Understanding Debt Mutual Funds

Debt is one of the primary avenues where individuals invest their savings to earn returns. The debt market comprises a wide range of financial instruments that enable the buying and selling of loans in exchange for fixed interest payments. Generally regarded as safer than equity investments, debt mutual funds are favored by risk-averse investors. However, they typically yield lower returns compared to equities.

This blog explores the concept of Debt Mutual Funds, their types, features, benefits, and taxation.

What is a Debt Fund?

Debt funds are mutual funds that allocate investments in fixed-income instruments such as government securities, corporate bonds, treasury bills, commercial papers, and various money market tools. These instruments have a predetermined maturity period and interest rate, providing predictable returns upon maturity. Due to their stable nature, they are less sensitive to market volatility, making them a low-risk investment choice.

Key Characteristics of Debt Mutual Funds

Let’s dive into the major features of debt funds:

- Investor Suitability

Debt funds usually invest across a variety of debt securities to balance and stabilize returns. Though returns aren’t guaranteed, they generally fall within an expected range. These funds are ideal for conservative investors, as well as those seeking short to medium-term investment options. - Returns

These funds offer moderate returns compared to equity funds. The NAV (Net Asset Value) of debt mutual funds is influenced by interest rate movements. A rise in interest rates leads to a fall in NAV, and vice versa. - Associated Risks

Debt mutual funds face three primary risks:- Credit Risk – Risk that the issuer may default on payment.

- Interest Rate Risk – Risk of fluctuations in interest rates impacting fund value.

- Liquidity Risk – Risk of the fund house facing a shortage of liquidity during redemptions.

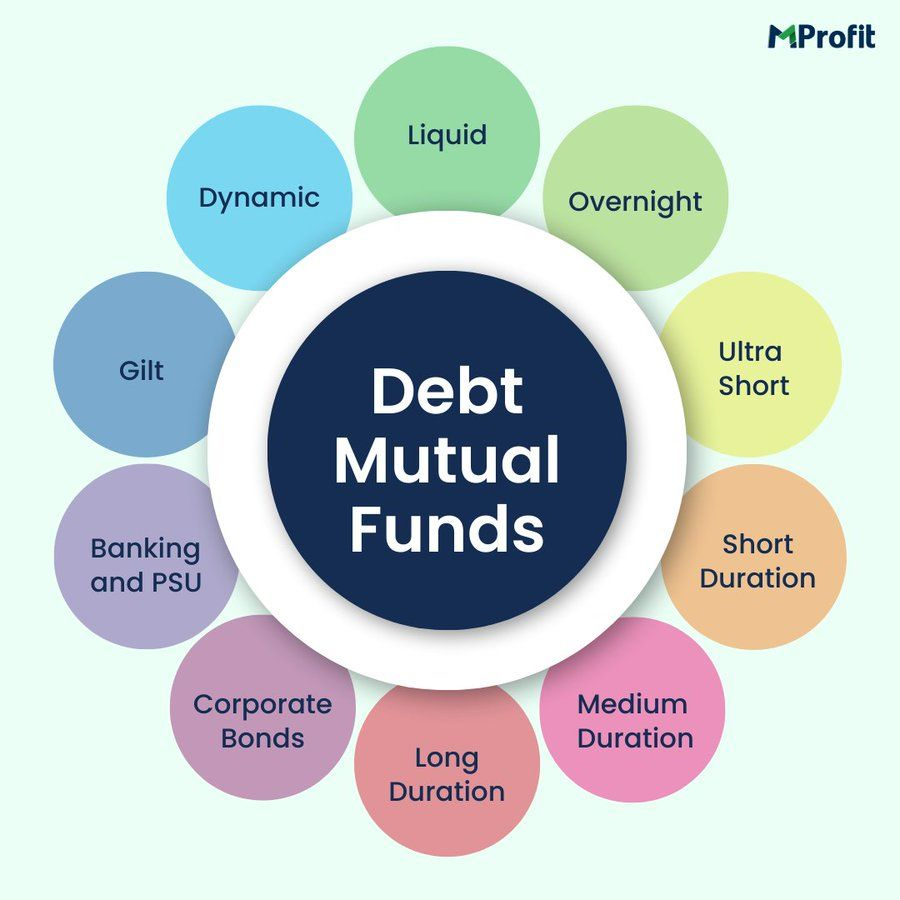

Types of Debt Mutual Funds

Debt funds are categorized based on the maturity duration of the instruments they invest in:

- Liquid Fund: Invests in securities maturing within 91 days. Suitable as a savings alternative.

- Money Market Fund: Invests in instruments maturing within 1 year.

- Overnight Fund: Invests in instruments with a 1-day maturity. Offers very high safety.

- Ultra Short Duration Fund: Has a Macaulay duration of 3–6 months.

- Low Duration Fund: Duration between 6–12 months.

- Short Duration Fund: Duration between 1–3 years.

- Medium Duration Fund: Duration between 3–4 years.

- Medium to Long Duration Fund: Duration of 4–7 years.

- Long Duration Fund: Duration beyond 7 years.

- Dynamic Bond Fund: Invests across durations depending on prevailing interest rate trends.

- Corporate Bond Fund: Allocates at least 80% to high-rated corporate bonds.

- Banking & PSU Fund: Minimum 80% allocation in bank and PSU debt instruments.

- Gilt Fund: Invests at least 80% in government securities; no credit risk but higher interest rate risk.

- Credit Risk Fund: Allocates at least 65% in lower-rated corporate bonds to target higher returns.

- Floater Fund: Invests 65% or more in floating-rate instruments, which adjust with interest rate changes.

How Do Debt Mutual Funds Work?

Each debt instrument carries a credit rating, indicating the likelihood of the issuer repaying the debt on time. Fund managers select instruments with high ratings to reduce default risk. Returns are generated through interest income and potential capital gains if the bond price increases.

Why Consider Investing in Debt Mutual Funds?

Here are several benefits of investing in debt funds:

- Expert Management

Professional fund managers handle portfolio selection, optimizing returns and managing risk. Investors also gain access to markets (like wholesale debt markets) which are otherwise inaccessible individually. - Diverse Investment Options

These funds cover a wide range of investment horizons and credit risks. Some funds aim for stable returns, while others seek to maximize gains by taking on calculated risks. - Reduced Risk Exposure

Compared to equities, debt mutual funds pose lower risk. Including them in your portfolio can enhance overall stability. - High Liquidity

Most debt funds are highly liquid, with redemption proceeds credited within 1–2 business days. There’s generally no lock-in period, though a few may impose a nominal exit load for early withdrawal.

Taxation of Debt Mutual Funds

Taxation on debt fund returns is based on the holding period:

- Short-Term Capital Gains (STCG): If held for less than three years, gains are taxed as per the investor’s income tax slab.

- Long-Term Capital Gains (LTCG): If held for more than three years, gains are taxed at 20% with indexation benefits, which adjusts purchase price for inflation, reducing taxable gains.

Popular Debt Mutual Fund Options

Here’s a list of some well-known debt mutual fund schemes:

- Aditya Birla Sun Life Liquid Fund – Direct Growth

- HDFC Short Term Debt Fund – Direct Growth

- Quant Liquid Fund – Direct Growth

- SBI Banking and PSU Fund – Direct Growth

- Parag Parikh Liquid Fund – Direct Growth

- Kotak Long Duration Fund – Direct Growth

- Nippon India Ultra Short Duration Fund – Direct Growth

- LIC Mutual Fund Liquid Fund – Direct Growth

- ICICI Prudential Liquid Fund – Direct Growth

NEWS

RBI’s Policy Changes Impacting Debt Mutual Funds

1. Securitization of Stressed Assets

In April 2025, the RBI introduced a policy allowing the securitization of stressed assets, including non-performing loans. This initiative aims to deepen India’s junk debt market and attract foreign portfolio investors by offering high-yield investment opportunities. While this move enhances market liquidity and provides investors with more diverse options, it also introduces higher credit risk, which investors need to consider when investing in debt funds.

2. Liquidity Infusion Measures

The RBI announced plans to purchase bonds worth ₹40,000 crore and conduct a 43-day repo of ₹1.5 lakh crore to maintain surplus liquidity in the banking system. This move aims to support economic growth and ensure effective monetary policy transmission. For debt mutual funds, this policy is expected to lower bond yields, potentially enhancing returns for investors in government securities.

3. Restoration of Investment Curbs on Long-Dated Bonds

The RBI’s decision to exclude new issuances of 14-year and 30-year government securities from the Fully Accessible Route (FAR) has raised concerns among investors. This move may reduce foreign portfolio investment in these securities, potentially leading to higher yields and increased volatility in long-duration debt funds.

Budget 2025 Proposals

The Association of Mutual Funds in India (AMFI) has proposed several changes in the Union Budget 2025 to restore investor confidence in debt mutual funds:

- Reinstatement of Indexation Benefit: AMFI has requested the government to restore the long-term indexation benefit for debt schemes of mutual funds, which was withdrawn in the Budget 2024. The removal of indexation benefits has led to increased tax liabilities for investors, and its reinstatement is seen as crucial for maintaining confidence among retail investors and stimulating growth within India’s bond market.

- Capital Gains Tax Rates: AMFI has urged the government to revert to the previous capital gains tax rates, as the significant percentage hike has deterred common investors from choosing mutual funds. Any change in taxation is believed to hamper efforts to move people from traditional savings to investments.

- Securities Transaction Tax (STT) Rates: AMFI has recommended reinstating the earlier STT rates for futures and options for mutual fund investors. The increased STT on futures has reduced the available arbitrage, and further increases in STT on futures will add to the cost of these funds.

Frequently Asked Questions (FAQs)

Q1. Are debt mutual funds a good investment?

It depends on your financial goals and risk appetite. They are great for investors seeking stability and modest returns. However, for higher returns, equities might be more suitable.

Q2. How do these funds generate returns?

By earning interest income and benefiting from the price appreciation of the bonds and debt instruments held.

Q3. What risks do debt funds carry?

Primarily credit risk (default by issuer) and interest rate risk (value fluctuations due to rate changes).

Q4. Are debt funds better than equities?

Debt funds are less volatile and safer, but generally offer lower returns. Suitability depends on your risk profile.

Q5. Are debt mutual funds safer than fixed deposits (FDs)?

FDs typically offer fixed, guaranteed returns, making them safer in that regard. Debt funds offer higher liquidity and potentially better returns, but do involve some level of risk.

Disclaimer: Mutual fund investments are subject to market risks. Please read the scheme-related documents carefully before investing.

Need Help with Mutual Fund Investments? We’ve Got You Covered!

If you’re unsure where to start, our experts at Altius Investech are here to guide you every step of the way.

👉 Fill out this form or Book a Slot Now to start building your wealth with the right mutual fund investments!

ALSO READ OUR OTHER BLOGS: