Blog Highlights

- Who is Ashish Kacholia?

- Education and Career

- Ashish’s Investments in Unlisted Shares

- Why Invest in Unlisted Shares?

- Ashish Kacholia’s Net Worth

- Ashish Kacholia Investment Strategy

A look inside Ashish Kacholia’s Latest Portfolio & Net Worth in 2024

The “Whiz-Kid” of stocks and the “Big Whale” by Media- Ashish Kacholia, has amassed colossal wealth with innumerable returns on his investments. His hawk-like attention to detail makes him recognize promising businesses with room for growth.

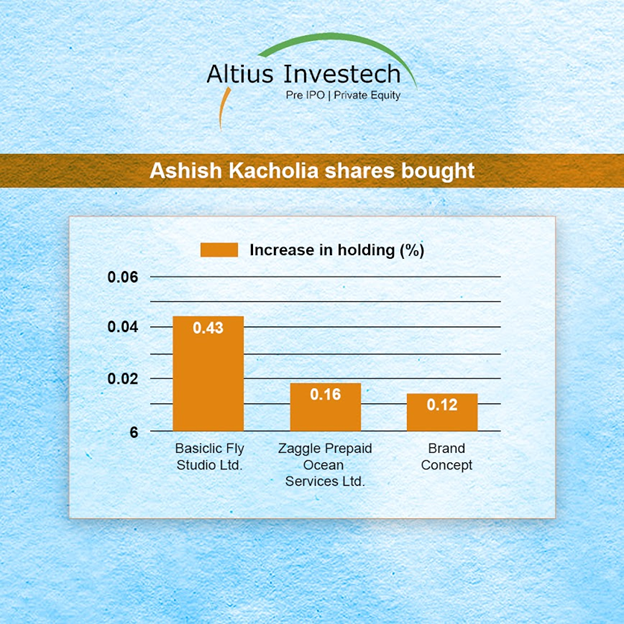

Kacholia invested in over 47 stocks, with a varied portfolio including education, infra-manufacturing, and hospitality stocks. He also invested in some unlisted shares which has diversified his portfolio, reducing his overall investment risks.

Who is Ashish Kacholia?

Ashish was born in Bombay in 1979. The story of his success inspires aspiring investors to testify to the power of perseverance with a keen eye for identifying promising avenues.

He is recognized to be a fitness enthusiast, music lover, and keen golfer. His primary interests in philanthropy include healthcare, livelihoods, education, sports, and wildlife.

Ashish Kacholia’s Education & Career

Ashish Kacholia has a Bachelor’s in Engineering from Mumbai University, along with a master’s in Management Studies from Jamnalal Bajaj Institute.

In 1993, he initiated his career at Prime Securities, followed by a brief stint at Edelweiss Capital Ltd. before the establishment of Lucky Securities Inc. He co-founded Hungama Digital with Rakesh Jhunjhunwala.

Ashish Kacholia founded Lucky Investment Managers in 2003 as a proprietary investor in the Indian equity market. It has evolved to be known as a leading brokerage organization in the Philippines, providing help and training to clients to manage portfolios. This highlights his determination to carve a path in the financial world.

Ashish Kacholia- Investments and Portfolio’s Top Holdings

Ashish used to make smaller stock investments initially. However, he learned to recognize companies with strong growth potential and started investing in them. Eventually, he increased investments in mid-cap, or small-cap companies for earning multi-bag returns.

Investors essentially consider him to be the expert in selecting multi-bagger stocks of small and mid-cap organizations. It is evident whenever Mr. Kacholia disinvests/invests in stocks, the market shows an impact through downward/upward trends. His investment decisions have a ripple effect influencing market trends.

As of the latest records from shareholding data of exchanges, he holds 40 stocks in his portfolio. The significant valuations of the stocks have induced great returns for him, some of them including NIIT Ltd and Acrysil Ltd, with a stake of 2.24% and 3.75%, respectively.

It is known that Ashish Kacholia’s latest buy is for Sanjivani Paranteral shares. It is a multi-bagger pharma stock that has risen with a 300% hike in the last year.

Ashish had faith to be bullish on the small-cap stock, making him hold 3.17% of the company’s shares.

Ashish Kacholia Latest Portfolio in 2024

Some of the prominent ones have been listed below in the determinants of the current price of shares- from highest to lowest :-

| Stock Name | Holding Value(In Rs) | Holding Percent % | Quantity Held |

| Gravita India Ltd | 193.8 Cr | 2.15% | 14,84,399 |

| Safari Industries Ltd | 187.7 Cr | 1.85% | 9,00,000 |

| Garware Hi-tech Films Ltd | 173.0 Cr | 3.42% | 7,94,000 |

| Ami Organic Ltd | 97.8 Cr | 2.05% | 7,54,974 |

| Aditya Vision Ltd | 92.0 Cr | 1.87% | 2,39,506 |

| Yasho Industries Ltd | 89.8 Cr | 4.17% | 4,75,394 |

| Carysil Ltd | 85.7 Cr | 3.73% | 10,00,000 |

| Ador Welding Ltd | 78.3 Cr | 4.17% | 5,66,600 |

| Beta Drugs Ltd | 68.0 Cr | 5.78% | 5,56,000 |

| Agarwal Industrial Corporation Ltd | 68.0 Cr | 4.00% | 5,97,977 |

| Sky Gold Ltd | 54.1 Cr | 3.05% | 4,04,116 |

| Knowledge Marine & Engineering Works Ltd | 43.1 Cr | 2.78% | 3,00,000 |

| Krishna Defence and Allied Industries Ltd | 32.2 Cr | 3.42% | 4,20,000 |

| Tanfac Industries Ltd | 22.9 Cr | 1.19% | 1,18,229 |

Ashish Kacholia Investments in Unlisted Shares

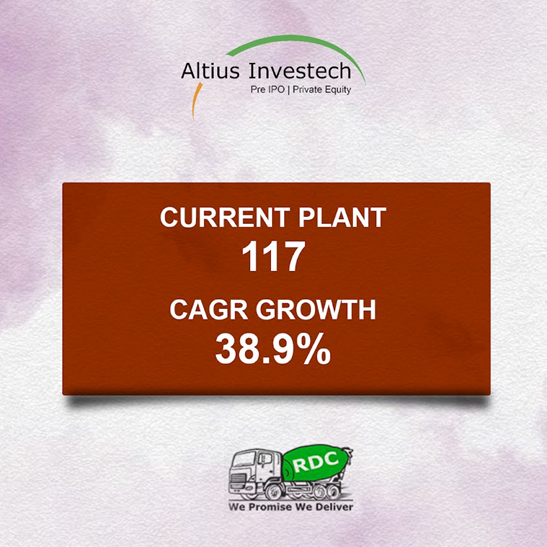

1. RDC Concrete

Infra Market had sold RDC Concrete for $20 Million. With RDC Concrete being acquired by the Infra. market in mid-2021 for $90 million and growing across 100 plants in 48 cities, Ashish Kacholia had been able to raise $20 Million, with a valuation of $225 million.

Ashish commented on how the interactions with the team at RDC left him with a great understanding of several opportunities in the country’s ready-mix concrete market, where the potential of RDC’s team to tap into the opportunities was highlighted.

The rapid growth in India’s construction and infrastructure sector, including the building of metros, airports, and highways, offers great chances for construction material companies. Investing in RDC Concrete is a smart choice to capitalize on this booming market.

Infra Market’s divestment in RDC concrete came ahead of its IPO planned for the near future. But you need not wait for the future to gain promising returns.

To have your hands-on gains that we can vouch for, buy rdc concrete unlisted shares from Altius Investech starting from just ₹ 510.

2. Orbis Financial

Orbis Financial had been able to raise Rs 111 Crores from numerous investors including our ace, Ashish Kacholia. Founded in 2009, Orbis Financial has been a key player in delivering innovative solutions and professional services to a range of investors. Funds secured by Orbis represent substantial investments from Kacholia, showcasing his firm will and confidence in this company’s potential. Learn more about Ashish Kacholia’s investments in Orbis Financial.

The capital injection would be earmarked for expanding Orbis Financial’s reach and overall capabilities in the dynamic financial arena. Read More about orbis financial.

Orbis Financial is registered with Sebi or “The Securities and Exchange Board of India” as a designated depository participant for foreign portfolio investors. Additionally, it is a clearing member on multiple exchanges like NSE, BSE, MCX, and MSEI.

It has seen remarkable growth in assets under custody( AUC), clearing services, fund accounting services, and trustees, among other areas. The growth has been claimed to be capital-efficient.

For promising returns on your investment, consider buying orbis financial unlisted share from Altius Investech, starting at just Rs 279.

Why Invest in Unlisted Shares?

Unlisted shares are owned typically by smaller groups of investors, including early-stage investors, employees, and founders. They are not publicly traded like listed shares, where their value is not determined by the market. If you plan on buying unlisted shares, consider reading about what unlisted shares are and how they work.

- Investors get access to companies that are not ready to go public or through the time-consuming and costly process of a stock exchange.

- These shares often offer great potential to appreciate the capital due to their low liquidity and high-risk profile. Unlisted Shares can offer higher returns than listed shares! Read this blog to understand how to mitigate the risks of buying unlisted shares.

- Potential for high dividends as unlisted companies are not subjected to similar regulations as listed companies and they can flexibly decide on how to distribute their profits.

- Investing in unlisted shares allows the diversification of an investment portfolio, reducing overall investment risks.

Unlock exclusive opportunities by investing with Altius Investech and unveil for yourself a new success story!

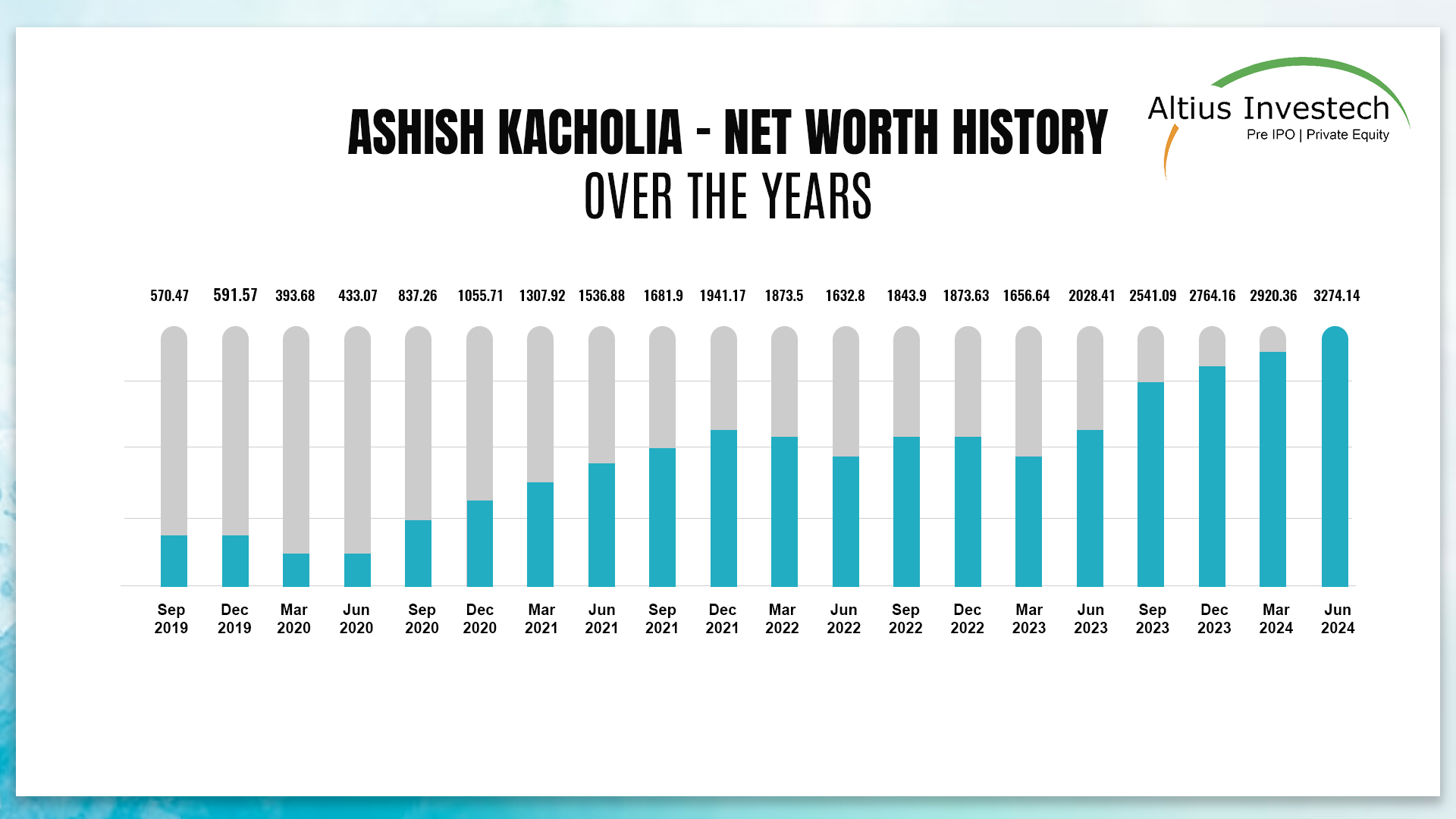

Ashish Kacholia Net Worth

Current records on the latest shareholdings suggest that Ashish Kacholia is publicly holding 46 stocks and has a net worth of over Rs 3031 Crores.

His net worth from his portfolio has risen by 12.08 % to Rs 3273 Crores. Ashish Kacholia publicly holds over 46 stocks contributing to his net worth.

Know the net worth of other influential figures in India

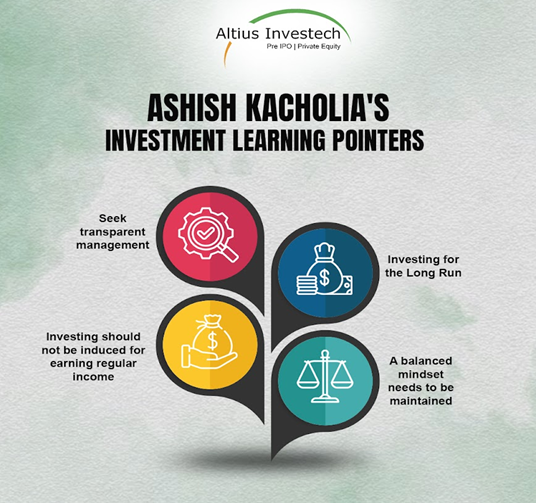

Ashish Kacholia Investment Strategy

Kacholia has induced investments in small-cap to mid-cap companies instead of going for mainstream organizations. The companies show the probability of giving multi-bagger returns in the long run.

- It is crucial to rebalance the portfolio occasionally. Ashish alters the investment strategies, as per financial goals and market conditions.

- Ashish has invested in companies in the education sector as it has a huge potential for growth and amplification.

- It is necessary to properly diversify the portfolio. Investing in multiple companies has made him balance his potential risk-rewards.

- One needs to be constantly monitoring investments, where necessary adjustments should be made if critical. Ashish has never hesitated to buy or sell securities when they are not performing at par with expectations.

Final Thoughts

Ashish Kacholia’s tale of turning from a small investor to a financial luminary makes us navigate the intricate financial world. Did he not face obstacles on his way? He did. The stock market is a volatile place, and going through the complexities requires adaptability and resilience. He has capitalized on the opportunities that came his way to weather storms and incur note-worthy triumphs.

One should take hints from the investing strategies and winning portfolio. In order to generate attractive stock market returns, you could start investing in unlisted shares with Altius Investech!

If you enjoyed reading this, consider learning about the portfolios of other powerful tycoons in the Indian financial world.

- Vijay Kedia’s Latest Portfolio & Networth

- Raamdeo Agrawal’s Investment Empire – His Portfolio & NetWorth

- An Inside Look at Porinju Veliyath’s Investment Portfolio

- Decoding Ashish Dhawan Portfolio

- Inside Radhakishan Damani’s Successful Portfolio & Net Worth

FAQs

Ashish Kacholia’s investment company is named Lucky Investment Managers.

Ashish Kacholia holds a Bachelor’s degree in Engineering from Mumbai University and a Master’s in Management Studies from Jamnalal Bajaj Institute.

Ashish Kacholia is the owner of Lucky Investments.

Ashish Kacholia’s recent buy includes Sanjivani Paranteral shares, a multi-bagger pharma stock.

Ashish Kacholia’s investment strategy involves investing in small-cap and mid-cap companies with strong growth potential, rebalancing his portfolio as needed, and diversifying his investments across multiple sectors.

Ashish Kacholia’s portfolio includes 40 stocks with significant valuations providing substantial returns.

Ashish Kacholia’s net worth is over Rs 3273 Crores.

Sushmita Kacholia is the wife of Ashish Kacholia.

Ashish Kacholia was born in 1979, making him 45 years old as of 2024.

Some of his top stock picks include NIIT Ltd, Acrysil Ltd, Aditya Vision Ltd, Garware Hi-tech Films Ltd, and Safari Industries Ltd.

Ashish Kacholia resides in Bombay (Mumbai), India.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.