Family Trusts: Safeguarding Wealth and Ensuring a Lasting Legacy

A family trust is a crucial estate planning tool that helps individuals protect their wealth, minimize tax liabilities, and ensure smooth succession for future generations. Whether you’re a high-net-worth individual or simply looking to secure your family’s financial future, understanding family trusts can help you make informed decisions.

What is a Family Trust?

A family trust is a legal arrangement where the settlor (the person creating the trust) transfers assets to a trustee (an individual or institution) who manages them for the benefit of designated beneficiaries (family members). It helps in preserving and distributing wealth according to the settlor’s wishes while providing legal protection from creditors, legal disputes, and unnecessary taxation.

Types of Family Trusts

1. Revocable Family Trust

A revocable trust allows the settlor to modify or dissolve the trust during their lifetime. It provides flexibility but does not offer significant tax benefits or asset protection.

2. Irrevocable Family Trust

Once established, this type of trust cannot be changed or revoked. It provides stronger asset protection and tax advantages, making it ideal for long-term estate planning.

3. Discretionary Family Trust

The trustee has full discretion over how and when to distribute assets to beneficiaries. This is useful in protecting assets from creditors and legal claims while ensuring beneficiaries do not misuse funds.

4. Testamentary Family Trust

This trust is created through a will and comes into effect after the settlor’s death. It helps in controlling how assets are distributed to heirs and can be useful in tax planning.

5. Fixed Family Trust

In this type, the trustee must distribute income or assets according to a predetermined formula, ensuring a fair and structured approach to wealth distribution.

Key Benefits of a Family Trust

- Wealth Protection: A trust shields assets from creditors, lawsuits, and financial mismanagement by beneficiaries, ensuring long-term security.

- Tax Efficiency: Trusts can help minimize estate taxes, capital gains taxes, and income taxes by strategically distributing wealth.

- Smooth Succession Planning: By clearly defining asset distribution, family trusts prevent disputes and legal battles among heirs, ensuring seamless wealth transition.

- Financial Control & Flexibility: Settlers can dictate terms on asset distribution, ensuring responsible financial management among beneficiaries.

- Protection from Divorce & Legal Claims: Assets held in a trust are generally protected from division in case of divorce or legal disputes involving beneficiaries.

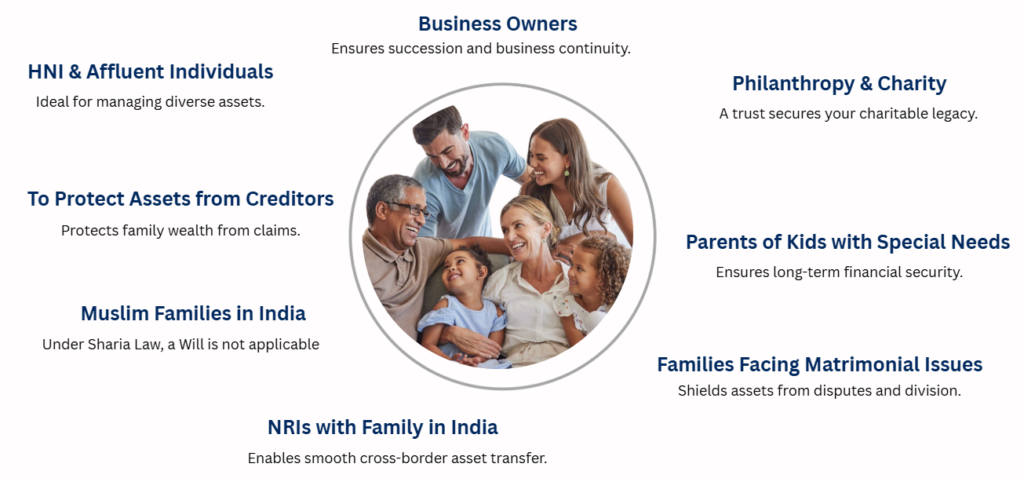

Who Should Create a Family Trust?

A family trust is beneficial for various individuals and families, including:

- Business Owners: Ensures business continuity and smooth succession planning.

- HNI & Affluent Individuals: Ideal for managing diverse assets and ensuring structured wealth distribution.

- NRIs with Family in India: Helps in seamless cross-border asset transfer and management.

- Muslim Families in India: As Sharia Law does not recognize a Will, a trust can be an effective alternative for wealth distribution.

- Families Facing Matrimonial Issues: Shields assets from disputes and potential division during legal battles.

- Parents of Kids with Special Needs: Provides long-term financial security for dependents who require lifelong care.

- To Protect Assets from Creditors: Safeguards family wealth from legal claims and liabilities.

- Philanthropy & Charity: Allows individuals to secure their charitable legacy through structured giving

How to Set Up a Family Trust

- Define Objectives: Identify why you need a trust—whether for tax benefits, wealth preservation, or succession planning.

- Choose the Right Type: Decide between revocable, irrevocable, discretionary, or testamentary trusts based on your goals.

- Select a Trustee: Appoint a reliable trustee (individual or institution) to manage the trust responsibly.

- Identify Beneficiaries: List the family members or dependents who will benefit from the trust.

- Draft a Trust Deed: Work with a legal expert to create a legally binding trust document outlining the terms and conditions.

- Transfer Assets: Move assets like property, investments, and savings into the trust for legal protection and management.

- Manage & Monitor the Trust: Ensure regular review and compliance with legal requirements for effective administration.

Common Mistakes to Avoid in Family Trust Planning

- Choosing the wrong trustee: Select someone who is financially responsible and trustworthy.

- Not updating the trust: Regularly review the trust to accommodate changes in laws, financial status, and family needs.

- Failing to consider tax implications: Consult financial and legal advisors to maximize tax benefits.

- Poor structuring of asset distribution: Ensure clear and fair terms to prevent conflicts among beneficiaries.

Final Thoughts

A well-structured family trust is an invaluable tool for safeguarding wealth, reducing taxes, and ensuring a smooth transition of assets to future generations. However, setting up a trust requires careful planning, legal expertise, and ongoing management. Consulting with estate planning professionals can help you design a trust that aligns with your financial goals and secures your family’s future.

Need Help Drafting Your Family Trust?

If you’re unsure where to start, our experts at Altius Investech are here to guide you every step of the way. Whether you need help understanding the process or drafting a legally sound Will, we’ve got you covered.

👉 Fill out this form or Book a Slot Now to get started on securing your legacy!

Read our other blogs