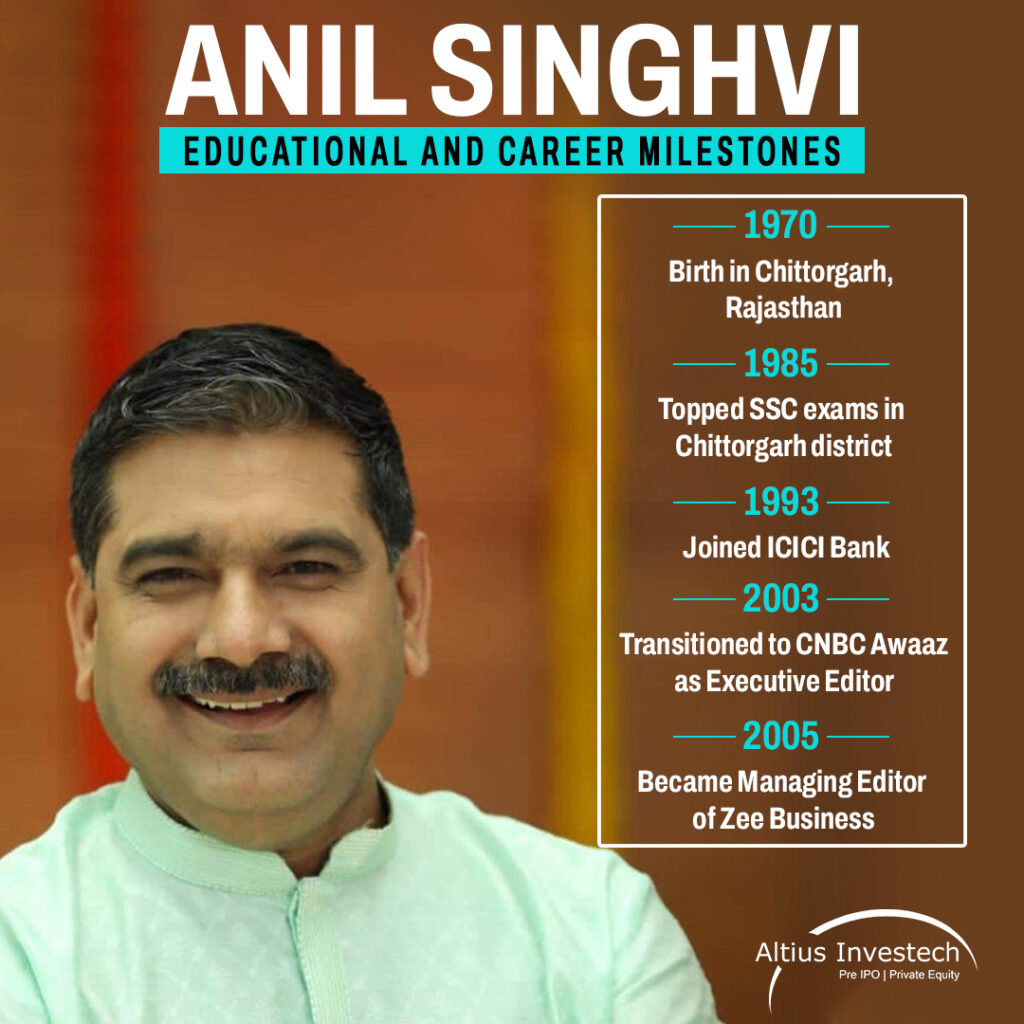

Born on June 2, 1970, in Chittorgarh, Rajasthan, Anil Singhvi’s early life was rooted in a region known for its rich history and culture. He completed his schooling at Ashram Matriculation Higher Secondary School in Chennai, where he demonstrated academic excellence by securing the top position in the SSC Exams in Chittorgarh district in 1985. Pursuing his passion for commerce, he earned a Bachelor of Commerce degree from MLS University in Udaipur. Furthering his education, Singhvi became a qualified chartered accountant, which equipped him with a robust foundation for his future endeavors in financial journalism.

Professional Journey

Singhvi’s career commenced in 1993 with the ICICI Bank, where he honed his skills in the financial sector. In 2003, he transitioned to journalism, joining CNBC Awaaz as an Executive Editor. His tenure at CNBC Awaaz lasted until 2008 when he became renowned for his stock market strategies and insightful analyses.

In 2005, Singhvi took on the role of Managing Editor at Zee Business, a Hindi-language business news channel. Under his leadership, Zee Business has become India’s leading source of financial news and market insights.

Net Worth of Anil Singhvi

As of December 31, 2024, Anil Singhvi, a prominent figure in the financial world, publicly holds 88 stocks with a cumulative net worth exceeding Rs 4,661 Crores. These holdings reflect his sharp investment acumen and strategic insights into the equity markets.

The shareholding data is based on filings with stock exchanges, showcasing Singhvi’s diversified portfolio across various sectors. However, it is worth noting that information from the latest quarter may be incomplete, as not all companies have reported their shareholding details yet.

Discover the net worth of other influential figures in India.

- Aman Gupta

- Ashneer Grover

- Radhika Gupta

- Vineeta Singh

- Ritesh Agarwal

- Virat Kohli

- Ms Dhoni

- Rakesh Jhunjhunwala

Financial Portfolio & Stock Recommendations

While Anil Singhvi’s personal investment portfolio is not publicly disclosed, his stock recommendations have garnered significant attention. In August 2022, during the “Azadi Ka Amrit Mahotsav” celebrating India’s 75th year of independence, Singhvi curated a list of 25 stocks for long-term investment, envisioning substantial returns by the time India reaches its centenary of independence. These stocks, spanning sectors such as Financials, Consumer Goods, Auto, and Pharma, were selected based on strong fundamentals and attractive valuations.

Here are Some Notable Stocks from Singhvi’s List:-

| Company | Description |

|---|---|

| SBI Life Insurance | A leading life insurance company in India, known for its comprehensive range of insurance products and strong market presence. |

| HDFC Asset Management Company (AMC) | One of the top asset management companies in India, offering a variety of mutual fund schemes catering to different investor needs. |

| Central Depository Services Limited (CDSL) | A key player in the Indian securities market, providing depository services to investors and facilitating the holding and transfer of securities in electronic form. |

| Bajaj Finserv | A diversified financial services company with interests in lending, insurance, and wealth management, known for its robust business model and growth prospects. |

| Kotak Mahindra Bank | A prominent private sector bank in India, offering a wide range of banking and financial services, recognized for its strong financial performance and customer-centric approach. |

| ITC Limited | A conglomerate with diversified business interests, including FMCG, hotels, paperboards, and agribusiness, known for its strong brand portfolio and market leadership. |

| Asian Paints | India’s leading paint company, offering a wide range of painting solutions, recognized for its innovation and market dominance. |

| Titan Company | A consumer goods company known for its watches, jewelry, and eyewear, with strong brand recognition and a growing market share. |

| Tata Motors | A leading automobile manufacturer in India, producing a range of vehicles from passenger cars to commercial vehicles, with a significant global presence. |

| Mahindra & Mahindra | A major player in the automotive and farm equipment sectors, known for its innovative products and strong market position. |

Shares Held by Anil Singhvi – A Detailed Overview

Anil Singhvi – Notable Stocks and Prices

1) Aarti Drugs Ltd.

Anil Singhvi holds 4,581,195 shares in Aarti Drugs Ltd., a key player in the pharmaceutical sector. As of the latest price of Rs 457.65 per share, the value of this holding stands at an impressive Rs 209.7 crore. His stake was recorded at 5.03% in September 2024, highlighting his strategic investment in healthcare and life sciences.

2) Allied Digital Services Ltd.

In Allied Digital Services Ltd., Singhvi has a relatively smaller holding of 500 shares, valued at Rs 242.10 per share, amounting to approximately Rs 1.2 lakh. This reflects his interest in the IT services and digital transformation space, which is gaining momentum globally.

3) Almondz Global Securities Ltd.

Singhvi’s portfolio includes 2,800,000 shares of Almondz Global Securities Ltd., which accounted for 1.66% of the company’s equity in September 2024. At the current price of Rs 32.82 per share, this holding is worth Rs 9.2 crore, emphasizing his belief in the growth potential of the financial services sector.

4) Amarjothi Spinning Mills Ltd.

With 423,000 shares in Amarjothi Spinning Mills Ltd., Singhvi has a stake valued at Rs 9.1 crore, based on the current price of Rs 214.30 per share. His recorded holding of 6.27% in September 2024 underscores his confidence in this textile manufacturing firm.

5) Apollo Hospitals Enterprise Ltd.

Singhvi owns 20 shares of Apollo Hospitals Enterprise Ltd., valued at Rs 7,435.90 per share. While the total value is Rs 1.5 lakh, this minor holding suggests a diversified strategy that includes high-performing healthcare stocks.

6) Archies Ltd.

In Archies Ltd., Singhvi holds 7,061,607 shares, valued at Rs 25.27 per share, amounting to Rs 17.8 crore. With a substantial 20.90% stake in September 2024, this demonstrates a strong interest in the stationery and gifting industry.

7) ARSS Infrastructure Projects Ltd.

Holding 339,821 shares in ARSS Infrastructure Projects Ltd., Singhvi’s stake is valued at Rs 89.4 lakh, based on a current price of Rs 26.30 per share. His 1.49% stake as of September 2024 points to his interest in infrastructure and construction sectors.

8) Asahi India Glass Ltd.

Singhvi owns 160,000 shares of Asahi India Glass Ltd., a leader in automotive and architectural glass manufacturing. With a current price of Rs 756.60 per share, his stake is worth Rs 12.1 crore. He held 0.07% in September 2024, indicating a focus on the manufacturing industry.

9) Asian Granito India Ltd.

Anil Singhvi’s portfolio includes 438,092 shares of Asian Granito India Ltd., a major tile and ceramics company. At Rs 70.48 per share, his holding is valued at Rs 3.1 crore, reflecting a stake of 0.34% as of September 2024.

10) Dalmia Bharat Sugar and Industries Ltd.

In the sugar and allied industries, Singhvi has 4,158,000 shares of Dalmia Bharat Sugar and Industries Ltd., valued at Rs 156.8 crore, with a current price of Rs 377 per share. His 5.14% stake as of September 2024 signifies confidence in India’s agriculture and sugar sectors.

This list demonstrates Anil Singhvi’s diversified investment approach, spanning sectors like pharmaceuticals, IT, textiles, healthcare, and infrastructure.

Insights from Singhvi’s Recommendations

Singhvi’s selection underscores several key investment principles:

- Diversification – By including stocks from various sectors, Singhvi emphasizes the importance of spreading investments across different industries to mitigate risks.

- Long-Term Perspective – His 25-year investment horizon highlights the potential benefits of patience and long-term commitment to wealth creation.

- Fundamental Analysis – The focus on companies with strong fundamentals suggests a preference for businesses with solid financial health and growth prospects.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Anil’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Anil Singhvi’s journey from a commerce student in Rajasthan to a leading financial journalist and market analyst serves as an inspiration to many. His stock recommendations and investment philosophies offer valuable insights for both novice and seasoned investors. By focusing on strong fundamentals, diversification, and a long-term perspective, Singhvi provides a roadmap for sustainable wealth creation in the dynamic world of stock markets.

For those seeking to emulate his success, Singhvi’s insights offer a valuable blueprint for building sustainable wealth and achieving financial stability.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain