Blog Highlights

- Early Life and Education

- His Career

- Net Worth of Amit Shah

- Sources of Income

- Financial Portfolio and Shareholdings

- Key Stocks in His Portfolio

A Look Inside Amit Shah’s Portfolio and Investment Strategy

Shah’s personal life, investments, and financial strategies reveal a meticulous and pragmatic individual. From his early beginnings to his impressive equity portfolio, Shah’s journey has been one of grit, strategy, and vision.

Early Life and Education

Amit Shah was born on 22nd October 1964, in Mumbai. He hailed from a Gujarati Hindu family of the Bania caste.

His father, Anil Chandra Shah dealt with PVC pipes. Shah’s upbringing instilled in him a sense of financial prudence and business, traits which later manifested in his investment decisions and political career. Shah completed his schooling in Mehsana, Gujarat, and pursued a degree in Biochemistry from CU Shah College in Ahmedabad. His academic background is rooted in science. His inclination towards leadership and organizational work has also become evident.

Career- From a RSS Volunteer to a BJP Strategist

Shah’s political career began in the 1980s when he joined the Rashtriya Swayamsevak Sangh (RSS). It was during this time that he formed a close association with Narendra Modi, a partnership that would later redefine Indian politics.

Over the years, Shah climbed the ranks of the Bharatiya Janata Party, becoming known for his strategic brilliance. His management of BJP’s campaigns in states like Uttar Pradesh and Gujarat, and his role in the party’s historic victories in the 2014 and 2019 general elections, solidified his reputation as a political mastermind.

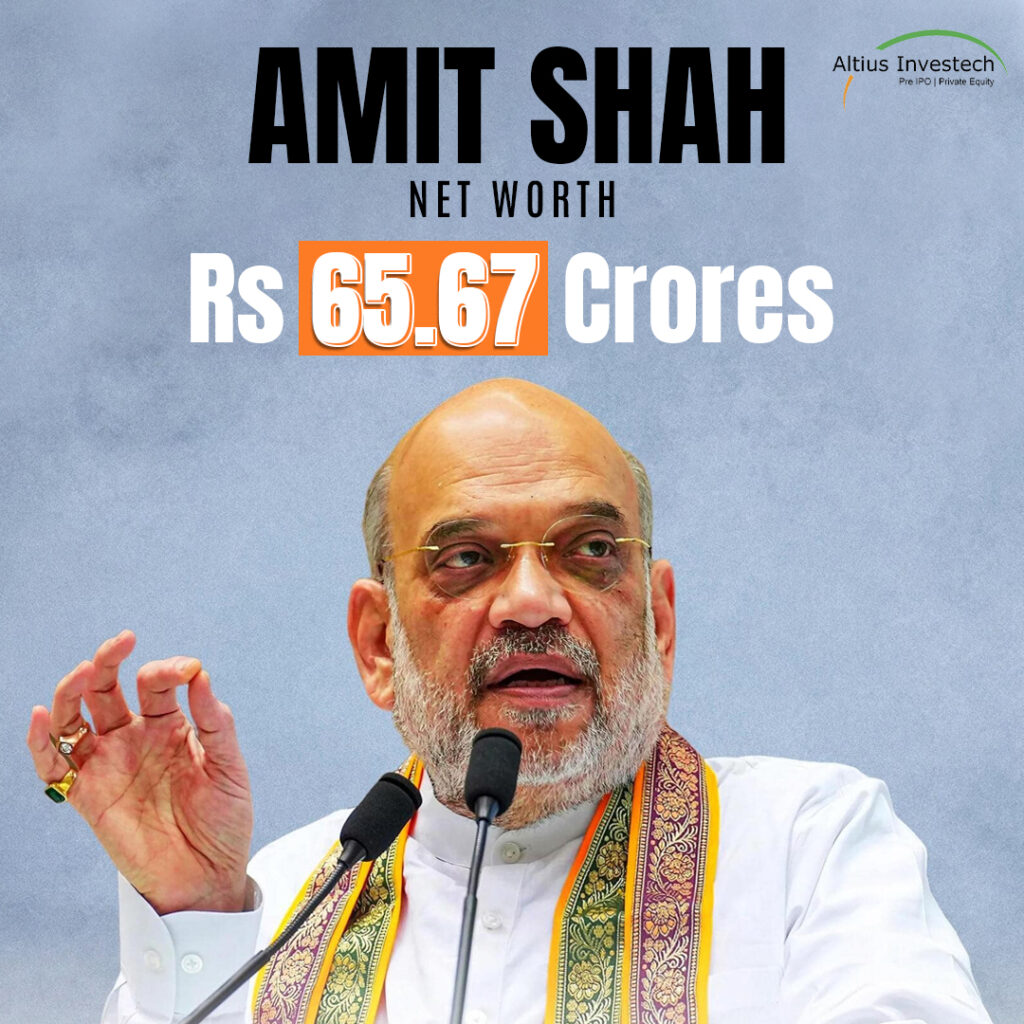

Net Worth of Amit Shah

As of April 2024, Union Home Minister Amit Shah and his wife, Sonal Shah, declared combined assets totaling Rs 65.67 crore, marking a significant increase from Rs 30.49 crore reported in 2019.

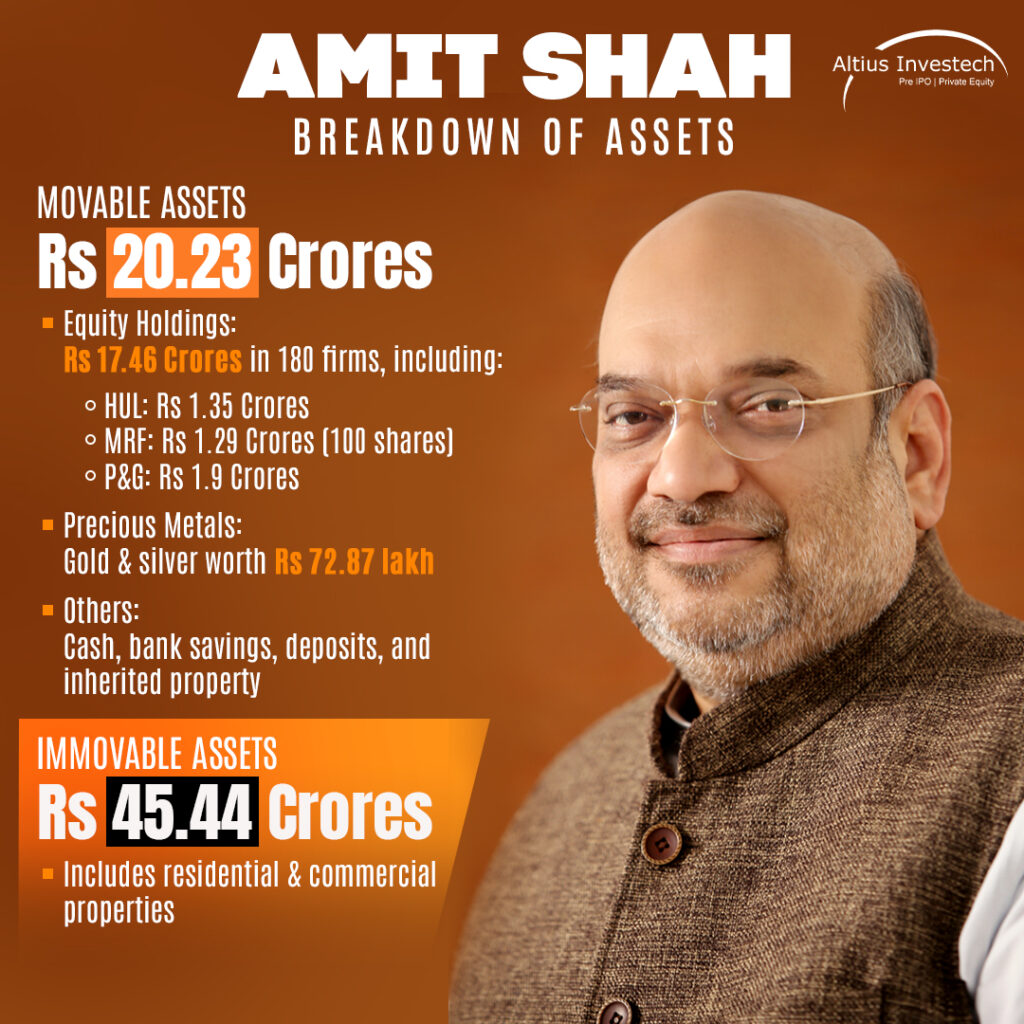

During the 2019 Lok Sabha elections, Amit Shah revealed his impressive financial portfolio, showcasing assets worth over Rs 20.23 crores. His wealth is primarily built through a diverse array of investments, including Rs 17.46 crores in equity shares and Rs 72.87 lakhs in precious metals. Shah also boasts significant immovable properties, valued at Rs 16.31 crores, which encompass both agricultural and residential land.

His income streams, from rental income, agricultural earnings, dividends, and his parliamentary salary, further bolster his financial standing. Adding to the family wealth, his wife Sonal Shah holds assets worth Rs 22 lakhs, which includes real estate valued at over Rs 6.55 crores. This substantial disclosure paints a picture of Shah’s considerable financial success and business acumen.

Discover the net worth of other influential figures in India.

- Aman Gupta

- Ashneer Grover

- Radhika Gupta

- Vineeta Singh

- Ritesh Agarwal

- Virat Kohli

- Ms Dhoni

- Rakesh Jhunjhunwala

Amit Shah’s Sources of Income

The total value of Amit Shah’s assets happens to be Rs 20.23 Crores. Assets can include bank savings, gold, silver, cash, and inherited properties. However, Shah owns shares worth over Rs 17.46 Crores and precious metals valued at over Rs 72.87 lakhs. Sonal Shah, his wife, has possession of assets worth over rs 22 lakhs among them.

Shah’s Financial Affidavit Reveals a Diverse Income Stream:-

- Rental Income – Shah owns multiple properties generating rental income.

- Agricultural Earnings – Shah leverages his family’s agricultural land, where he earns substantially through farming activities.

- Dividends from Shares – This includes significant equity holdings and dividends.

- Parliamentary Salary – As a recognized minister and member of the parliament (MP), Shah draws a hefty income from his official roles.

Amit Shah’s Financial Portfolio and Shareholdings

Irrespective of Shah’s political acumen taking center stage, his financial strategies are equally impressive. As per the affidavit submitted to the Election Commission during the Lok Sabha elections in 2019, Shah had disclosed investments in over 180 companies, with his wife, holding shares in more than 80 companies.

The combined equity portfolio of the couple has been estimated to be worth over Rs 37.46 Crores. It only shows a strategically curated, well-diversified investment plan.

1) Tarmat Ltd.

Amit Atmaram Shah holds a significant position in Tarmat Ltd., owning 639,427 shares at a current price of Rs 83 per share. This represents a 3% stake in the company, with a total holding value of approximately Rs 5.3 Crores. The portfolio shows no change in the holding percentage from the previous quarter, reflecting a stable investment outlook.

2) Richa Info Systems Ltd.

Amit Bipinbhai Shah’s recent entry into Richa Info Systems Ltd. is a new addition to the portfolio. The holding includes 10 shares at a current price of Rs 82.90 per share, with a minimal overall holding value of Rs 829. While the stake is negligible, it might indicate a potential interest in exploring new opportunities.

3) Rekvina Laboratories Ltd.

Amit Mukesh Shah holds 827,883 shares in Rekvina Laboratories Ltd., making up 13.73% of the company’s total equity. At a current price of Rs 4.50 per share, this stake is valued at approximately Rs 37.3 lakh. The static position shows confidence in the holding.

4) 360 One Wam Ltd.

One of the most substantial holdings in the portfolio, Amit Nitin Shah owns 4,059,330 shares in 360 One Wam Ltd., valued at a current price of Rs 1,216 per share. This represents a 1.11% stake in the company, amounting to a holding value of Rs 493.6 crore. Although there is a slight reduction of 0.15% from the previous quarter, this remains a cornerstone investment.

5) KK Shah Hospitals Ltd.

Amit Shah holds a commanding 15.19% stake in KK Shah Hospitals Ltd., with 1,034,451 shares valued at Rs 47 per share. The total holding is worth Rs 4.9 crore, and the stake is a new addition to the portfolio, signaling a strategic interest in the healthcare sector.

6) Zodiac JRD MKJ Ltd.

Amit Surendra Shah owns 30,000 shares of Zodiac JRD MKJ Ltd., representing a 0.58% stake in the company. At a current price of Rs 86.05 per share, this investment amounts to approximately Rs 25.8 lakh, with no changes reported from the previous quarter.

7) KBS India Ltd.

Namita Tushar Shah holds 11,200 shares in KBS India Ltd., representing a marginal 0.01% stake. With a current price of Rs 9.67 per share, the total value of the investment is Rs 1.1 lakh. The holding shows stability, with no change from the previous quarter.

8) Virgo Polymers (India) Ltd.

Shah Amit Ugamraj holds 1,000 shares in Virgo Polymers (India) Ltd., making up 0.03% of the company. Although the price data is unavailable, the stake represents a minor yet steady position in the portfolio.

9) Yarn Syndicate Ltd.

Vismay Amitkumar Shah owns 1,017,575 shares in Yarn Syndicate Ltd., holding a 4.68% stake. At a current price of Rs 30.37 per share, the total value is approximately Rs 3.1 crore. There is a 1.38% reduction in the stake from the previous quarter, indicating a possible recalibration of the position.

Key Stocks in Amit Shah’s Portfolio

Shah’s investments lean heavily toward blue-chip companies and sectors with consistent growth. Here are some of the most notable stocks in his portfolio:

- Hindustan Unilever Limited (HUL) – HUL is one of India’s most trusted and high-performing companies, making it a safe bet for consistent returns.

- MRF Limited – MRF is renowned for its stability and growth in the automotive industry, aligning with Shah’s preference for reliable investments.

- Colgate-Palmolive (India) Limited – This stock highlights Shah’s focus on consumer-driven industries with steady demand.

- Procter & Gamble Hygiene and Health Care – Healthcare is a sector known for resilience, and this investment reflects Shah’s long-term outlook.

- ABB India Limited – This aligns with Shah’s diversification strategy, investing in industries driving technological innovation.

Amit’s Properties & Investments

Amit Shah possesses more than Rs 16.31 Crores in immovable property, which includes agricultural land, semi-cultivated land, plots, and Ashram Road, Thaltej, Gandhinagar, and Daskroi. Sonal Shah owns real estate, including houses in different places, with a combined value of over Rs 6.55 Crores.

Investment Philosophy

The analysis of Amit Shah’s portfolio reveals several key principles of successful investing:-

- Diversification is Key – Shah’s investments span multiple sectors, including FMCG, healthcare, manufacturing, and technology. This reduces risk while ensuring steady returns.

- Preference for Blue-Chip Companies – Shah has also prioritized high-performing, well-established companies with a track record of stability. The approach reduces volatility and maximizes long-term growth.

- Focus on Consistent Returns – Investing in dividend-yielding stocks and high-demand sectors has made Shah ensure a steady flow of passive income.

- Multiple Streams of Income – Shah has diversified his earnings through agriculture and real estate, allowing financial stability even during market fluctuations

- Long-term Perspective – The portfolio is a reflection of patience and a willingness to hold investments for extended periods. It will allow them to mature and deliver compounded returns.

Lessons from His Investment Journey

1) Discipline and Patience

Shah’s long-term approach to investments demonstrates the value of discipline and patience. By holding on to investments for extended periods, he allows them to mature and yield compounded returns, a strategy that minimizes short-term market fluctuations and focuses on sustainable wealth growth.

2) Sectoral Awareness

Shah’s investments in high-growth sectors showcase his keen awareness of market trends and industry potential. By targeting resilient and consistently performing sectors, he mitigates risks while positioning himself for steady returns, even during economic uncertainties.

3) Diversification for Stability

Diversification is a cornerstone of Shah’s portfolio, spreading investments across multiple sectors including manufacturing, technology, and real estate. This approach not only reduces exposure to sector-specific risks but also ensures a balanced and steady growth trajectory over time.

4) Leveraging Resources

Beyond equities, Shah demonstrates the importance of utilizing other income-generating assets. His agricultural land and rental properties provide a stable and diversified income stream, complementing his investment portfolio and ensuring financial stability regardless of market conditions.

Philanthropy & Social Impact

Amit Shah’s financial and political strategies remain widely discussed. His contributions to social welfare deserve recognition. Shah has been instrumental in supporting initiatives for healthcare and education, especially in rural areas. His investments in community welfare align with the broader vision for India’s development.

His investments and support for projects like rural hospitals and medical camps address critical gaps in accessibility and infrastructure. Similarly, his emphasis on education aims to empower the next generation, ensuring that children in such communities receive quality learning opportunities.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Amit’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Amit Shah’s portfolio complements his commitment, unwavering focus, and strategic thinking. It offers valuable lessons in long-term planning, diversification, and risk management. Whether you are an investor or someone seeking inspiration, Shah’s approach underscores the significance of aligning your decisions- be they in politics, finance, or life, with a clear purpose and vision. By examining Shah’s financial choices, we can be reminded of how true success lies in staying disciplined, thinking ahead, and investing in principles that stand the test of time.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain