Blog Highlights

- Early Life & Education

- Piramal eSwasthya

- Piramal Realty

- Piramal Capital & Housing Finance

- Investment Portfolio

- Leadership Style & Philosophy

- Lifestyle, Family & Personal Assets

Anand Piramal Net Worth: Journey to Becoming One of India’s Richest

Anand Piramal represents a new generation of Indian industrialists who combine legacy and innovation seamlessly. He is a prominent Indian businessman, entrepreneur, and philanthropist, and is known for his role as Executive Director of the Piramal Group.

Anand’s ventures span healthcare, real estate, and finance, and he is also widely recognized for his marriage to Isha Ambani, daughter of Mukesh Ambani, chairman of Reliance Industries. His lineage links him to a long-standing business empire. However, Anand has forged his identity through bold entrepreneurship, social innovation, and a forward-thinking approach to leadership.

This article explores Anand Piramal’s educational journey, business accomplishments, strategic investments, personal lifestyle, and an estimation of his net worth in the broader context of the Piramal Group.

Explore the Net Worth of the Other Members of the Ambani family.

Early Life & Education

Anand Piramal was born on October 25, 1985, into the prestigious Piramal family, known for its pharmaceutical, financial, and real estate ventures. He attended Cathedral and John Connon School in Mumbai, a prominent institution producing many Indian business and political leaders. He pursued a bachelor’s degree in economics from the University of Pennsylvania and later went on to complete his MBA from Harvard Business School. During his time at Harvard, Anand was deeply inspired by both academic thought leadership and grassroots entrepreneurship. His educational background laid a strong foundation in both traditional economic theory and modern business strategy.

Even before completing his education, Anand demonstrated a penchant for leadership and social impact. He became the youngest president of the Indian Merchant Chambers’ youth wing, where he focused on promoting entrepreneurship and business ethics among young professionals.

1) Piramal eSwasthya

Social Entrepreneurship in Healthcare

One of Anand’s earliest and most socially impactful ventures was the founding of Piramal eSwasthya in 2008.

The initiative aimed to democratize access to healthcare by offering mobile and digital solutions for rural India. With more than 140,000 teleconsultations delivered in a year and partnerships with government health systems, Piramal eSwasthya became a scalable model for tech-driven healthcare in underserved regions.

The initiative was later merged into the Piramal Foundation’s activities, and Anand’s work with eSwasthya was featured as a case study at Harvard Business School. This early success established him as a socially conscious entrepreneur who was as interested in impact as he was in profit.

2) Piramal Realty

Building India’s Skyline

In 2012, Anand Piramal took a bold step by entering the real estate sector and launching Piramal Realty. The decision came at a time when Indian real estate was cluttered with poorly executed developments and a lack of consumer trust. Piramal Realty positioned itself differently, focusing on quality construction, transparent practices, and iconic design collaborations with global firms like Foster + Partners and HOK.

Under Anand’s leadership, Piramal Realty attracted significant investments. In 2015, two of the world’s largest sovereign funds, namely Goldman Sachs and Warburg Pincus committed $434 million to the company. It reflected their confidence in Anand’s vision. The firm’s flagship projects include:-

- Piramal Mahalaxmi: A premium residential development in South Mumbai.

- Piramal Aranya: High-rise luxury apartments overlooking the botanical gardens.

- Piramal Vaikunth: An expansive township in Thane, blending urban and natural elements.

As of 2025, Piramal Realty continues to be one of the fastest-growing players in the Indian luxury real estate market.

3) Piramal Capital & Housing Finance

Anand Piramal has also played a key role in the financial services arm of the group- Piramal Capital & Housing Finance (PCHF). With the aim of bridging credit gaps in India’s housing market, PCHF offers home loans, loans against property, construction finance, and other structured debt products.

In 2021, Piramal Group completed a significant acquisition of Dewan Housing Finance Corporation Ltd. (DHFL) for Rs 34,250 crore, marking one of the largest resolutions under the Insolvency and Bankruptcy Code (IBC).

This acquisition catapulted PCHF into one of India’s top five housing finance companies in terms of loan book size. Anand was involved in the strategic planning of this acquisition, and its successful execution marked a milestone in Piramal Group’s financial services journey.

Investment Portfolio

Piramal has made personal and strategic investments in high-growth startups and companies across different sectors, including-

- Cult.fit: A leading health and wellness platform.

- SILA: A facility management and real estate services firm.

- HomeCapital: A fintech startup offering down payment assistance for first-time homebuyers.

As an angel investor, he has invested personal money into promising companies, in exchange for equity. He has made numerous investments in companies like Isprava Vesta, HomeCapital, and Snapdeal in the hotels, resorts, consumer finance, and internet retail industries.

These investments reflect Anand’s interest in digital-first consumer businesses and platforms that address structural inefficiencies in the Indian economy. His investment philosophy echoes his broader vision of building sustainable, impactful enterprises that blend profit with purpose.

Leadership Style & Philosophy

Anand Piramal’s leadership is deeply influenced by his education, exposure to global business practices, and family values. Known for being detail-oriented and customer-centric, he frequently visits construction sites and meets stakeholders personally. He is an advocate for:

- Purpose-driven capitalism

- Sustainability in design and business operations

- Customer-first product development

- Long-term value over short-term gains

In various interviews, Anand has emphasized the importance of empathy in leadership, a value he attributes to his parents, particularly his mother, Dr. Swati Piramal, a renowned medical doctor and businesswoman.

Lifestyle, Family & Personal Assets

Anand Piramal’s lifestyle is luxurious yet understated. He married Isha Ambani in December 2018 in one of the most high-profile weddings India has ever witnessed. As a wedding gift, the Piramal family presented the couple with a five-story sea-facing mansion named ‘Gulita’ in Worli, Mumbai. Valued at over Rs 450 Crores, the property boasts:

- A private swimming pool

- Diamond room

- Three-level basement parking

- Grand chandeliers and dining halls

- A private temple

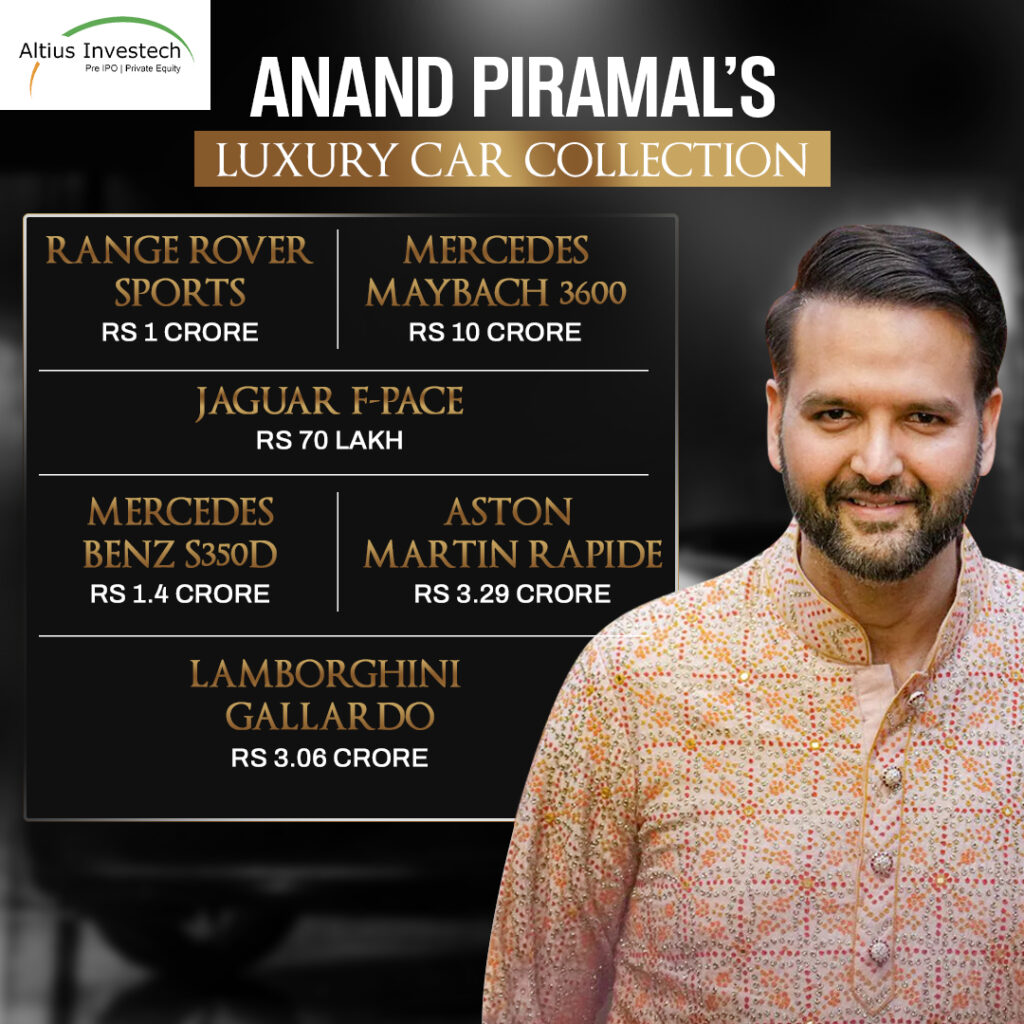

Anand is also an automobile enthusiast. His luxury car collection includes

- Range Rover Sports

- Mercedes Maybach 3600

- Jaguar F-Pace

- Mercedes Benz S350D

- Aston Martin Rapide

- Lamborghini Gallardo

Anand Piramal’s Net Worth

As of 2025, Anand Piramal’s net worth is not publicly disclosed, but educated estimates place it between Rs 10,000 Crores to Rs 12,000 Crores (~$1.2 to $1.5 billion USD), based on his executive role, equity in Piramal Group subsidiaries, and his real estate holdings.

Discover the net worth of other influential figures in India.

- Aman Gupta

- Ashneer Grover

- Radhika Gupta

- Vineeta Singh

- Ritesh Agarwal

- Virat Kohli

- Ms Dhoni

- Rakesh Jhunjhunwala

Contributing Factors Include:

- Ownership and management of Piramal Realty

- Stake in Piramal Capital & Housing Finance

- Personal investments in private startups

- Luxury real estate holdings

The Piramal family is considered the wealthiest among the Ambani in-laws, with Ajay Piramal, the chairman overseeing a global business conglomerate. As per Forbes, Ajay Piramal’s net worth is estimated at $4.2 billion (approximately Rs 34,898 crore). The Piramal Group itself, as led by Anand’s father Ajay Piramal, has a net worth exceeding $4 billion. With consolidated revenues of Rs 9,087 Crores for the year 2023 and a diversified asset base, the group is one of India’s leading conglomerates.

Philanthropy & Social Impact

Anand is an active participant in the Piramal Foundation, the social development arm of the Piramal Group. The foundation works across healthcare, education, water security, and women’s empowerment. Anand’s early work with Piramal eSwasthya was a prelude to his larger involvement in philanthropy.

He believes that business success and social responsibility are not mutually exclusive. His long-term vision includes creating enterprises that solve India’s pressing challenges, including affordable housing, accessible healthcare, and employment for the youth.

Future Outlook

With India’s economy poised to become the third-largest in the world by the end of the decade, Anand Piramal is well-positioned to play a crucial role in shaping its urban, financial, and social infrastructure. His dual focus on legacy businesses and future-forward startups gives him a balanced portfolio for long-term impact.

Whether it is building skyscrapers in Mumbai, transforming healthcare access in villages, or investing in digital-first platforms, Anand’s journey is a compelling example of the modern Indian entrepreneur. He stands as a bridge between tradition and transformation, deeply rooted in values but equally driven by vision.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Anand’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Anand Piramal is more than a legacy heir, he is a dynamic leader charting a bold course across multiple sectors. His work in real estate, finance, and healthcare, coupled with his commitment to social impact, showcases the evolving nature of Indian business leadership. As he continues to expand his ventures and influence, Anand Piramal exemplifies how vision, education, and empathy can converge to build both wealth and meaningful change. With a growing portfolio and rising prominence on the national and global stage, Anand Piramal’s story is still being written, but the chapters so far reflect a remarkable journey of purpose-driven success.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain