Blog Highlights

- Early Life, Education & Career

- Net Worth of Mukul Agarwal

- Portfolio & Investments of Mukul Agarwal

- Investment Philosophy

- Top Holdings in Portfolio

- Lessons from His Investment Journey

Mukul Agrawal Portfolio: Key Stocks & Investment Insights from the Maestro

Mukul Agarwal, the maestro, is celebrated for his keen eye for long-term growth prospects. Especially known for his distinctive investing style, he has built a diversified portfolio, that intrigues market analysts and new investors in the same light. Let us delve further into his top stock picks, net worth growth, and key principles driving his investment philosophy!

Early Life, Education & Career

Mukul Mahavir Agrawal, widely regarded as a prudent investor, began his journey from humble beginnings. Born into a middle-class family, Agrawal displayed a passion for numbers and financial markets from a young age. He pursued his education in commerce, equipping himself with knowledge essential for navigating the stock market. This academic foundation laid the groundwork for his analytical skills, which would later drive his investment success.

With the initiation of his career as a stock trader, Mukul Agarwal gradually honed his skills in the competitive Indian Stock Market. He has learned to recognize the value of undervalued stocks with the growth potential. Agrawal’s initial investments focused on established sectors such as pharmaceuticals and banking, industries that he believed would withstand market demands and fluctuations.

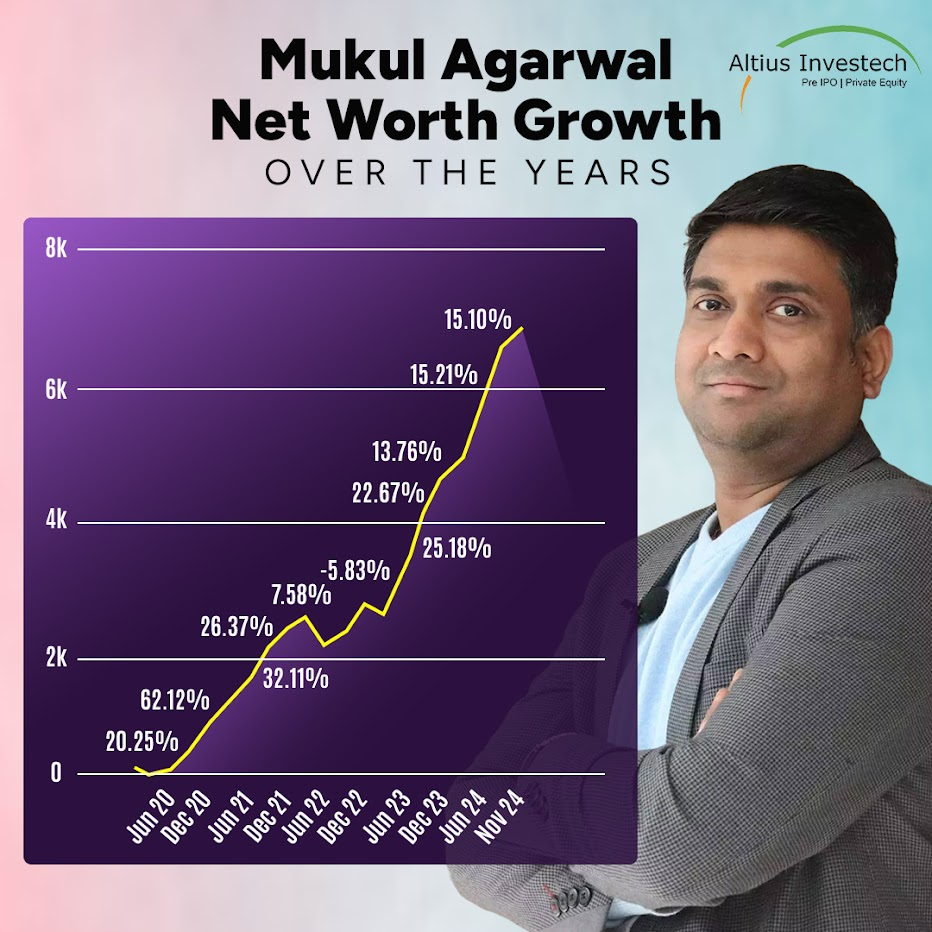

Net Worth of Mukul Agarwal

As per the records of the latest corporate shareholdings, Mukul Agarwal holds 56 stocks currently, collectively giving him a net worth of above Rs 6863.2 Crores. This is true for the current quarter ending in September 2024.

Net Worth History of Mukul Agarwal

This valuation reflects his success in strategic stock selection and prudent investment management. His net worth has consistently grown over the years, a testament to his foresight in identifying companies with sustainable growth potential. Agrawal’s financial success is not only a result of his investments in top-performing stocks but also his disciplined approach to managing his portfolio.

His net worth rose by 3.6% in the last quarter to yield Rs 6863.09 Crores. He made his latest buy in Lux Industries Ltd, which increased the stake by 0.14%.

Discover the net worth of other influential figures in India.

- Aman Gupta

- Ashneer Grover

- Radhika Gupta

- Vineeta Singh

- Ritesh Agarwal

- Virat Kohli

- Ms Dhoni

- Rakesh Jhunjhunwala

Portfolio & Investments of Mukul Agarwal

Mukul Agarwal is an aggressive investor, and he does not budge from taking a risk with penny stocks that have the chance of becoming a multi-bagger. He keeps two separate portfolios for trading and investment. Mukul has 52 active stocks from a total of 71 stocks that he owns.

In 2024, Mukul Agrawal’s portfolio showcases a balanced mix of sectors, including technology, pharmaceuticals, manufacturing, and finance. His investment approach reflects a keen understanding of the Indian market’s current demands, as well as future growth trends. By diversifying his holdings across multiple industries, Agrawal minimizes risk while maximizing potential returns. This sectoral allocation aligns with his philosophy of balancing stability with growth opportunities.

Mukul Agarwal’s portfolio includes a varied range of stocks, that feature small-cap companies having the potential for growth. Some of the prominent stocks in Mukul Agarwal’s notable holdings as of June 2024 are presented below.

Top Holdings in Portfolio in 2024

The top holdings in Mukul Agrawal’s 2024 portfolio, including performance indicators for each stock, showcase his strategy of combining high-growth equities with stable, income-generating debt investments.

1) Strides Pharma Science Ltd.

With a holding value of Rs 198.4 Cr and 1,400,000 shares, Strides Pharma stands as a cornerstone of Mukul Agarwal’s portfolio. This leading pharmaceutical company develops and distributes a wide range of innovative pharmaceutical products, signaling strong confidence in its growth within the competitive healthcare sector.

2) Deepak Fertilisers & Petrochemicals Corporation Ltd.

An investment of Rs 194.2 Cr across 1,500,000 shares reflects a belief in Deepak Fertilisers’ diversified chemical and fertilizer portfolio. As one of India’s largest manufacturers in the sector, it plays a critical role in the agricultural and industrial economy, making it a vital component of the portfolio.

3) PTC Industries Ltd.

PTC Industries, specializing in advanced metal components and engineering, represents an impressive Rs 191.9 Cr holding with 160,000 shares. Its innovation-driven approach and growing demand for precision engineering solutions position it as a niche player with immense potential.

4) Raymond Lifestyle Ltd.

With Rs 163.1 Cr invested in 800,000 shares, Raymond Lifestyle embodies the growth potential of India’s premium apparel market. As part of the iconic Raymond brand, this investment reflects faith in the continued expansion of its lifestyle and clothing business.

5) ASM Technologies Ltd.

Holding Rs 108.3 Cr in 762,500 shares, ASM Technologies is a global IT service provider poised for growth. The company’s focus on delivering cutting-edge solutions makes it a strategic investment in the rapidly evolving tech sector.

6) KDDL Ltd.

Agarwal has invested Rs 112.1 Cr in 423,180 shares of KDDL, a leader in watch components and luxury retail. Its strong market presence in the premium consumer segment highlights its significance in the portfolio.

7) Ceat Ltd.

Ceat Ltd., with an investment of Rs 131.1 Cr in 450,000 shares, exemplifies Agarwal’s interest in the auto ancillary sector. Known for its durable and innovative tires, Ceat is set to benefit from increasing demand in both domestic and international markets.

8) Lux Industries Ltd.

A holding of Rs 79.8 Cr across 442,100 shares showcases confidence in Lux Industries, a leader in the innerwear and hosiery market. With its widely recognized brands, the company is well-positioned to capture consistent consumer demand.

9) Stanley Lifestyles Ltd.

Stanley Lifestyles, a premium furniture and lifestyle brand, represents a Rs 37.4 Cr investment with 900,000 shares. Its focus on high-quality products makes it a noteworthy addition to the portfolio’s diversified approach.

10) Dredging Corporation Of India Ltd.

With Rs 38.1 Cr invested in 450,000 shares, this infrastructure-focused holding highlights Agarwal’s interest in India’s growth story. Specializing in dredging services for ports and waterways, the company plays a critical role in national development.

11) Jagsonpal Pharmaceuticals Ltd.

An allocation of Rs 31.1 Cr in 463,023 shares highlights Mukul Agarwal’s confidence in Jagsonpal Pharmaceuticals. Known for its branded formulations, the company’s niche offerings hold strong growth potential.

12) Hind Rectifiers Ltd.

With Rs 27.2 Cr invested in 238,026 shares, Hind Rectifiers exemplifies strategic alignment with infrastructure development. The company’s expertise in power electronics serves critical sectors like railways and energy.

This portfolio reflects a balanced investment approach, spanning diverse industries from pharmaceuticals and chemicals to tech and infrastructure, underscoring Mukul Agarwal’s eye for growth-oriented opportunities.

Investment Philosophy

His philosophy centers on a long-term perspective and value investing mechanism. He believes that if he thoroughly analyzes the fundamentals of a company, he will be able to make wise investment decisions. Agarwal also emphasizes the importance of sector diversity, which he can achieve by balancing traditional industries with emerging fields. The approach makes him capitalize on growth trends and ensure some stability in his overall portfolio.

Investment Principles

- Risk Management – Through careful analysis, Agarwal seeks to manage as well as mitigate risks in his portfolio.

- Sectoral Diversity -Agrawal diversifies across sectors, ensuring he is not overexposed to any single industry.

- Long-term Growth – He emphasizes levying investments in companies having sustainable growth potential, preferring businesses that would withstand market volatility.

- Value Investing – He focuses on buying undervalued stocks, following the principle that true value can always rise in the long term.

What Lessons Can We Learn From His Journey?

For new investors, Mukul Agrawal’s journey offers valuable lessons:

- Adapting to Market Conditions: Agrawal’s portfolio is dynamic, evolving with market trends and economic shifts.

- Investing in Knowledge: Agrawal emphasizes understanding market fundamentals and staying updated on industry trends.

- Patience is Virtue: Long-term investments are essential for achieving sustained growth.

- Risk Management is Crucial: Mitigating risk through diversification and careful stock selection is critical to a resilient portfolio.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

Mukul’s investment philosophy emphasizes not only impressive returns but also a forward-thinking approach to value creation and wealth management. This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Mukul Agarwal’s 2024 portfolio demonstrates a deep understanding of the market and a commitment to value-driven investments. Focusing on sectors like the long-term growth potential, he has created a portfolio that stands out in the landscape of Indian investment.

His journey is quite inspiring for new investors, highlighting the significance of knowledge, patience, and strategic thinking.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain

FAQs

Ans:- Mukul Agarwal is a prominent Indian investor known for his strategic investments in equity markets. He is widely regarded for his diversified portfolio and insightful approach to stock market investments.

Ans:- Mukul Agarwal typically focuses on value investing, identifying growth-oriented opportunities in mid-cap and small-cap companies. He emphasizes sectors with long-term growth potential and scalable business models.

Ans:- Mukul Agarwal invests across diverse sectors, including pharmaceuticals, chemicals, technology, auto ancillaries, infrastructure, and consumer goods.

Ans:- Some notable stocks in his portfolio include Strides Pharma Science Ltd., Deepak Fertilisers & Petrochemicals Corporation Ltd., and Ceat Ltd., among others. His investments span various industries, reflecting a balanced portfolio.

Ans:- Mukul Agarwal’s net worth is primarily derived from his stock market investments. While his exact net worth fluctuates based on market valuations, it is estimated to be in the hundreds of crores.

Ans:- Mukul Agarwal uses a mix of fundamental analysis, industry trends, and long-term growth potential to identify undervalued stocks and invest in companies with strong business models and leadership.

Ans:- Mukul Agarwal primarily focuses on long-term investments, aiming to capitalize on the growth potential of companies over extended periods.

Ans:- Mukul Agarwal’s portfolio is unique because of its diversification across industries and a focus on high-growth companies in niche segments. His investments often reflect strong confidence in emerging trends and undervalued opportunities.

Ans:- Like any investor, Mukul Agarwal has encountered market volatility and risks. However, his disciplined investment strategy and ability to adapt to market dynamics have contributed to his success.

Ans:- Investors can learn the importance of diversification, patience, and thorough research from Mukul Agarwal’s approach. His focus on identifying undervalued stocks with strong fundamentals and long-term growth potential highlights the value of disciplined and strategic investing.