Blog Highlights

- Early Life & Education

- Career Beginnings

- The Rise of Zomato

- Key Milestones for Zomato

- Deepinder Goyal’s Net Worth

- Deepinder Goyal’s Wealth in Numbers

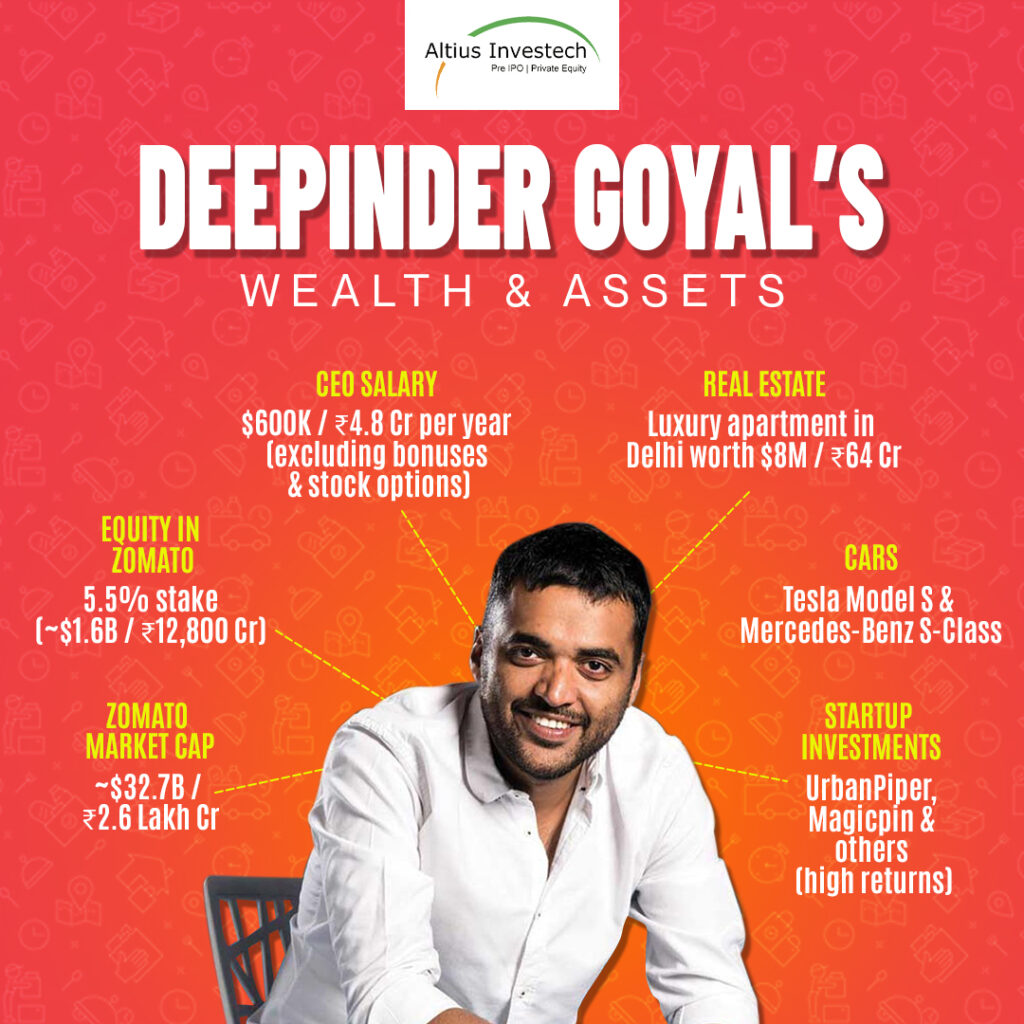

- Deepinder Goyal’s Wealth & Assets

- Philanthropy & Social Impact

How Deepinder Goyal Built Zomato & Amassed a $1.5B Net Worth

Deepinder Goyal, the co-founder and CEO of Zomato, is a name synonymous with India’s tech revolution and the global food delivery landscape. With relentless drive and an eye for innovation, Goyal transformed Zomato from a humble startup into one of the world’s largest food tech platforms. As of January 2025, his estimated net worth stands at $1.5 billion or Rs 12,000 Crores, firmly establishing him among India’s most successful entrepreneurs. Let’s explore how this visionary built his empire.

Early Life & Education

Born on January 26, 1983, in Muktsar, Punjab, Deepinder Goyal came into a modest, middle-class family. His father was a teacher, grounding his upbringing into discipline and education. Goyal’s academic excellence paved his way for admission to the prestigious IIT, Delhi, where he further pursued a degree in Computing and Mathematics. During his time at IIT, Goyal’s problem-solving skills and analytical skills became vivid and apparent. He met Kanchan Joshi, his future wife, during his college years. Deepinder’s time at IIT laid the groundwork for his entrepreneurial ambitions, equipping him with the confidence as well as the tools to tackle challenges.

Career Beginnings

After graduating in 2005, Goyal joined Bain & Company as a Senior Associate Consultant. At Bain, he could trace a recurring problem among his colleagues. It was the hassle of locating restaurant menus for team lunches. This led to the idea of an online platform that could consolidate restaurant information and menus, making them easily accessible.

So, he and his colleague Pankaj Chaddah took the leap in 2008. They left their corporate jobs for launching FoodieBay. This platform provided scanned menus from local restaurants and quickly gained a lot of popularity. In two years, the platform became rebranded as Zomato, allowing the beginning of a global food tech giant.

The Rise of Zomato

Zomato started as a simple idea but soon evolved into a multifaceted platform offering restaurant reviews, table reservations, and online food delivery. Under Goyal’s leadership, Zomato expanded rapidly, first across major Indian cities and then internationally. By 2020, Zomato operated in over 24 countries, serving millions of users.

Key Milestones for Zomato

1) Growth of Revenue

Zomato’s revenue surged from $206 million or Rs 1,500 Crores in 2020 to $1.1 billion or Rs 8,500 Crores in 2024, showing exponential growth driven by advertisement services and food delivery.

2) User Base

The platform boasts over 80 million monthly active users globally, with India contributing the lion’s share.

3) Success of IPO

In July 2021, Zomato became the first Indian tech unicorn to go public. The IPO was oversubscribed 35 times, raising $1.3 billion or Rs 10,200 Crores, and debuting at a market valuation of $12 billion or Rs 96,000 Crores.

4) Acquiring Blinkit

In 2022, Zomato acquired the quick-commerce platform Blinkit for $570 million or Rs 4,500 Crores, diversifying its portfolio and entering the instant delivery segment.

Deepinder Goyal’s Net Worth

Goyal’s wealth is derived primarily from his stake in Zomato. Under his leadership, Zomato has expanded operations both internationally and domestically, contributing to his enormous success and net worth. As of February 2025, the CEO of Zomato has a net worth of over $1.5 billion (Rs 12,000 Crore), placing him at number #2215 on the global billionaires list. In December 2024, Goyal had secured second place on Hurun India’s list of top 200 self-made entrepreneurs, with a net worth exceeding Rs 15300 Crores. In September 2024, reports indicated him to be among the only 23 people in Gurgaon having a net worth of more than Rs 1000 Crores, ranking him as the city’s second richest person during that time.

Discover the Net Worth of Other Judges of Shark Tank India

- Aman Gupta

- Ashneer Grover

- Radhika Gupta

- Vineeta Singh

- Ritesh Agarwal

- Anupam Mittal

- Peyush Bansal

- Kunal Bahl

Deepinder Goyal’s Wealth in Numbers

As of 2025, Deepinder Goyal’s net worth is estimated at $1.5 billion (Rs 12,000 Crore). Here’s a closer look at the sources of his wealth:

- Equity in Zomato: Goyal holds a 5.5% stake in Zomato, valued at approximately $1.6 billion or Rs 12,800 crores, based on the company’s current market capitalization of $32.7 billion or Rs 2.6 lakh crores.

- Salary and Perks: As CEO, Goyal’s annual compensation package is reported to be $600,000 or Rs 4.8 Crores, excluding bonuses and stock options.

- Investment Returns: Goyal has also made personal investments in several startups, including UrbanPiper and Magicpin, which have yielded major returns.

- Real Estate and Assets: Goyal owns a luxury apartment in Delhi valued at $8 million or Rs 64 Crores and has a penchant for high-end automobiles, including a Tesla Model S and a Mercedes-Benz S-Class.

Deepinder Goyal’s Wealth & Assets

- Equity in Zomato: 5.5% stake (~$1.6B / ₹12,800 Cr)

- Zomato Market Cap: ~$32.7B / ₹2.6 Lakh Cr

- CEO Salary: $600K / ₹4.8 Cr per year (excluding bonuses & stock options)

- Real Estate: Luxury apartment in Delhi worth $8M / ₹64 Cr

- Cars: Tesla Model S & Mercedes-Benz S-Class

- Startup Investments: UrbanPiper, Magicpin & others (high returns)

Philanthropy & Social Impact

Deepinder Goyal is not just a business leader but also a socially conscious individual. During the COVID-19 pandemic, Zomato launched the “Feed India” initiative, providing over 10 million meals to underprivileged communities. Goyal also introduced Zomato’s “Gold Support” program, offering financial assistance to delivery partners affected by the pandemic.

In 2023, Goyal pledged to donate $10 million (Rs 80 Crores) towards initiatives aimed at improving gig workers’ welfare. This included accident insurance, health benefits, and education programs for their children.

Beyond the Boardroom

Goyal’s personal life has always been a focus and a subject of public interest. In 2023, he married Mexican entrepreneur Grecia Muñoz in a private ceremony. This was Goyal’s second marriage, after following his earlier relationship with Kanchan Joshi.

Goyal is an avid reader and a fitness enthusiast, outside the boundaries of work. He often shares insights about entrepreneurship and leadership on social media, inspiring young professionals.

Resilience

Goyal’s journey has not been without hurdles. Zomato faced significant challenges during its initial years, including stiff competition from global giants like Uber Eats & Swiggy. The failed merger discussions with Swiggy in 2020 further tested Goyal’s resolve. However, his ability to adapt and pivot has been central to Zomato’s success.

You Can Also Read Our Blog On:- Zomato vs Swiggy

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Deepinder Goyal’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Zomato expands its offerings with continuous momentum, including investments in sustainability and renewable energy for food delivery logistics. Deepinder Goyal remains at the forefront of innovation. The organization’s upcoming initiatives, such as drone-based food delivery and AI-driven customer experiences, must be promising in revolutionizing the industry further.

His tale is that of a vision, of how perseverance and adaptability can work wonders. From a middle-class upbringing in Punjab to leading a $32 billion global enterprise, his journey exemplifies the transformative power of entrepreneurship.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain