Blog Highlights

- Who is Dolly Khanna?

- Net Worth of Dolly Khanna

- Dolly Khanna- Net Worth Growth Over the Years

- Investments & Top Holdings in Portfolio

- Investments in Unlisted Shares

- Key Investment Strategies

An Insightful Look into Dolly Khanna Portfolio and Stock Choices

.Dolly Khanna, a prominent Indian stock market investor, is known for her strategic investments, primarily in small and mid-cap companies. Her portfolio, managed by her husband Rajiv Khanna, reflects a focus on sectors like manufacturing, chemicals, textiles, sugar, and auto ancillaries.

As of September 2024, her portfolio comprises 19 stocks valued at over Rs 509 Crores. Notable holdings include Zuari Industries, Nile Ltd., and Radico Khaitan-CHANGE, showcasing her preference for traditional industries with high growth potential.

Dolly Khanna is often called the “Queen of Multibaggers” for her consistent, continuous success in choosing stocks that can multiply significantly with time. Some examples of such stocks are Nitin Spinners, Deepak Spinners, Monte Carlo Fashions and Prakash Pipes.

Who is Dolly Khanna?

Dolly Khanna is a renowned Chennai-based investor, known for her remarkable stock-picking prowess. Often referred to as the “Quiet Investor,” she maintains a low profile, while her portfolio reflects meticulous research and an ability to identify hidden gems in sectors like chemicals, textiles, and FMCG. Managed by her husband, Rajiv Khanna, an IIT-Madras graduate and entrepreneur, their investment strategy focuses on businesses with strong fundamentals and long-term growth potential. Together, they have built a portfolio that exemplifies patience, thorough analysis, and foresight.

Net Worth of Dolly Khanna in 2024

In order to understand fluctuations of net worth for owning a diverse portfolio, we must dwell into market performances. Investor Dolly Khanna has signaled a potential exit from an underperforming stock in her portfolio, after holding it for one quarter. It is the stock named Ujjivan Small Finance Bank, where Khanna picked up a stake in the June 2024 quarter, but her name was missing from the key shareholder’s list for this quarter.

Her net worth as of June 2024 was Rs 580 Crores, with her investments spanning multiple sectors like fertilizers, chemicals, textiles, sugar, refineries, hotels, and so on.

As per the latest filing of the corporate shareholdings, Dolly Khanna now holds 19 stocks with an updated net worth of over Rs 468.4 Crores. However, this is subject to change as per market situations and reporting of shareholding data by the various companies.

But there are other avenues of income which makes her actual net worth to be reflected as Rs 509 Crores as per the latest data of October 2024.

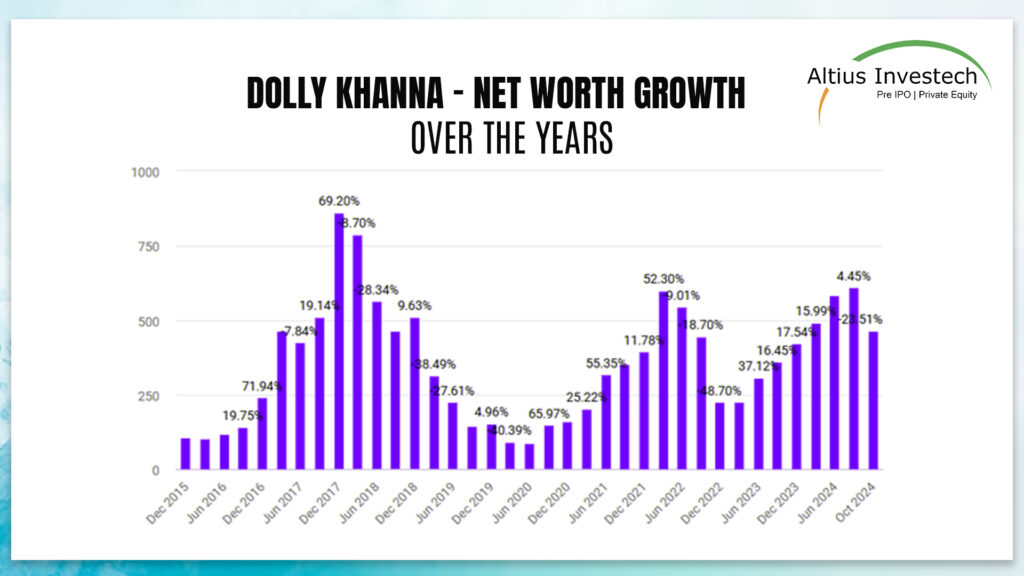

Dolly Khanna’s Net Worth Growth Over the Years

Between June and September 2024, Dolly Khanna’s net worth experienced a significant drop, reaching Rs 468 Crores, reflecting a -23.5% decline. However, with her diversified portfolio and income sources, her estimated net worth rebounded to approximately Rs 509 Crores by October 2024. This suggests a resilient recovery in her financial standing, indicating the positive impact of her other investments beyond the fluctuations seen in her core holdings.

Dolly Khanna- Portfolio Sectors

It is an exhibit of the diverse allocation across various sectors. Here is a breakdown-

- Chemicals- Her portfolio includes chemical companies, involving specialty chemicals, carbon products, and rubber chemicals.

- Textiles- Companies involving fabric manufacturing, yarn production, and clothing brands.

- Plastics and Packaging- Some of her best picks include companies operating in the plastic industry, including manufacturers of plastic products and packaging materials.

- Auto-Ancillaries- Auto ancillary companies, including manufacturing components and elements for automobiles.

- Aquaculture and Animal Feeds- She has invested in companies in the aquaculture industry, especially those engaged in the production of shrimp and fish feeds.

Dolly Khanna Latest Portfolio & Investments

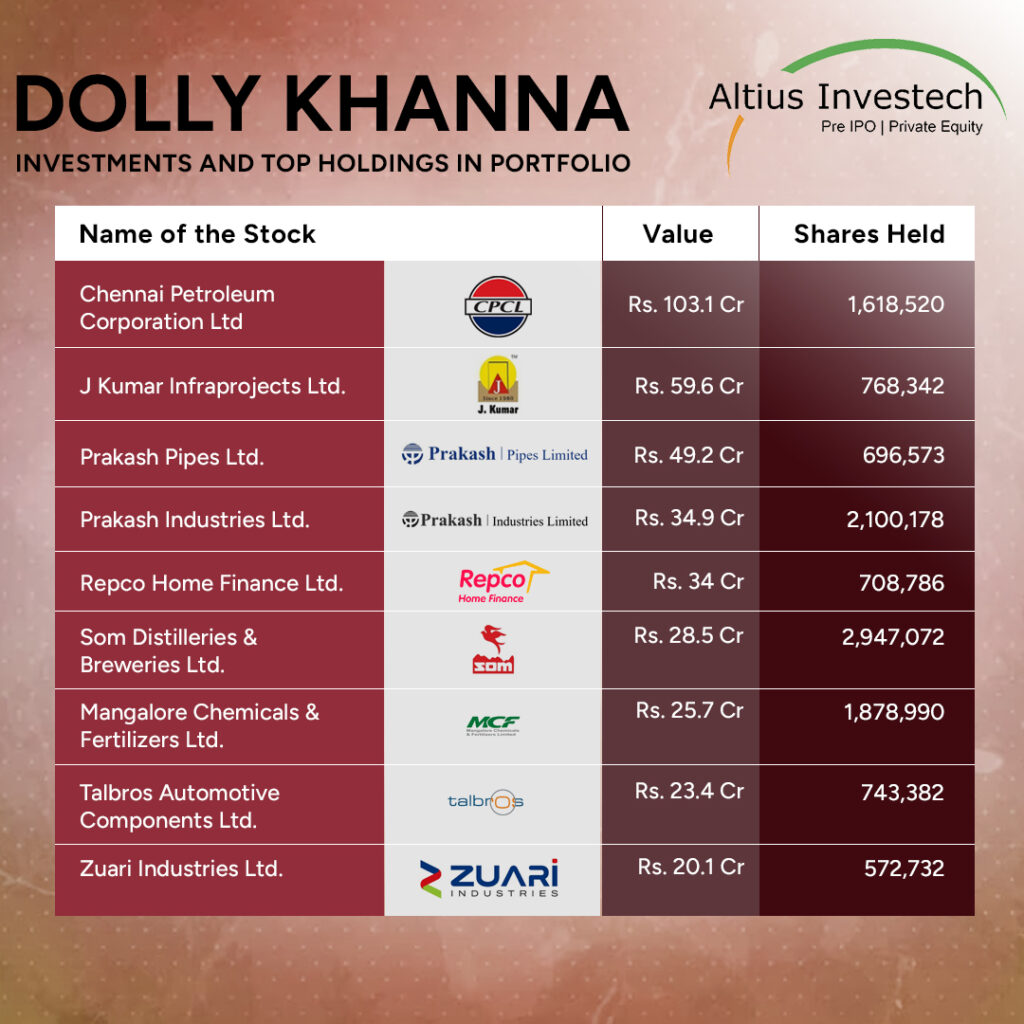

Dolly Khanna, a well-regarded investor in India’s stock market, has strategically curated a portfolio of companies spanning critical industries from infrastructure to consumer goods. Known for her sharp eye on emerging growth sectors, Khanna’s top holdings reveal a focus on high-potential companies like Chennai Petroleum Corporation Ltd. and J Kumar Infraprojects Ltd., both poised to benefit from infrastructure expansion and energy demand. Her diverse investments showcase a balanced approach, capturing growth in sectors such as housing finance, industrial manufacturing, agriculture, and automotive components, solidifying her status as a leading retail investor.

She has bagged intriguing stocks that were included in her top holdings.

| Company | Description | Shares Held | Valuation (in Crores) |

|---|---|---|---|

| Chennai Petroleum Corporation Ltd | Indian state-owned oil and gas company, involved in refining and marketing petroleum products. | 1,618,520 | Rs 103.1 |

| J Kumar Infraprojects Ltd | Infrastructure company known for metro rail, flyover, and highway projects, capitalizing on India’s development. | 768,342 | Rs 59.6 |

| Prakash Pipes Ltd | Manufacturer of PVC pipes; part of Prakash Industries, a major steel producer diversifying into power generation. | 906,052 | Rs 49.2 |

| Prakash Industries Ltd | Leading steel producer with diversification into power generation. | 2,100,178 | Rs 34.9 |

| Repco Home Finance Ltd | Housing finance company focused on affordable loans for the retail housing sector. | 708,786 | Rs 34 |

| Som Distilleries & Breweries Ltd | Producer of beer and spirits, positioned to benefit from growing demand in the alcoholic beverages industry. | 2,823,939 | Rs 28.5 |

| Mangalore Chemicals & Fertilizers Ltd | Key producer of fertilizers and chemicals, supporting agricultural productivity in India. | 1,878,990 | Rs 25.7 |

| Talbros Automotive Components Ltd | Manufacturer of gaskets and automotive components, benefiting from India’s automotive sector growth. | 743,382 | Rs 23.1 |

| Zuari Industries Ltd | Operates in fertilizers and industrial chemicals, serving agricultural needs with a focus on sustainable farming inputs. | 577,732 | Rs 19.4 |

Investments in Unlisted Shares

While Dolly Khanna’s portfolio is largely focused on listed stocks, some of her well-known investments in the June 2024 quarter included small and mid-cap listed stocks like Super Sales India, Selan Exploration Tech, Emkay Global Financial Services, Nile Ltd, and Tinna Rubber and Infrastructure. However, there is limited public information regarding her direct involvement in unlisted companies, as her primary investment strategy emphasizes publicly traded equities.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Dolly’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Key Investment Strategies of Dolly Khanna

- Growth-Oriented Mid-Cap Stocks – Dolly focuses on recognizing early-stage companies with growth potential. Most of her investments are in mid and small-cap stocks which have the chance of multiplying in value with time. For instance, it can be reflected with her placing significant bets in sectors such as aquaculture, plastics, and auto ancillaries.

- Sectoral Diversity – Khanna’s well-diversified portfolio shows how she leans toward traditional sectors like chemicals and manufacturing, including investments in emerging industries like consumer and packaging goods.

- Long-term Perspective – Khanna’s decisions demonstrate a long-term investment approach. She holds onto stocks through market fluctuations, making businesses grow and reaping large returns in the long run. Her patience is deemed pivotal to her success.

- Active Management of Portfolio – Irrespective of her long-term perspective, she actively manages her portfolio, while adjusting to holdings regularly based on market conditions and new opportunities. The flexibility allows the alignment of her decisions with market trends, and she can capitalize on potential multi-bagger opportunities.

- Extensive Research – All of her investments remain rooted in strong fundamental analyses. It ensures she chooses companies with promising prospects of growth.

Final Thoughts

Dolly Khanna’s portfolio is a testament to her keen eye for growth opportunities in India’s traditional sectors, combined with her patience and active portfolio management. Her focus on small-cap companies, backed by thorough research, has enabled her to achieve significant returns over the years.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain

FAQs

Ans:- Dolly Khanna is a renowned Indian investor known for her stock-picking skills, primarily in small-cap and mid-cap companies. Her investments are widely followed by retail investors.

Ans: – Dolly Khanna focuses on fundamentally strong companies, often in small-cap and mid-cap sectors, with growth potential and undervalued stocks. She holds investments for the long term.

Ans:- Yes, Dolly Khanna is her real name. However, her investments are managed by her husband, Rajiv Khanna, who has extensive experience in the stock market.

Ans:- Dolly Khanna invests in a variety of sectors, including manufacturing, chemicals, textiles, and agriculture, often targeting companies with strong financials and growth potential.

Ans:- Dolly Khanna’s portfolio can be tracked through regulatory filings like quarterly disclosures, which are available on financial websites and through stock exchanges.

Ans:- Dolly Khanna usually holds long-term but occasionally rebalances her portfolio, with changes seen in quarterly filings.

Ans:- Some of her well-known investments have included stocks like Rain Industries, Nocil Ltd., Thirumalai Chemicals, and Manappuram Finance, among others.

Ans:- Dolly Khanna and her husband Rajiv Khanna began investing in the stock market in 1996, initially in smaller stocks before gaining a reputation for successful mid-cap investments.

Ans:- No, Dolly Khanna does not share her investment strategies publicly. However, her portfolio is often analyzed by market analysts based on public disclosures.

Ans:- Her portfolio is popular because of her consistent track record of identifying high-growth stocks in lesser-known sectors. Retail investors often follow her investments to gain insights into potential growth stocks.