Blog Highlights

- Education and Career

- Mohnish Pabrai Portfolio

- Mohnish Pabrai Net Worth

- Reasons for Pabrai’s Declining Net Worth

- Pabrai’s Investment Strategy

A look inside Mohnish Pabrai’s Latest Portfolio & Net Worth in 2024

What happens when one gains the spotlight for spending over $650k on lunch? Mohnish did so to have a meal with his mentor Mr Warren Buffet. This Crorepati has surely bagged Billions by following Buffet’s strategies.

Investment preferences for this man include high-certainty yet low-risk stocks, where he tends to invest in businesses that are established with sound management and minimum downside. Precisely, he follows the value investing dogma intrinsically.

In 1999, he founded Pabrai Investment Fund which has given over 517% returns to date, after selling his IT business for $6 Million in 2000.

Pabrai has no interest in a company that is undervalued, where he would only pass on the opportunity if it is not blindingly obvious.

Mohnish Pabrai’s Education and Career

Mohnish was born in 1964 in India. After moving to the USA, he studied software engineering and later shifted to international marketing. This induced benefits on how businesses run globally.

Pabrai launched his IT consulting firm called Transtech Inc. in 1991. His investment journey began after selling off TransTech to Kurt Salmon Associates for $20 Million in 1999. The Pabrai investment fund was launched with an initial $1 million investment.

Mohnish Pabrai Latest Investment Portfolio in 2024

Pabrai’s journey marked by strategic bets and substantial returns shows the efficacy of Buffet’s methods.

Pabrai’s initial successes included Satyam Computers, where his investments made him gain 140 times in 5 years. This stock was sold in 2000 to make a profit of $1.5 Million. He then multiplied this capital in 5 years to make $10 Million.

The portfolio includes investments in companies like Fiat Chrysler Automobiles and Micron Technology.

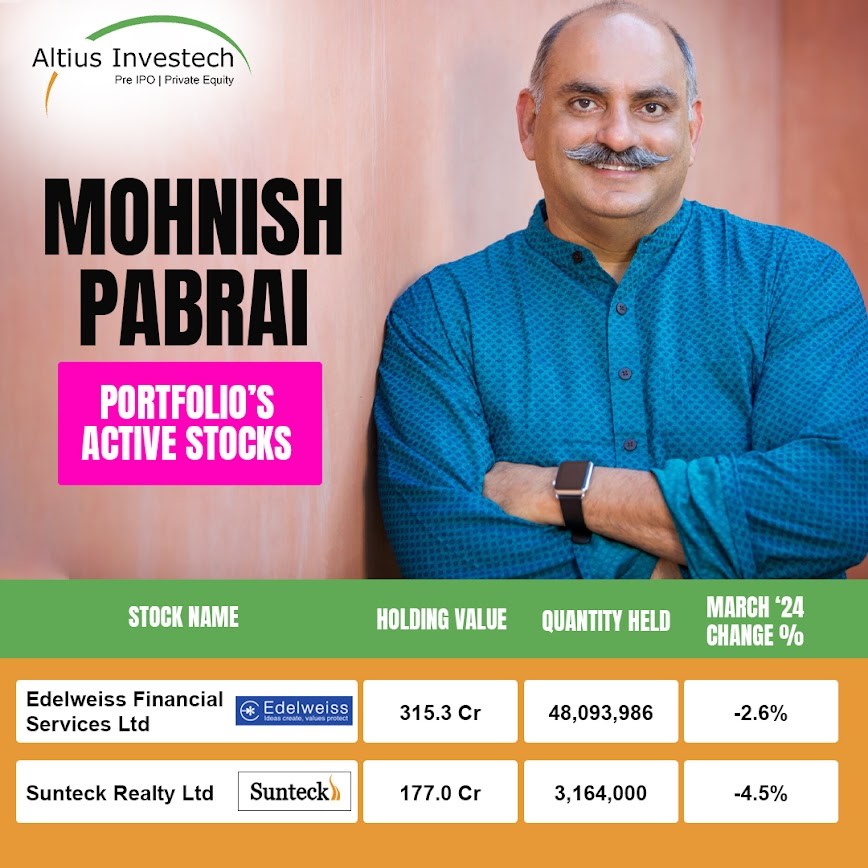

As per the latest information on current shareholdings, there are 2 active stocks out of 3 total stocks owned.

1. Sunteck Realty Ltd – One of the most significant investments of Pabrai, as it is deemed to be the second-largest equity investment in the portfolio.

The current valuation for this company is 186.12 Cr with a March 24 holding % to be 2.16%.

He sold his shares in Sunteck Realty Ltd, which lowered his stake by -4.52%.

2. Edelweiss Financial Services Ltd – It is a renowned investment and financial services company.

The current valuation for this company is 322.42 Cr with a March 2024 holding % to be 5.09%.

3. Rain Industries Ltd – It is one of the largest coal tar pitch and petroleum coke-producing companies in the world. The last holding % as observed on Dec 2023 was 4.35%, from when it was deemed inactive.

In the first quarter of the year ‘24, he neither sold the stock nor bought it. But, the total investment of Rs 482.70 Cr in Rain Industries Ltd makes it his largest portfolio investment.

Mohnish Pabrai Net Worth in 2024

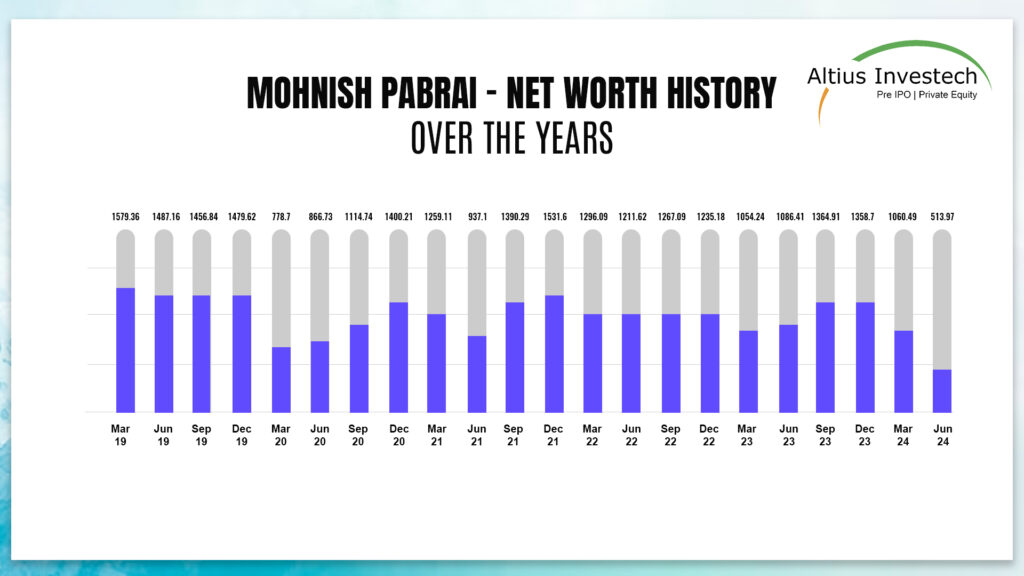

Mohnish Pabrai’s net worth as per current records of the latest quarter yields Rs 513.97 Crore in total.

It has been estimated to fall by -51.53% through his portfolio. Last year June, the net worth of Mohnish was about 1202.7 Crores.

With the multitude of ups and downs as visible from the graph presented above, the fluctuations failed to cause a dip in his perseverance. His portfolio declined again by 47% in 2020 and 25% in 2021.

Mohnish Pabrai – Net Worth History Over the Years

Know the Net Worth of Other Influential Figures in India

Reasons for Pabrai’s Declining Net Worth

- Investment Concentration and Market Volatility – As we find, Pabrai’s investment strategies involve a high concentration of bets on a few stocks, which despite yielding high returns, have also exposed him to significant market volatility.

- Emerging Market Challenges – A substantial portion of his investments lies in emerging markets like India, which are susceptible to political or economic changes. For eg, large positions in companies like Rain Industries and Sunteck Realty have faced fluctuations in broader market conditions in the country.

- Sector-Specific Problems – Economic downturns and shifts in market dynamics have adversely affected the sectors in which Mohnish has invested like automotive and finance, causing an impact on his overall portfolio value.

- Global Economic Downturns – The pandemic caused significant market disruptions, affecting the valuation of his holdings and contributing to the net worth decline during that period.

Lessons from Mohnish Pabrai’s Net Worth Decline: Investment Mistakes to Avoid

- Analysis of Market Trends – Study various marketing conditions that lead to decline in particular periods.

- Diversification – Ensure the maintenance of a diversified portfolio for mitigation of risks.

- Regular Reviews – Conducting regular reviews on the portfolio can help adapt to changing market scenarios and new information.

- Learning from Mistakes – Past mistakes are surely beneficial not to incur repetition in flaws.

- Staying Informed – One needs to monitor and keep up with economic indicators, regulatory modifications, and reports of company performances.

- Risk Management – The implementation of strategies based on risk management like stop-loss orders and hedging, can protect significant losses.

Mohnish Pabrai’s Investment Strategy

An intelligent value Investing philosophy can make investors realize tremendous gains by purchasing securities that can trade below their intrinsic value.

A stock cannot merely be a ticker symbol but an ownership interest for an actual business, where the underlying value is not dependent on the share price.

Pabrai focuses on-

- Identification of the right stocks – He buys stocks as if buying whole companies. He does not mind being a “shameless copycat”, without original ideas. After all, even imitation needs a dose of common sense.

- Big Bets – His portfolio contains carefully chosen stocks, and high-conviction investments.

- Competitive Advantage – He emphasizes investing in companies that have a competitive advantage.

- Value Investment– Investment in assets that are worth more than the purchase price.

Mohnish has written a book on his investment style, the “Dhandho Investor”.

If you want to grow your investments like Mohnish Pabrai and are willing to take minimal risks for double or even triple the returns, unlisted shares are your best bet. Purchase them from a trusted platform like Altius Investech and maximize your revenues.

Conclusion

Pabrai’s investment journey focuses on value-based, disciplined forms of investing. Adapting and following Warren’s principles has made him carve a niche for himself, thereby demonstrating strategic emulations leading to substantial success in the investment world.

He has been calculated and careful in his attempts to copy Buffet’s style, where he has realized that mastering the game of compounding can double his returns.

If you enjoyed reading this, consider learning about the portfolios of other powerful tycoons in the Indian financial world.

- Vijay Kedia’s Latest Portfolio & Networth

- Raamdeo Agrawal’s Investment Empire – His Portfolio & NetWorth

- An Inside Look at Porinju Veliyath’s Investment Portfolio

- Decoding Ashish Dhawan Portfolio

- Inside Radhakishan Damani’s Successful Portfolio & Net Worth

FAQs

Mohnish Pabrai’s portfolio includes investments in companies like Fiat Chrysler Automobiles, Micron Technology, Sunteck Realty Ltd, Edelweiss Financial Services Ltd, and Rain Industries Ltd.

Mohnish Pabrai is known for emulating Warren Buffet’s investment strategies.

As of the latest quarter, Mohnish Pabrai’s net worth is Rs 513.97 Crore.

Mohnish Pabrai lives in Austin, Texas.

The shares were bought on December 3, 2020.

Pabrai’s grandfather was a famous magician Gogia Pasha.

Mohnish Pabrai is famous for his successful investment strategies and for spending over $650k on a lunch with Warren Buffet. He follows a value investing philosophy similar to Buffet’s.

Harina Kapoor is the wife of Mohnish Pabrai.

Mohnish Pabrai was born in 1964, making him 60 years old as of 2024.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.