Midland Microfin Ltd – Company Overview, Financial & Share Price Informations

Midland Microfin Limited (MML) is a pioneering microfinance institution headquartered in Jalandhar, Punjab, committed to empowering women financially and socially. It offers savings, business loan, insurance, credit, money transfers, counseling, and other financial support services. Midland Microfin serves customers in India.Since its establishment in January 2011, MML has operated as a Systemically Important Non-Deposit taking Non-Banking Financial Company (NBFC-ND-SI), registered with the Reserve Bank of India (RBI).

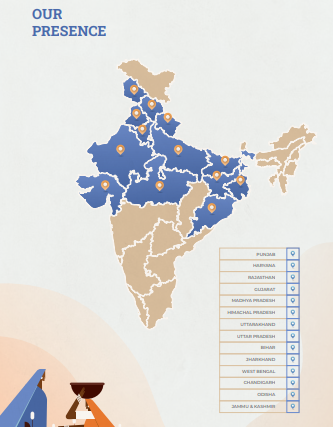

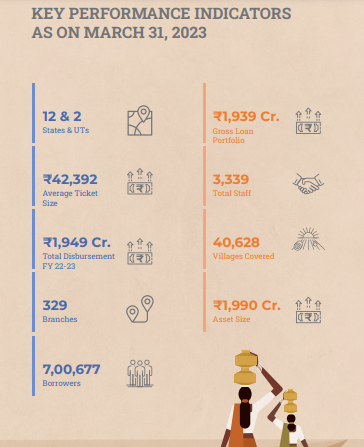

Specializing in small Business Loans, particularly for women entrepreneurs, MML aims to ignite entrepreneurship, foster economic independence, and contribute to poverty eradication. With a steadfast commitment to regulatory compliance and integrity, MML has expanded its operations to encompass 329 branches across 12 States and 2 Union Territories, reaching individuals in diverse regions. Noteworthy achievements include a 71% exponential growth in portfolio and a robust asset base of Rs. 1939 crores as of March 31, 2023.

Recognized as a “Great Place to Work” for four consecutive years, MML fosters an inclusive workplace culture, nurturing enduring relationships with stakeholders to create a supportive ecosystem for individuals and communities. Through its visionary approach, unwavering commitment, and innovative strategies, MML continues to reshape lives and contribute to a more inclusive and prosperous society.

| Company Name | MIDLAND MICROFIN LIMITED |

| Company Type | Unlisted Public Company. Buy Unlisted Shares of MML |

| Industry | Finance |

| Founded | 1988 |

| Registered Address | Jalandhar, Punjab, India |

| Website | www.midlandmicrofin.com |

Source: Midland Microfin Annual Report

Vision, Mission and Values

Vision:

Midland Microfin Limited aspires to be a world-class, role model, technology-driven Micro Finance Institution that provides support to the progressive poor at a low cost.

Mission:

The company is committed to encouraging micro-enterprise as a source of sustainable livelihood, with a special emphasis on women, by offering financial services supported by technology. Midland Microfin Limited works towards the financial and social empowerment of women, aiming to provide easy access to financial services for low-income entrepreneurs. Through these efforts, the company seeks to enable individuals to improve their standard of living and create sustainable assets for themselves.

Values:

Midland Microfin Limited upholds the following values:

- Courage

- Respect

- Responsibility

- Commitment

- Achievement

These values guide the company’s actions and decisions, ensuring integrity, empathy, and dedication in all endeavors.

Product Offerings

Midland Microfin Limited provides a range of customer-centric and need-based products, aimed at enhancing the standard of living and increasing income for its customers.

- Business Loan:

- Midland Microfin offers tailored business loans to serve as a sustainable livelihood source for progressive poor rural women. These loans empower female entrepreneurs to address various business needs, including acquiring tools and equipment, purchasing stock, and managing working capital.

- Ticket Size: 11K – 70K

- Tenure: 12 – 24 Months

- Individual Loan:

- This loan product is designed to support the expansion of businesses for graduate borrowers who have successfully completed one business loan cycle using the Joint Liability Group (JLG) Model. It facilitates investments, resource procurement, and operational enhancement.

- Ticket Size: 60K – 1.5 Lakhs

- Tenure: 24 Months

- Water Supply and Sanitation:

- Midland Microfin contributes to the Swachh Bharat Initiative by offering Water and Sanitation Loans to rural villages. These loans support the creation of household-level toilets, water facilities, and sanitation infrastructure, contributing to cleanliness and healthcare improvement.

- Ticket Size: 10K – 30K

- Tenure: 6 – 18 Months

- Dairy Loan:

- This loan facilitates borrowers in acquiring additional cattle to foster the growth of their dairy enterprises. It also includes Cattle Insurance policies to provide protection for cattle purchases.

- Ticket Size: 60K – 1.5 Lakhs

- Tenure: 24 Months

- Education Loan:

- Midland extends financial aid to students pursuing post-secondary or higher education endeavors. These loans cover tuition fees, essential books, gadgets, and related expenses.

- Ticket Size: 10K – 20K

- Tenure: 12 Months

- Social Impact Products:

- These green financing products aim to address specific social needs by providing access to essential resources like clean energy, healthcare, and sanitation. Ranging from kitchen items to solar lights, these products act as catalysts for positive change in customer’s lives.

- Ticket Size: 1K – 5K

- Tenure: 6 – 9 Months

- PM Svanidhi Loan:

- This product supports the livelihoods of street vendors, contributing to overall well-being and socio-economic upliftment in local communities. It aims to foster livelihood opportunities and promote holistic development for street vendors.

- Ticket Size: 10K – 15K

- Tenure: 12 Months

- Ajeevika Loan:

- Midland Microfin collaborates with NSFDC to provide financial assistance to eligible borrowers from Scheduled Castes, Scheduled Tribes, and Backward Classes. These loans promote educational and economic interests, contributing to inclusive growth and prosperity.

- Ticket Size: 30K – 40K

- Tenure: 12 – 24 Months

Key Performance Indicators (as on March 31, 2023)

Management of the Company

Vijay Kumar Bhandari: Chairman

Mr. Vijay Kumar Bhandari serves as the Chairman of Midland Microfinance, bringing with him extensive expertise in the banking sector. A Fellow member of the Institute of Chartered Accountants of India, he has amassed over 31 years of experience in various roles within the banking industry. With a background as a banker and former General Manager of Central Bank of India, Mr. Bhandari has held key positions overseeing credit, treasury, investment, fund management, and international banking divisions. His career includes stints as a Senior Internal Auditor, Branch Manager, Regional Manager, and Zonal Manager, providing him with a comprehensive understanding of the sector’s intricacies.

Amardeep Singh Samra: Managing Director

Mr. Amardeep Singh Samra serves as the Managing Director of Midland Microfin Limited. His background stems from extensive engagement in asset financing, hire-purchase, and leasing sectors. Notably, in 2010, Mr. Samra undertook the acquisition of Sajan Hire Purchase Private Limited, a pre-existing NBFC, which he subsequently rebranded as Midland Microfin Limited, marking a pivotal step in his journey within the microfinance industry.

.

Santokh Singh Chhokar: Non-Executive Director

Mr. Santokh Singh Chhokar serves as the non-executive director of Midland Microfinance. His academic background includes a degree in medical and social sciences from the University of London, followed by the completion of the Law Society’s Post Graduate Diploma in Law, with honors, in 1992. Since 1994, he has been the Senior Partner at Chhokar & Co Solicitors, a reputable law firm based in the United Kingdom, with associate offices in the United Arab Emirates. Additionally, he is an accredited Will Writer registered with the Dubai International Financial Centre (DIFC).

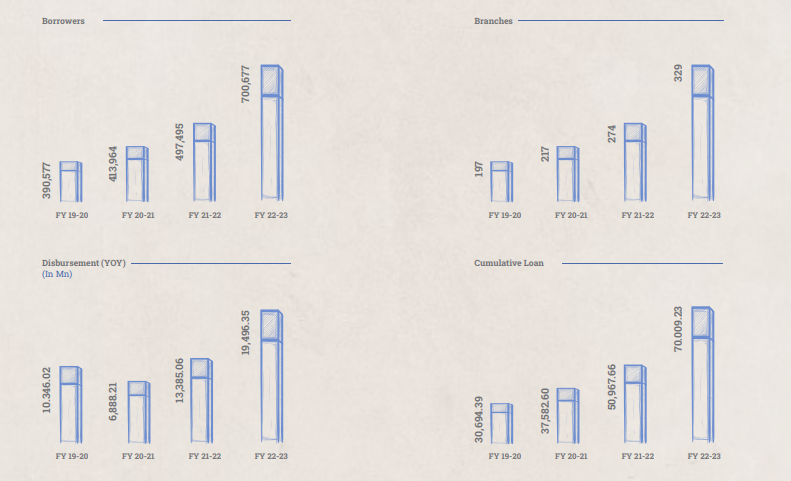

Operational Highlights

- Branch Expansion: The Company has significantly bolstered its distribution capabilities and extended its footprint into new territories, including the state of Odisha and the Union Territory of Jammu & Kashmir, with the addition of 55 new branches, bringing the total network to 329 branches, up from 274 in the previous year. This expansion has been complemented by a concerted effort to enhance the operational efficiency of existing branches.

- Operational Cost: In addition to geographical expansion, the Company has focused on technological upgrades to augment operational capabilities and efficiency. This strategic emphasis has resulted in an increased loan portfolio per branch. Notably, operational costs have been reduced to 7.38% during the current financial year, down from 7.98% in the previous financial year.The operational and financial performance of the Company during the year ending March 31, 2022, are as follows:

| Particulars | March 31, 2023 | March 31, 2022 | March 31, 2021 |

|---|---|---|---|

| States | 12 | 11 | 8 |

| Union Territories | 2 | 1 | 1 |

| Districts | 169 | 140 | 112 |

| Villages Covered | 40,628 | 29,658 | 24,603 |

| Joint Liability Groups | 1,45,889 | 98,658 | 81,867 |

| Number of Borrowers | 7,00,677 | 4,97,495 | 4,13,964 |

| Maximum Loan Amount (Rs.) | |||

| – Individual Loans | 1,50,000 | 1,50,000 | 1,50,000 |

| – Joint Liability Group | 70,000 | 50,000 | 50,000 |

| Average Ticket Size (Rs.) | 42,392 | 32,731 | 24,859 |

| Cumulative Loan Disbursement (Rs. In crore) | 7046.39 | 5096.75 | 3758.26 |

| Outstanding Loan Portfolio (Own Book) (Rs. In crore) | 1536.76 | 1059.41 | 773.90 |

| Managed Portfolio (Rs. In crore) | 252.68 | 78.00 | 25.26 |

| Gross Loan Portfolio (Rs. In crore) | 1939.41 | 1137.41 | 799.17 |

| Loan Disbursed in FY (Rs. In crore) | 1949.63 | 1338.50 | 688.82 |

| Equity Share Capital (Rs. In crore) | 45.57 | 45.57 | 39.17 |

| Preference Share Capital (Rs. In crore) | 74.61 | 39.33 | 43.04 |

| Total Assets (Rs. In crore) | 1990.21 | 1569.34 | 1099.81 |

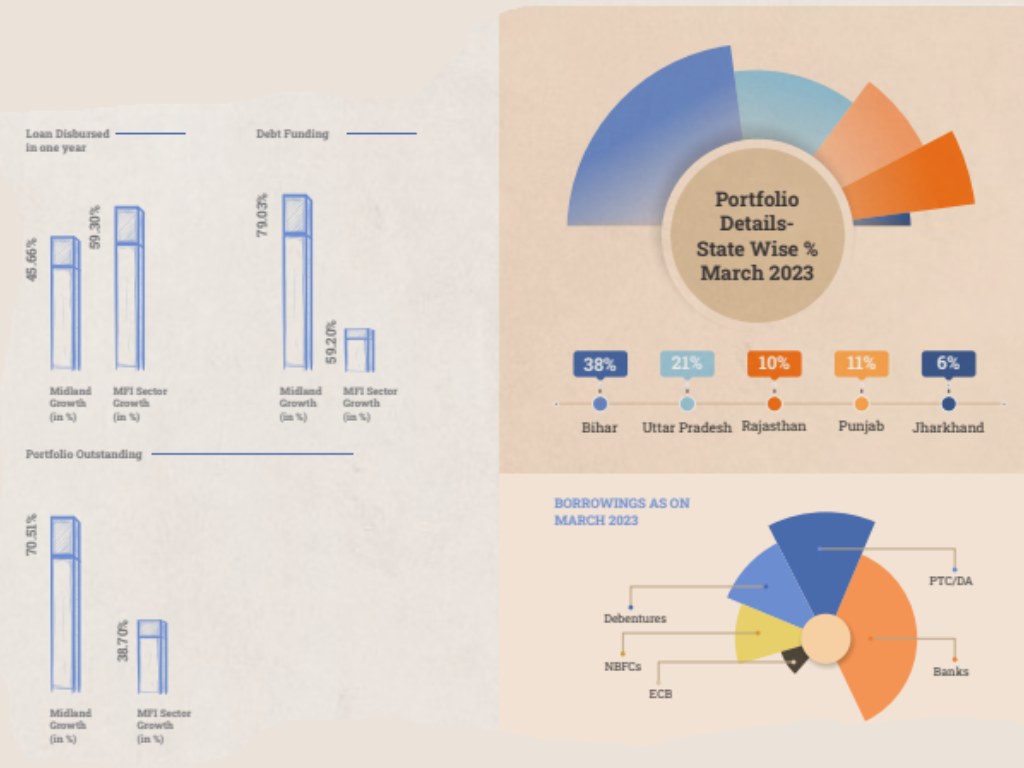

Summary of Loan Disbursements and Growth in FY 2022-23

During FY 2022-23, loan disbursals totaled Rs. 1949.63 crore, a significant increase of 45.66% compared to the previous year’s disbursals of Rs. 1338.50 crore. The cumulative disbursement by March 31, 2023, amounted to Rs. 7046.39 crore, reflecting a growth of 38.25% from the previous year’s cumulative disbursements of Rs. 5096.75 crore as of March 31, 2022. This growth can be attributed to a rise in the number of branches by 55 and an increase in disbursement per branch to Rs. 5.9 crore, up from Rs. 4.9 crore per branch previously.

Top 5 and other Disbursement till date:

| State | Disbursement (Rs. In Crore) |

|---|---|

| Punjab | 2234.47 |

| Bihar | 1799.88 |

| Rajasthan | 1025.32 |

| Uttar Pradesh | 910.44 |

| Haryana | 569.37 |

| Others | 506.81 |

| Total | 7046.29 |

Indian Microfinance Industry Overview

The Indian microfinance industry encompasses a diverse range of entities, each contributing to financial inclusion and empowerment at the grassroots level. Among these are Non-Banking Financial Companies – Micro Finance Institutions (NBFC-MFIs), banks, Small Finance Banks (SFBs), NBFCs, and non-profit MFIs. By March 2023, the industry had achieved a substantial milestone, with its gross loan portfolio surging to an impressive Rs 3,48,339 crore, reflecting a robust year-on-year growth rate of 22.0%.

NBFC-MFIs Lead the Way

Within the microfinance landscape, NBFC-MFIs have emerged as the primary drivers of micro-credit accessibility. Their contribution to fostering financial inclusion and extending credit facilities to underserved segments of the population has been pivotal. As of March 2023, NBFC-MFIs accounted for the largest share of the micro-credit universe, with a remarkable loan amount outstanding of Rs 1,38,310 crore. This substantial figure underscores their significant role in providing vital financial services to the economically marginalized sections of society.

Banks and SFBs

Following NBFC-MFIs, banks and Small Finance Banks (SFBs) play a crucial role in advancing micro-credit solutions across India. With a combined loan outstanding of Rs 1,19,133 crore, banks hold the second-largest share of the micro-credit universe. Similarly, SFBs, with a total loan amount outstanding of Rs 57,828 crore, contribute significantly to the microfinance ecosystem. Together, these institutions form pillars of financial support, facilitating access to credit for millions of individuals and micro-enterprises, thereby driving socio-economic development at the grassroots level.

Transformation in the Microfinance Sector

The microfinance sector in India has undergone extensive transformation, driven by structured guidelines, government initiatives, digital interventions, and enhanced customer servicing approaches. Noteworthy highlights include an increase in the number of clients and loan disbursements, growth in AUM, and a reduction in Portfolio at Risk over 30 days.

Overall, the microfinance industry plays a vital role in providing affordable credit to lower and mid-income households and MSMEs, fostering financial inclusion and socioeconomic development across the country.

Empowering Communities: The Role of Microfinance in India

Microfinance in India is a vital tool for poverty alleviation, particularly in rural areas, aiming to empower marginalized communities and promote economic growth. By providing capital to small entrepreneurs, especially women, it fosters financial independence and tackles gender inequality. Targeting both urban and rural poor, microfinance ensures financial inclusion and economic upliftment for low-income populations and informal sector workers.

Microfinance is an effective channel for providing credit to low-income population and those in the informal sector. Hence, microfinance is instrumental in ensuring financial inclusion at the bottom of the economic pyramid.

Some highlights of Microfinance Sector for the financial year 2020-2023 are as under:

- As on 31 March 2023, 3.9 Cr clients have loan outstanding f rom NBFC-MFIs, which is 20.0% higher than clients as on 31 March 2022.

- The Asset Under Management (AUM) of MFIs is Rs 1,31,163 Cr as on 31 March 2023, including owned portfolio Rs 1,07,232 Cr and managed portfolio (off BS) of Rs 23,931 Cr. The owned portfolio of MFIN members is about 77.5% of the NBFC-MFI universe portfolio of Rs 1,38,310 Cr.

- On a YoY basis AUM has increased by 38.7% as compared to 31 March 2022 and by 15.7% in comparison to 31 December 2022.

- Loan amount of Rs 1,30,563 Cr was disbursed in FY 22-23 through 3.1 Cr accounts, including disbursement of Owned as well as Managed portfolio. This is 59.3% higher than the amount disbursed in FY 21-22.

- Average loan amount disbursed per account during FY 22-23 was Rs 42,010 which is an increase of around 12.9% in comparison to the last financial year.

Latest News About Midland Microfin

1. Midland Microfin Receives Great Place to Work Award

Midland Microfin has been honored with an award from Great Place to Work. This recognition underscores Midland Microfin’s commitment to fostering a positive workplace culture and prioritizing employee satisfaction and well-being. By creating an environment where employees feel valued, supported, and motivated, Midland Microfin not only enhances its organizational success but also positively impacts the communities it serves. [6]

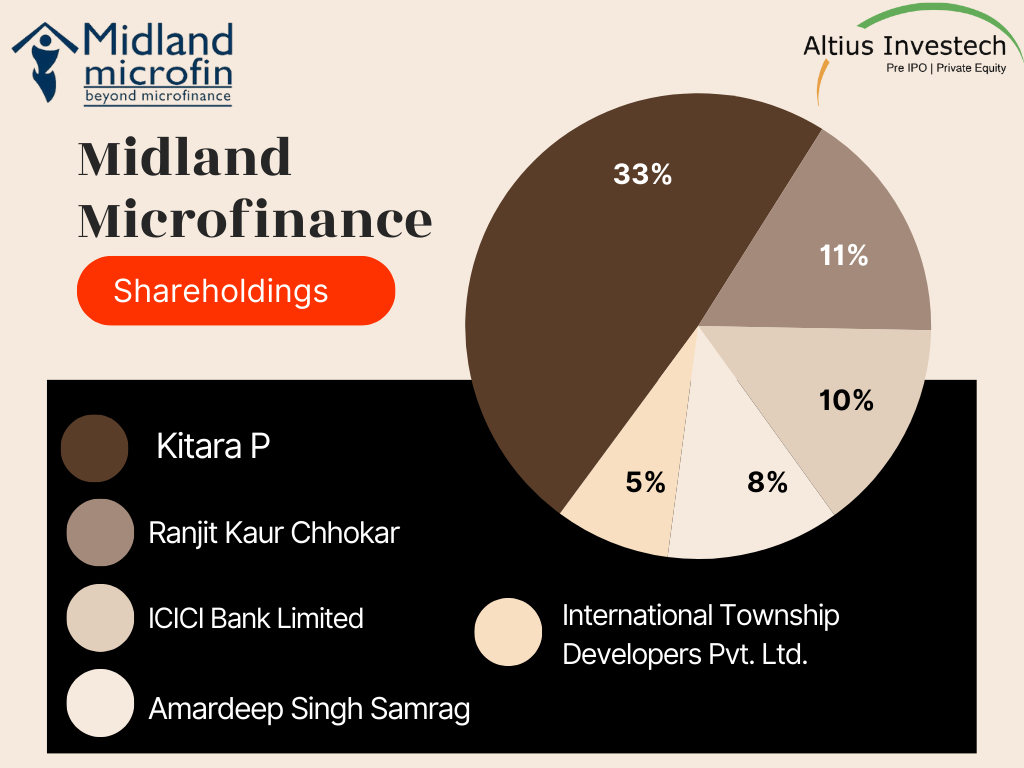

2. ICICI Bank Invests in Equity Shares of Midland Microfin: Acquisition Details

(On September 30, 2021) ICICI Bank entered into an agreement to invest in equity shares of Midland Microfinance. The bank invested Rs 52.42 crore to acquire 4,508,169 equity shares with a face value of Rs 10.0 per share, at a share premium of Rs 106.27 per share. Following the investment, ICICI Bank held 9.9% of the equity share capital and 7.3% of the total share capital of Midland.

.

3. Aviator EMF Invests $3.1 Million in Midland Microfin for Women Empowerment

(May 2020) Aviator EMF, a Mauritius-based investment fund, has injected USD 3.1 million into Midland Microfin Ltd. This investment, comprising a mix of NCDs & ECB, aims to bolster Midland’s lending capacity and expand its branch network across multiple states. Recognizing the potential of microlending in reaching underserved populations, Aviator EMF sees Midland as a key player in promoting financial inclusion.

Share Price of Midland Microfinance (as of 09.04.2024)

- The buy price of MML varies based on quantity, ranging from ₹179 for quantities between 50 – 99 shares to ₹173 for quantities between 500 – 999 shares, with corresponding rates per share.

- The 52-week high is ₹240, and the 52-week low is ₹173 indicating the range of fluctuations in the share price

Currently, the MML Share Price is trading at around Rs. 193/share. CLICK HERE to Invest.

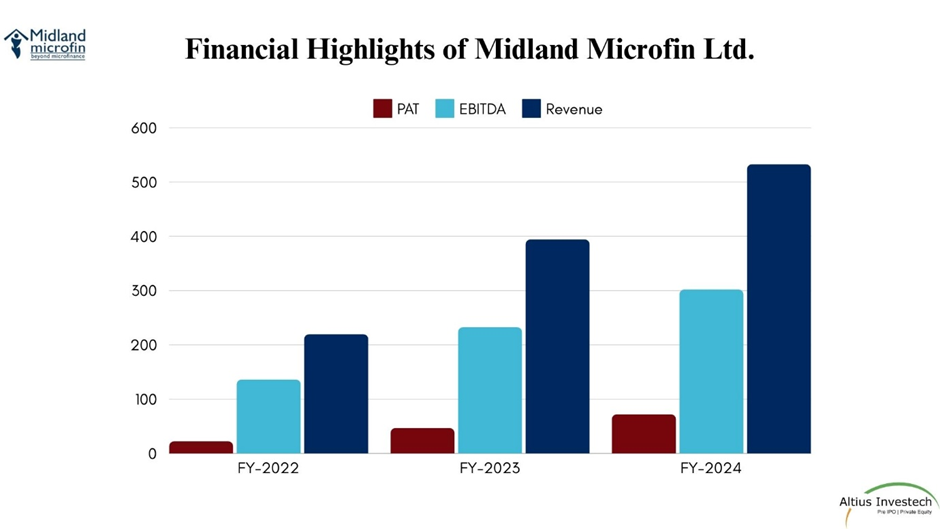

Financial Highlights

₹ in crores

| Financials | 31st March, 2024 | 31st March, 2023 | % increase |

| Revenue | 532.76 | 394.41 | 35% |

| PAT | 72.155 | 46.83 | 54% |

| EPS | 15.53 | 10.7 | 45% |

| EBITDA | 302.11 | 232.47 | 30% |

| PAT Margins | 13.54% | 11.87% | 14% |

The company has earned a Gross Total Income of Rs. 394.91 Crore for the year ended March 31, 2023, as compared to Rs. 219.78 Crore as on March 31, 2022 registering a growth of 79.69%. The contributing factor to this growth in income was an increase in the interest income on the JLG loan portfolio. Further, the company has registered a growth of 109% in fees income of Credit Plus Products which has increased to Rs.17.90 Crore from Rs. 8.57 Crore.

Valuation

| Share Price | 193 |

| Outstanding shares | 5 Cr. (Approx) |

| MCAP | 1011 Cr. (Approx) |

| P/E Ratio | 12.43 |

| P/S Ratio | 1.90 |

| P/B Ratio | 2.07 |

| Book value per share | 93 |

Midland Microfin Limited: Key Strengths

- Strong Operational History: MML has shown consistent growth since its inception in January 2011, with a 57% year-on-year increase in its portfolio to ₹1,789 crore in FY23. The company operates 376 branches across 12 states and two Union Territories, serving 7.35 lakh borrowers with an average ticket size of ₹41,391. CARE Ratings expects assets under management to reach ₹3,400 crore by March 2024.

- Improved Asset Quality Metrics: MML saw a significant reduction in gross non-performing assets (GNPA) ratio from 3.07% in March 2022 to 0.06% in March 2023. However, there was a slight uptick in asset quality metrics in Q1FY24, with GNPA and net non-performing assets (NNPA) ratios rising to 1.73% and 0.84%, respectively, as of June 30, 2023.

- Diversified Resource Profile: With banking relationships established with over 40 institutions, MML primarily relies on term loans for funding. The company has also raised funds from NABARD, MUDRA, and SIDBI, alongside utilizing securitisation and direct assignment transactions to access funds.

- Steady Profitability Despite Challenges: Despite increasing cost of funds, MML improved its net interest margins to 10.5% in FY23. Return on total assets increased to 2.64% in FY23 from 1.68% in FY22, despite rising credit costs. While operating expenses remained high at 6.39% in FY23 due to geographical expansion, income from direct assignment transactions led to improved profitability, with a return on total assets of 4.1% in Q1FY24. CARE Ratings expects MML to maintain a stable profitability profile going forward.

Midland Microfin Limited: Key Weaknesses

- High Gearing Levels: While there’s been an improvement in adjusted gearing to 3.82x as of June 30, 2023, from 4.5x as of March 31, 2023, it remains relatively high. The company received capital infusions in FY23 and Q1FY24, enhancing its capital adequacy ratio to 28.44% as of March 31, 2023. Further equity raising of ₹240 crore in the September quarter is expected to improve the gearing profile.

- Geographical Concentration: The company operates in 12 states and two Union Territories with 386 branches as of June 30, 2023. Key areas like Bihar, Uttar Pradesh, Rajasthan, and Punjab contribute significantly to the portfolio, accounting for 40%, 23%, 11%, and 8% respectively. The top four states constitute 82% of the total AUM, posing a risk of geographical concentration.

- Inherent Industry Risks: The microfinance sector faces inherent risks such as socio-political intervention, regulatory uncertainty, and challenges from unsecured lending. Borrowers’ marginal profile makes them vulnerable to economic downturns, alongside operational risks associated with cash-based transactions.

Peer Comparison

| Particulars | Midland Microfin | Fusion Micro Finance Ltd |

| Revenue | 533 Cr. (Approx) | 2412 Cr. (Approx) |

| PAT | 72 Cr. (Approx) | 505 Cr. (Approx) |

| EPS | 15.53 | 50.11 |

| EBITDA | 302 Cr. (Approx) | 1463 Cr. (Approx) |

| PAT Margins | 13.54% | 20.9% |

| Share Price | 193 | 314 |

| Outstanding shares | 5 Cr. (Approx) | 10 Cr. (Approx) |

| MCAP | 1011 Cr. (Approx) | 3160 Cr. (Approx) |

| P/E Ratio | 12.43 | 9.06 |

| P/S Ratio | 1.90 | 1.31 |

| P/B Ratio | 2.07 | 1.11 |

| Book value per share | 93 | 283 |

Corporate Action

| Financial Year | Particulars | Record Date | Ratio/Rates/Amount | Remarks |

|---|---|---|---|---|

| 2023-24 | RIGHTS | 12-Jan-2024 | 1:3 | CCPS Announced, 1 for every 3 equity shares @Rs 160/shr (Premium: 150). Issue Period: 20-02-2024 to 20-03-2024 |

| 2022-23 | DIVIDEND | 31-Mar-2023 | 0.7 | Company has given interim dividend of Rs 0.7 per share. |

Midland Microfinance: Shareholdings Pattern

| SHAREHOLDING ABOVE 5% | HOLDING % |

|---|---|

| Kitara P | 32.71% |

| Ranjit Kaur Chhokar | 10.95% |

| ICICI Bank Limited | 9.89% |

| Amardeep Singh Samra | 8.07% |

| International Township Developers Pvt. Ltd. | 5.38% |

Conclusion

- Company Overview: Midland Microfin Limited (MML) is a pioneering microfinance institution headquartered in Jalandhar, Punjab, India, established in 1988. It’s committed to empowering women financially and socially, offering various financial services.

- Vision, Mission, and Values: MML aims to be a world-class, technology-driven microfinance institution supporting the progressive poor. It encourages micro-enterprise as a sustainable livelihood source, emphasizing values like courage, respect, responsibility, commitment, and achievement.

- Product Offerings: MML provides tailored financial products including business loans, individual loans, water supply, and sanitation loans, among others.

- Key Performance Indicators: With 329 branches across 12 states and 2 Union Territories, MML has shown significant growth, with notable achievements such as a 45.66% increase in loan disbursements in FY 2022-23.

- Operational Highlights: MML has expanded its branch network significantly and improved operational efficiency, leading to increased loan disbursements and geographic coverage.

- Financial Metrics: Strong financial metrics reflect MML’s stability and growth potential, with a Price to Earnings Ratio (P/E) of 16.85 and a Market Cap of Rs. 798 crore.

- Strengths: MML boasts a strong operational history, improved asset quality, diversified resource profile, and steady profitability.

- Weaknesses: Challenges include high gearing levels, geographical concentration, and inherent industry risks.

- Peer Comparison: MML’s performance against peers like Fusion Microfinance underscores its competitive edge. Key metrics such as total income, assets under management, profitability, and market capitalization offer clear insights into MML’s standing within the microfinance sector.

- Financial Highlights: In FY 2023, Midland Microfin Limited (MML) saw its total income surge by 79.69% to Rs. 394.41 crore, primarily driven by increased interest income from the JLG loan portfolio and a 109% growth in fees income from Credit Plus Products. Profit After Tax (PAT) more than doubled, reaching Rs. 46.83 crore, while Earnings Per Share (EPS) rose to Rs. 10.27, indicating improved profitability and shareholder value.

- Corporate Action Summary: In FY 2023-24, Midland Microfin Limited announced a Rights issue, offering 1 Compulsorily Convertible Preference Share (CCPS) for every 3 equity shares at Rs. 160 per share (Premium: Rs. 150), with the issue period from February 20, 2024, to March 20, 2024. Additionally, in FY 2022-23, the company declared an interim dividend of Rs. 0.7 per share on March 31, 2023.

- Conclusion: Midland Microfin Limited’s commitment to empowerment, coupled with its strong operational and financial performance, positions it as a leading microfinance institution in India, despite facing challenges.

References:

- [1]. Midland Microfin Website: https://www.midlandmicrofin.com/

- [2]. Business Presence, Midland Microfin Annual Report: https://www.midlandmicrofin.com/wp-content/uploads/Annual-Report-2022-23.pdf

- [3]. Vision, Mission and Values: Midland Microfin Website: https://www.midlandmicrofin.com/

- [4]. Some highlights of Microfinance Sector for the financial year 2020-2023 are as under, Midland Microfin Annual Report: https://www.midlandmicrofin.com/wp-content/uploads/Annual-Report-2022-23.pdf

- [5]. Operational Highlights, Midland Microfin Annual Report: https://www.midlandmicrofin.com/wp-content/uploads/Annual-Report-2022-23.pdf

- [6]. Midland Microfin Receives Great Place to Work Award : https://www.greatplacetowork.in/great/company/midland-microfin-ltd

- [7]. ICICI Bank Invests in Equity Shares of Midland Microfin: Acquisition Details, Business Standard: https://www.business-standard.com/article/news-cm/icici-bank-acquires-minor-stake-in-midland-microfin-121100100613_1.html

- [8]. Aviator EMF Invests $3.1 Million in Midland Microfin for Women Empowerment, Live Mint: https://www.livemint.com/brand-post/mauritius-based-aviator-emf-invests-3-1-million-in-midland-microfin-ltd-11588679446246.html

- [9]. Share Price of Midland Microfinance (as of 09.04.2024), Altius Investech:https://altiusinvestech.com/company/midland-microfin-limited

- [10]. Midland Microfin Limited: Key Strengths, Care Report: https://www.careratings.com/upload/CompanyFiles/PR/202309130924_Midland_Microfin_Limited.pdf

- [11]. Midland Microfin Limited: Key Weaknessess, Care Report: https://www.careratings.com/upload/CompanyFiles/PR/202309130924_Midland_Microfin_Limited.pdf

- [12]. Peer Comparison, Midland Microfin Annual Report: https://www.midlandmicrofin.com/wp-content/uploads/Annual-Report-2022-23.pdf

- [13]. Peer Comparison, Fusion Microfinance Limited Annual Report: https://fusionmicrofinance.com/wp-content/uploads/2023/09/Annual-Report-2022-2023.pdf

- [14]. Gross Total Income Summary, Midland Microfin Annual Report: https://www.midlandmicrofin.com/wp-content/uploads/Annual-Report-2022-23.pdf

GET IN TOUCH WITH US:

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

ALSO READ: