Introduction: Hindu Undivided Family

The Hindu Undivided Family (HUF) is a unique entity under Indian law that holds significant financial and tax benefits. It is a separate legal entity that allows a family to manage assets collectively while enjoying tax exemptions. This article delves deep into the concept of HUF, its formation, taxation benefits, and legal considerations.

What is a Hindu Undivided Family (HUF)?

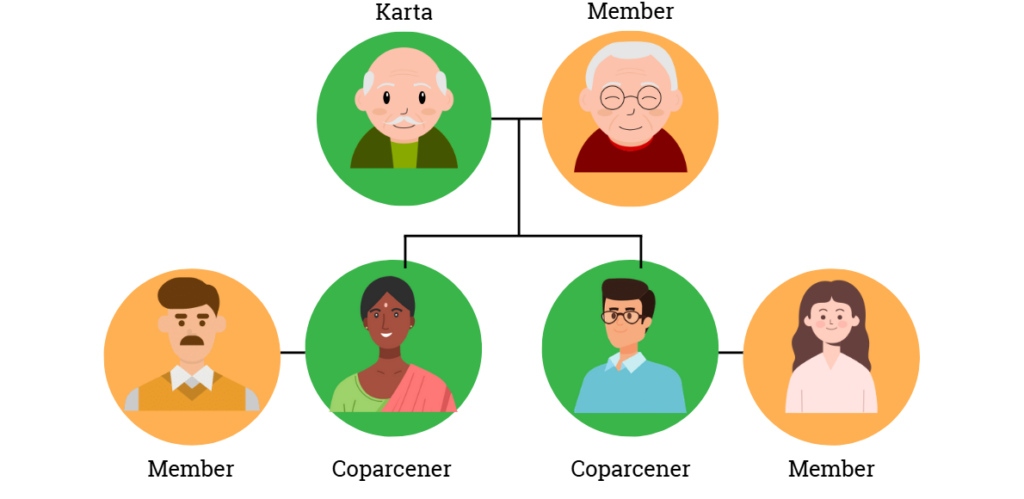

A Hindu Undivided Family (HUF) is a family unit recognized under Hindu law that consists of lineal descendants of a common ancestor, including their wives and unmarried daughters. It is governed by the Hindu Succession Act, 1956, and applies to Hindus, Buddhists, Jains, and Sikhs.

Key Features of HUF:

- Separate Legal Entity – HUF is considered a distinct taxable entity under the Income Tax Act, 1961.

- Formation by Birth – A HUF comes into existence automatically in a Hindu family but requires a formal declaration for tax purposes.

- Common Pool of Assets – The HUF holds joint family assets and income, separate from individual incomes.

- Perpetual Existence – HUF continues to exist even after the death of its members, with the eldest male member (or female, after recent legal changes) acting as the Karta (head of the family).

How to Form a HUF?

Forming a HUF requires the following steps:

- Create a HUF Deed – A legal document declaring the formation of the HUF, listing the members and the Karta.

- Apply for PAN – A Permanent Account Number (PAN) is necessary for tax filing and financial transactions.

- Open a Bank Account – A separate bank account should be opened in the name of the HUF for financial transactions.

- Transfer Assets – Any ancestral property, gifts, or voluntarily contributed funds can be added to the HUF corpus.

Tax Benefits of HUF

A major advantage of forming a HUF is the tax savings it offers. Some of the key benefits include:

- Separate Taxation – HUF is taxed separately from its members, allowing additional exemptions and deductions.

- Income Tax Deductions – HUF can claim deductions under Sections 80C, 80D, and 80G of the Income Tax Act.

- Exemption Limits – The basic exemption limit for HUF is the same as for individuals, reducing the overall tax burden.

- Investments and Tax-Free Income – HUF can invest in tax-free instruments like PPF and avail long-term capital gains exemptions.

- Business Income – HUF can run a business and pay tax separately, optimizing tax liabilities.

Challenges and Legal Considerations

While HUFs offer numerous benefits, they also come with challenges and legal obligations:

- Partitioning Issues – If members decide to dissolve the HUF, assets must be distributed legally, which may lead to disputes.

- Limited Control – Individual members may not have full control over HUF assets, as the Karta has decision-making authority.

- Restriction on Inclusion – Only male members, their wives, and unmarried daughters are traditionally part of a HUF, though legal changes have expanded women’s rights in HUFs.

- Tax Scrutiny – HUF transactions are subject to scrutiny by tax authorities to prevent misuse for tax evasion.

How to Dissolve a HUF?

Dissolution of a HUF requires a formal partition, where assets are divided among members. This can be done through:

- Mutual Agreement – All members agree to partition and legally distribute assets.

- Court Order – In case of disputes, a court order may be required to ensure a fair distribution.

- Tax Implications – Upon dissolution, tax liabilities on capital gains or income transfers must be settled.

Conclusion

A Hindu Undivided Family (HUF) is a powerful financial and legal entity that can offer significant tax benefits and asset protection. However, it requires careful planning, compliance with tax regulations, and proper legal structuring. If used effectively, a HUF can be a great tool for wealth management and tax optimization in Indian families.

Need Help with HUF?

Fill out our interest form today, and let the experts at Altius handle everything for you!

If you’re unsure where to start, our experts at Altius are here to guide you every step of the way. Ready to cut taxes and grow wealth the smart way?

👉 Fill out this form or Book a Slot Now to get started on securing your legacy!

Read our other blogs: